Major tax Amendments to the Salaried Persons for F.Y. 2020-21 And New Provisions of Finance Act 2020 With Automated Excel Based all in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2020-21 (Old Regime and New Regime)

All Individuals & HUF can prefer

to pay tax as per new slab rates without availing

exemptions & deductions for the fiscal year 2020-21

and Assessment Year 2021-22 as per the Budget 2020.

The option has been given to all or any individuals/HUF to pay tax as per new slab rates (Optional tax regime) on total income computed without claiming any deductions/exemptions – As per Sec 115BAC inserted by Finance Act, 2020 -Applicable from FY 2020-21 (AY 2021-22). Below table summarizes tax rates as per optional tax regime Vs. old rates:

The option has been given to all or any individuals/HUF to pay tax as per new slab rates (Optional tax regime) on total income computed without claiming any deductions/exemptions – As per Sec 115BAC inserted by Finance Act, 2020 -Applicable from FY 2020-21 (AY 2021-22). Below table summarizes tax rates as per optional tax regime Vs. old rates:

| Total Income (Rs.) |

Existing Tax Rates (%)

|

New Tax Rates (Optional) (%)

|

0-2,50,000

|

0%

|

0%

|

2,50,001-5,00,000

|

5%

|

5%

|

5,00,001 – 7,50,000

|

20%

|

10%

|

7,50,001 – 10,00,000

|

15%

|

|

10,00,001 – 12,50,000

|

20%

|

|

12,50,001 – 15,00,000

|

25%

|

|

> 15,00,000

|

30%

|

• Basic exemption limit for oldster

and super citizen individuals remains unchanged at

Rs.3,00,000 and Rs.5,00,000

• Rebate of tax (i.e. up to Rs.12,500 if total income doesn't exceed Rs.5,00,000) remains unchanged and equally applicable for resident individual albeit prefer to choose new tax

• No change in surcharge rates. However, surcharge on STT paid capital gains shall not exceed 15%.

Individuals/HUF who doesn't have business income & prefer to pay tax as per new regime, option shall be exercised for every year at the time of filing of ITR

Allowances/investments not eligible for claiming deductions/exemptions if choose new tax regime

An Individual/HUF who doesn't have business income and choose new tax regime shall not be eligible to say various allowances/investments as deductions/exemptions under different heads of income and therefore the same are summarized below:

• Rebate of tax (i.e. up to Rs.12,500 if total income doesn't exceed Rs.5,00,000) remains unchanged and equally applicable for resident individual albeit prefer to choose new tax

• No change in surcharge rates. However, surcharge on STT paid capital gains shall not exceed 15%.

Individuals/HUF who doesn't have business income & prefer to pay tax as per new regime, option shall be exercised for every year at the time of filing of ITR

Allowances/investments not eligible for claiming deductions/exemptions if choose new tax regime

An Individual/HUF who doesn't have business income and choose new tax regime shall not be eligible to say various allowances/investments as deductions/exemptions under different heads of income and therefore the same are summarized below:

Allowances/investments eligible for claiming as deductions/exemptions if choose

new tax regime

An Individual/HUF who doesn't have business income and choose new tax regime shall eligible to say the below mentioned allowances/investments as deductions/exemptions only, under different heads of income:

Other conditions

i. Option shall be exercised for each year along side filing of tax return

ii. No exemption in respect of free coupon/meal vouchers (i.e. taxable within the hands of employee as perquisite) – Proposed to amend Rule 3 of tax Rules,

Individuals/HUF having business income & prefer to pay tax as per new rates, option are often exercised at any time on or before the maturity of filing ITR for any AY on or after 2021-22 and applicable for subsequent AY’s also.

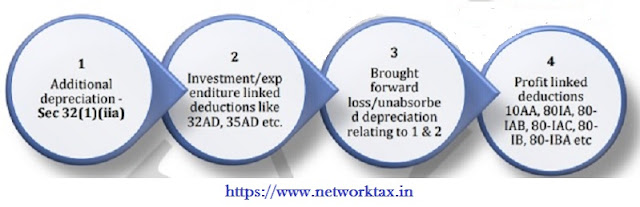

Amounts not eligible for claiming as deductions under the top income from business or profession

An Individual/HUF having business income and prefer to pay tax as per new rates shall not be eligible to say various deductions under the top PGBP and therefore the same are summarized below:

An Individual/HUF who doesn't have business income and choose new tax regime shall eligible to say the below mentioned allowances/investments as deductions/exemptions only, under different heads of income:

Other conditions

i. Option shall be exercised for each year along side filing of tax return

ii. No exemption in respect of free coupon/meal vouchers (i.e. taxable within the hands of employee as perquisite) – Proposed to amend Rule 3 of tax Rules,

Individuals/HUF having business income & prefer to pay tax as per new rates, option are often exercised at any time on or before the maturity of filing ITR for any AY on or after 2021-22 and applicable for subsequent AY’s also.

