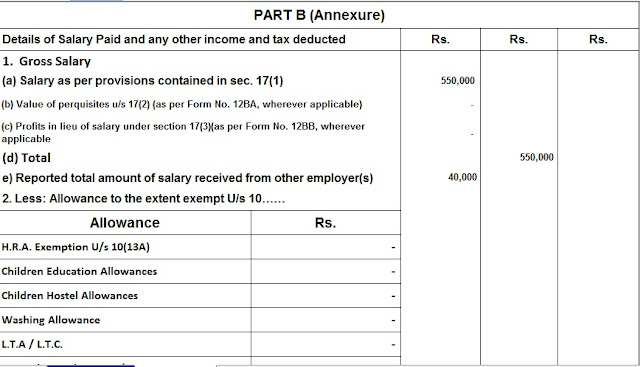

Automated Income Tax Form 16 Part B U/S 203 for the F.Y.2020-21 as per New and Old tax Regime

Automated Income Tax Form 16 Part B, U / s 203.

(1) Every person who has been tax-deductible in accordance with the aforesaid provisions of this the chapter shall, within this period, from the time of payment of credit or payment of the prescribed period, or as the case may be, from the time of issuance shall issue a check to any shareholder for payment of any dividend. such credit has been given or to whom this payment has been made or the check or warrant has been issued, the certificate of duty specifying the amount deducted, and the amount deducted, the rate at which the tax has been deducted and other prescribed Description.

(2) Every person, as an employer, as referred to in sub-section (1a) of section 199, should submit, within the prescribed period, the person whose income has been taxed, the tax paid to the Central Government. Specifies a certificate and the amount paid in it, the rate at which taxes have been paid and other details as prescribed.

Who can the TDS certificate issue?

Tax deducted at source Each person has been tax deducted under Section 203 along with some other details required to issue the certificate to the issuer. This certificate is commonly called a TDS certificate. Even tax-exempt banks have to issue such certificates when paying pensions. In the case of employees earning salary including pension, the certificate should be issued in Form No.-16. In all other cases, a TDS certificate must be issued in Form 16 B. The certificate is issued at the cutter's own stationery. However, in the case of source duty, there is no obligation to issue a TDS certificate. Discount / Discount is not deductible due to claim.

Duplicate certificate issued

Where the original TDS certificate is lost, the issuers can go to the cutter to issue a fake TDS certificate. You may issue a duplicate certificate on Form No. 16 or Form 16 as deducted. However, this type of certificate must be duplicated by the cutter. Further, the cutter, in its alternative, can use digital signatures to authenticate such certificates. In case of issuing such certificate, the cutter can confirm-

Provisions of sub-rule (2) of rule 31 relating to the specification of TAN, PAN of containing the book identification number; Invoice identification number; Relevant quarterly statements etc. are agreed with the number of receipts;

2. Once the certificate is digitally signed, the contents of the certificates are not changeable; and

3. Certificates have a control number and are protected by a log of such certificates

No comments:

Post a Comment