Download All in One Automatic Tax Compute Sheet +HRA Exemption + Salary Sheet +Salary Structure +Form 16 Part B and Part A and B for Central & All State Govt employees for the Financial Year 2017-18

You can prepare at a time your Income Tax Compute Sheet + Individual Salary Sheet + Automatic HRA Exemption + Automatic Form 16 Part B and Form 16 Part A&B.

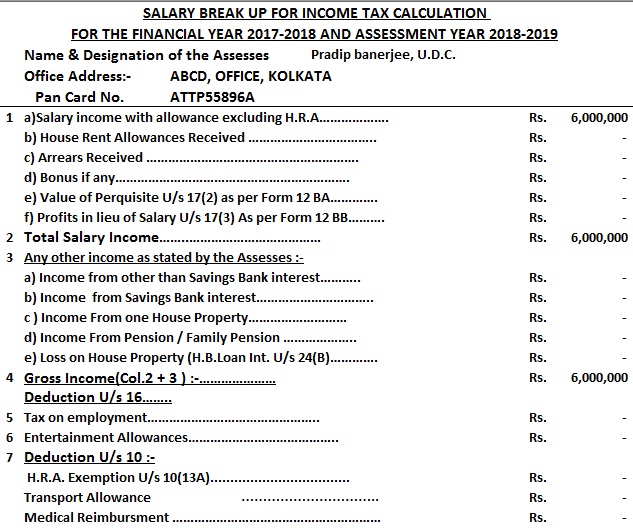

In this, Excel Based Software have a Salary Structure which can fit for the Central and All-State Govt employees, in this Salary Structure you can easily Calculate your Gross Salary Income and after generating this Salary Sheet the other Form 16 Part B and Part A&B will be generated automatically. All the Income Tax Section has in this Utility with the brief of each Income Tax Section as per the Finance Budget 2017-18 with New Tax Slab Rate for F.Y.2017-18.

As per the Finance Budget 2017 have some changed in the Income Tax Slab Rate and some changed in the Income Tax Section.

Feature of this Utility:-

- Prepare at a time the Tax Computed Sheet + Salary Sheet + Automatic HRA Exemption Calculation

- Automatic Convert the Amount into the In-Words

- All Income Tax Section you can see in this Utility with the link to all Section.

- Automatic Prepare the Form 16 Part B for F.Y.2017-18

- Automatic Prepare the Form 16 Part A&B for F.Y.2018-19

- Easy to install on any computer

- Easy to Generate this utility just like as an Excel File

- All the Income Tax Section and Tax Slab Rate have in this utility as per the Finance budget 2017-18

Main Deductor input sheet

|

Salary Structure with Income Tax Deduction Sheet Tax Section Wise

|

Income Tax Computed Sheet

|

Automated Form 16 Part B

|

No comments:

Post a Comment