Pay Due Tax Payable Off line or Online which is Due Using ITNS Challan 280? Download Excel Based Automated Challan 280

Where an individual assessee fails to file income tax returns of the previous year. One can file the same before March 31, is you have failed to file the previous years tax returns.

Any Income Tax due, can be paid by using tax payment challan 280. One can also pay it offline by downloading and submitting the same to designated branch and payment can be made through cheque or cash.

You can pay the due tax through the ITNS Challan 280 manually filled and submit to the nearest authorized Bank of Branch.

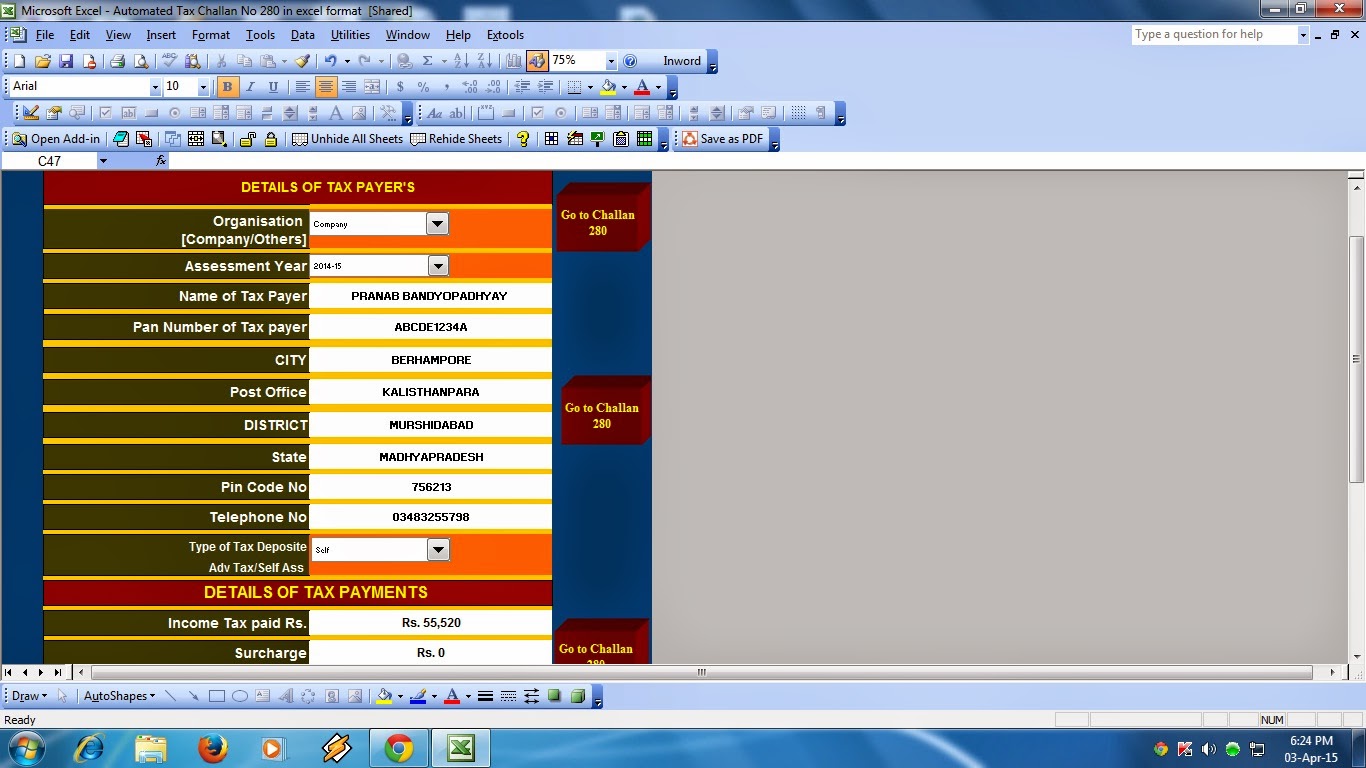

Download the Excel Based Automated Challan280 [ just fill the first page, print the Challan 280 and submit to the Bank]

How to pay Income Tax online which is due?

To make payment online one needs to be registered for net banking user by authorized bank which have facility of paying direct taxes. Click to know list of authorized banks for e-payments.

Step 2: Select Challan 280- Payment of Income Tax and Corporate Tax

Challan 280: Fill in the details such as PAN, address, Assessment Year, Major Head Code, Minor Head Code, Type of payment, Choose the bank name.

Note: Please note that to deposit Appeal Fees either Major Head 020 or 021 (depending upon the tax payer's status) has to be ticked under ‘Tax Applicable'.

Followed by this; Minor Head: Self Assessment Tax (300) has to be ticked under ‘Type of Payment' and the amount is to filled under Others in ‘Details of Payments'.

Step 3: Verify the details. If any changes in data entry, click on "EDIT" to correct the same.

Step 4: Once correct, click on "SUBMIT" button.

Step 5: In net banking site, enter the details such as Assessment year education cess etc

Step 6: Your bank account will be debited and on it will show acknowledgement form which is Challan Identification Number (CIN).

Ensure that the Challan Identification Number (CIN) has been provided on the counterfoil issued after successful payment of tax. Challan Identification Number (CIN) consist of the following

- Seven digit BSR code of the bank branch where tax is deposited

- Date of Deposit (DD/MM/YY) of tax

- Serial Number of Challan

These details will be needed while filing return of income as of tax payment.

Once can verify the status of the challan only after a week after the payment through Challan Status Inquiry at NSDL-TIN website using CIN.

No comments:

Post a Comment