Amounts not eligible for claiming as deductions under the top income from business or profession

An Individual/HUF having business income and prefer to pay tax as per new rates shall not be eligible to say various deductions under the top PGBP and therefore the same are summarized below:

Eligible to

say deduction u/s 80JJAA in respect of additional

employee cost

Not required to pay Alternate Minimum Tax (AMT) and not eligible to hold forward and depart of AMT credit, if any

• Provisions of AMT shall not apply to Individual/HUF having business income and prefer to pay tax as per new regime – Sec 115JC amended by Finance Act,

• Individual/HUF having business income and choose new tax regime, shall not be eligible to line off of brought forward AMT credit, if any and carry over and depart of AMT credit, if any – 115JD amended by Finance Act,

Time limit for loan sanction under affordable housing scheme extended till 31-Mar- 2021 for availing deduction of interest on loan taken by a private

• An individual is eligible to say deduction of interest payable up to Rs.1,50,000 on loan taken for purchase of residential house property for AY 2020-21 and subsequently if the subsequent conditions are satisfied:

> Loan taken from financial organization during 01-Apr-2019 to 31-Mar-2020 (extended till 31-Mar-2021 – Amended by Finance Act, 2020);

> stamp tax value of the property doesn't exceed 45,00,000

> Individual doesn't own any residential house property on the date of sanction of loan

• Deduction claimed under this section shall not be eligible to say as deduction once more under the other section under the

Cumulative employer’s contribution to recognized PF, approved pension fund and NPS in more than Rs.7.50 lakhs is taxable within the hands of employee as perquisite

• To bring a uniformity in taxation between high earning and low earning salaried employees in respect of employer’s contribution to recognized PF, approved pension fund and National Pension Scheme, Sec 17(2)(vii) of the Act was amended vide Finance Act, 2020 by introducing a combined upper cap limit of Rs.7,50,000 and any excess contribution made by an employer shall be taxable within the hands of employee as

• Further, clause (viia) of sub-section (2) of section 17 introduced to tax annual accretion by way of interest, dividend or the other amount of comparable nature during the previous year to the accumulated balance to the extent of contribution included in total income of the individual as per section 17(2)(vii).

Head-wise summary of Investments/expenses not eligible for claiming as deduction/ exemption if prefer to pay tax as per new rates

Not required to pay Alternate Minimum Tax (AMT) and not eligible to hold forward and depart of AMT credit, if any

• Provisions of AMT shall not apply to Individual/HUF having business income and prefer to pay tax as per new regime – Sec 115JC amended by Finance Act,

• Individual/HUF having business income and choose new tax regime, shall not be eligible to line off of brought forward AMT credit, if any and carry over and depart of AMT credit, if any – 115JD amended by Finance Act,

Time limit for loan sanction under affordable housing scheme extended till 31-Mar- 2021 for availing deduction of interest on loan taken by a private

• An individual is eligible to say deduction of interest payable up to Rs.1,50,000 on loan taken for purchase of residential house property for AY 2020-21 and subsequently if the subsequent conditions are satisfied:

> Loan taken from financial organization during 01-Apr-2019 to 31-Mar-2020 (extended till 31-Mar-2021 – Amended by Finance Act, 2020);

> stamp tax value of the property doesn't exceed 45,00,000

> Individual doesn't own any residential house property on the date of sanction of loan

• Deduction claimed under this section shall not be eligible to say as deduction once more under the other section under the

Cumulative employer’s contribution to recognized PF, approved pension fund and NPS in more than Rs.7.50 lakhs is taxable within the hands of employee as perquisite

• To bring a uniformity in taxation between high earning and low earning salaried employees in respect of employer’s contribution to recognized PF, approved pension fund and National Pension Scheme, Sec 17(2)(vii) of the Act was amended vide Finance Act, 2020 by introducing a combined upper cap limit of Rs.7,50,000 and any excess contribution made by an employer shall be taxable within the hands of employee as

• Further, clause (viia) of sub-section (2) of section 17 introduced to tax annual accretion by way of interest, dividend or the other amount of comparable nature during the previous year to the accumulated balance to the extent of contribution included in total income of the individual as per section 17(2)(vii).

