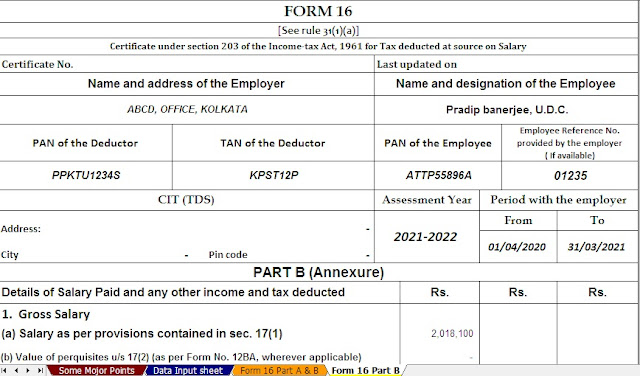

How to save tax for salaried individuals for the F.Y.2021-22– With Automated Income Tax Revised Form 16 for the F.Y.2020-21

How to save tax for salaried individuals for the F.Y.2021-22. Who doesn't want to save taxes? So, in this article, we are discussing how a salaried person can save tax through tax planning. Salary earners have relatively limited options when it comes to saving salaries. Yet, what we use efficiently can achieve a significant amount of tax.

B. Save tax through deductions

You may be interested to read about which system will be beneficial for you, this article can be a bit helpful here

A. Save tax by including tax-saving elements in the pay structure:

I) Save tax on rent payments

If you live in a rented house, this can help you save on taxes through HRA discounts.

The maximum HRA discount will be the lowest of any claim

Got the original HRA

40% / 50% * (Basic Salary + DA)

Rental (minus) 10% (Basic Salary + DA)

* For metro cities

Note: To claim HRA exemption, one needs to have HRA as a component of salary

Download Automated IncomeTax House Rent Exemption Calculator U/s 10(13A) in Excel

If you are renting, if you do not have HRA as a component of your salary, then you can save duty on the rent paid. You can claim a discount of up to Rs 5,000 per month under the 80GG section.

Note: You need to file 80GG Form 10BA to claim clearance

You may also, like- Prepare at a time 50 Employees Automatic Income Tax Revised Form 16 Part B F.Y.2020-21(This Excel Utility can prepare at a time 50 Employees Form 16 Part B)

Children's education allowance

Education allowance for children up to Rs.100 per month is not taxable (up to a maximum of 2 children)

Hostel Expenditure Allowance is not taxable up to Rs.300/- Per month

Medical facilities U/s 80D

Medical insurance paid or paid by the employer is not applicable for premium tax. So, include it in your salary structure to save tax. For below 60 Years of age Max Rs. 25,000/- and above 60 Years Rs. 50,000/- for Senior Citizen.

Leave Travel Allowance (LTA)

It is tax-free when an employer raises an employee to go anywhere in

This deduction will be allowed twice in a block of 4 years.

Some restrictions can be claimed here for the cost of travel although it is quite reasonable. Anyone can take the equivalent cost of first-class train fare or economy class airfare.

Note: This is only available for submission of spent bills

You may also, like- Prepare at a time 100 Employees Automatic Income Tax Revised Form 16 Part B F.Y.2020-21(This Excel Utility can prepare at a time 100 Employees Form 16 Part B)

Contribution of recruiters to PF and NPS

Employers' contribution to NPS and EPF is tax-free up to 12% of basic salary. So, it helps you to save tax as well as induce saving habits.

Important aspects should be known before filing ITR

B. Deduction from salary income

A Standard Deduction of Rs 50,000 for all salaried persons

II. Employment / Professional Tax

In fact, the amount paid during the year is discountable. However, if the professional tax is paid by the employer on behalf of his employee, it is first included in the employee's salary as a precondition and then the same amount is allowed to be deducted.

You may also, like- Automatic Income Tax Revised Form 16 Part B for the F.Y.2020-21(This Excel Utility can prepare One by One Form 16 Part B)

III. Investment-linked Deductions

A. Exemption under section 80C

This is the most popular area used by taxpayers to save taxes. It allows discounts of up to Rs 1.5 lakh. Any taxpayer may invest in PF, ELSS, FD, NSC, NPS, life insurance. In addition, you can claim payment of principal for any home loan, tuition fee, and stamp duty under this section.

B. Exemption under Section 80 CCD(1B)

It gives an additional discount of Rs 50,000 for investing in NPS

C. Exemption under Section 80D

This department provides discounts for medical insurance premiums paid for self, family, and parents.

People under the age of 60 years can claim a discount of Rs 25,000 for themselves and their families and Rs 25,000 for parents (if they are below 60 years) but above the age of 60 years Rs.50,000/- for the Senior Citizen

D. Section 80E for interest on education loan

The interest paid on a loan taken for the higher education of self, wife, or children can be claimed on a real basis. There is no upper limit for this discount.

E. Deduction U/s 80G

Eligible grants are subject to a 50-100% deduction.

F. Deduction for home loan interest

For self-occupied houses and for those who have the opportunity to move out of the house, there is a system of interest rebates on home loans up to Rs 2 lakh, there is no limit to claim interest rebates.

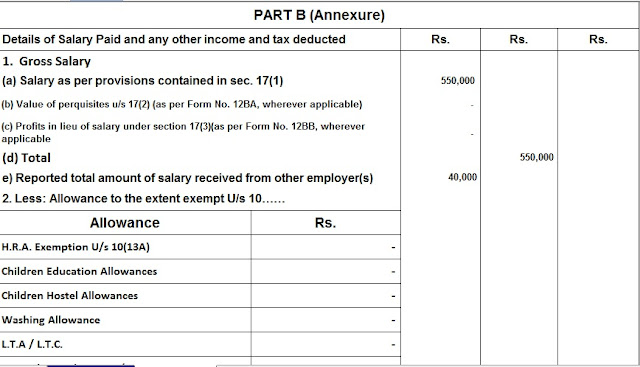

Download and Prepare at a time 50 Employees Automatic Income Tax Revised Form 16 Part A&B F.Y.2020-21(This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B)

No comments:

Post a Comment