Head-wise summary of Investments/expenses not eligible for claiming as deduction/ exemption if prefer to pay tax as per new rates

S No

|

Section/ Rule

|

Deductions/Exemptions

|

Head of income

|

1.

|

10(5)

|

Leave Travel Allowance (LTA)

|

Salary

|

2.

|

10(13A)

|

House Rent Allowance (HRA)

|

|

3.

|

10(14)

|

Allowances covered (for e.g. allowances to meet cost of

living or to meet personal expenses etc.)

|

|

5.

|

16(ia)

|

Standard deduction of Rs.50,000

|

|

6.

|

16(ii)

|

Entertainment allowance (to government employees) Max. Rs.

5000/-

|

|

7.

|

16(iii)

|

Tax on employment (i.e. Professional Tax – PT)

|

|

8.

|

24(b)

|

Interest on housing loan (Self-occupied/Vacant Property –

Sec. 23(2)) Max Rs.2,00,000/-

|

House Property

|

9.

|

57(iia)

|

Family Pension

|

Other Sources

|

10.

|

35AD

|

Capital expenditure on specified business

|

|

11.

|

35CCC

|

Expenditure on agricultural extension project

|

|

12.

|

80C

|

LIC Premium, Children Tuition Fees, PF contribution,

Principal component of housing loan etc..,

|

|

13.

|

80CCC

|

Contribution to certain pension funds

|

|

14.

|

80CCD(1)

|

Employee’s contribution to national pension scheme

|

|

15.

|

80D

|

Health Insurance Premium/Medical Expenditure/Preventive

Health-check up

|

|

16.

|

80DD

|

Maintenance/medical treatment of dependent disabled person

|

|

17.

|

80DDB

|

Medical treatment of specified diseases

|

|

18.

|

80E

|

Interest on loan taken for higher education

|

|

19.

|

80EE

|

Interest on loan taken for residential house property

|

|

20.

|

80EEA

|

Interest on loan taken for residential house property (if

not eligible to claim u/s 80EE)

|

|

21.

|

80EEB

|

Interest on loan taken for purchase of electric vehicle

|

|

22.

|

80G

|

Donation institutions to certain funds/charitable

|

|

23.

|

80GG

|

Rent paid (if not eligible deduction u/s 10(13A)) to claim

HRA

|

Free Download Automated Excel Based Software All in One For Govt &Non-Govt employees for the Financial Year 2020-21 and Assessment Year 2021-22 (Old Regime and New Regime method as per Budget 2020)

Main feature of this Excel Utility

1)

This Excel utility can prepare at a

time all of the Income Tax Calculation sheet.

2)

This Excel Utility Prepare Automated

Income Tax Computed Sheet as per Budget 2020 ( New Tax Regime & Old Regime)

3)

This Excel utility can prepare

automatic Income Tax Computed Sheet for individual Salary Sheet for Govt and

Non-Govt employees

4)

This Excel Utility can prepare

Automatic Income Tax House Rent Exemption Calculation U/s 10(13A) if you Opt in

Old Tax Regime.

5)

Prepare automated Income Tax Arrears

Relief Calculator U/s 89(1) with Form 10E from the F.Y. 2000-01 to F.Y. 2020-21

(Amended Version)

6)

Automated Income Tax Revised Form 16

Part A&B for F.Y. 2020-21

7)

Automated Income Tax Revised Form 16

Part B for F.Y. 2020-21

8)

Automatic Convert the amount to the

In-Words without any Excel Formula.

Main Data Input Sheet

Employee's Details Input Portion

Deductor's Details Portion

Tax Computed Portion

Salary Structure for both of Govt and Non-Govt Employees

Automated Revised Form 16 Part A&B

Income Tax Revised Form 16 Part B

Automated Arrears Relief Calculation U/s 89(1) with Form 10E

No comments:

Post a Comment