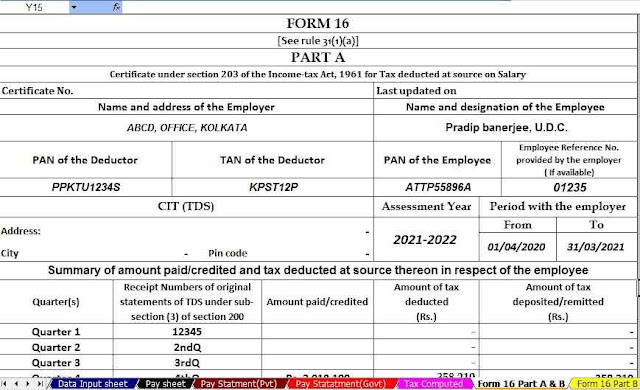

Income Tax Allowance and Exemptions F.Y.2020-21 along with Automatic Income Tax Form 16 for the F.Y.2020-21

Income Tax Allowance and Deduction F.Y.2020-21.

Salary employees make up the largest share of the country’s overall taxpayers and the contribution they make to tax collection is significant enough. As a result of income tax exemption, there is an opportunity to save tax for the salaried class. With the help of these discounts and rebates and, one can significantly reduce his taxes.

In this article, we try to list some of the big discounts and allowances available to salaried individuals, using which can reduce their income tax liability.

Allowance exemption

A tenant-based on rent can get the benefit of HRA (house rent allowance).

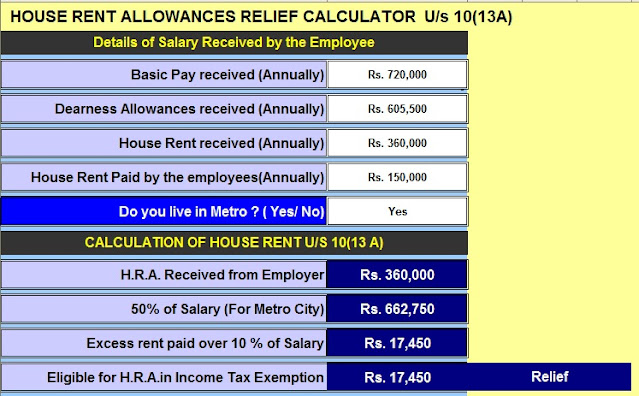

You can claim the lowest of the following as an HRA discount.

A. Total HRA received from your employer

B. Rent paid less than 10% (Basic Salary + DA)

C. 40% of non-metro salary (basic salary + DA) and 50% of metro salary (basic salary + DA)

Download Automated Income Tax House Rent Exemption Calculator in Excel U/s 10 (13A) as per Income Tax Act

The Finance Minister of India, at the time of presenting the Union Budget 2018, the limit was Rs. 40,000 has been increased. The interim budget for 2019 is Rs 50,000.

You may also, like- One by One Preparation Form 16 Part A&B and Part B in Excel for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Deduction travel allowance (LTA)

The Income-tax Act also provides for LTA exemptions for salaried employees, which restricts travel expenses to their pages. The following are the restrictions applicable to LTAs:

The LTA covers only domestic travel, not the cost of International travel

This type of travel mode must be by rail, air travel or public transport

Approved discount

Sections 80C, 80CCC and 80CCD (1)

Section 80C is the most widely used option for income tax protection. Here, any person or HUF (Hindu Undivided Family) who invests or spends on prescribed tax protection opportunities can claim a rebate of up to Rs 2,000. One and a half lakh rupees for tax exemption. To save taxes. For some such investments up to a maximum of Rs 1.5 lakh is provided under Section 80C, 80CCC, and 80CCD (1).

Life insurance premium

Equity Linked Savings Scheme (ELSS)

Employees Provident Fund (EPF)

Anniversary / Pension Schemes

Home loans are the main payment

Tuition fees for children

Contribute to PPF account

Sukanya Samridhi Account

NSC (National Conservation Certificate)

Fixed Deposit (Tax Savings)

Post office deposit

National Pension Scheme

You may also, like- One byOne Preparation Form 16 Part B in Excel for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Medical Expenses and Insurance Premiums (Section 80D)

Section 80D is a discount that you can claim for medical expenses. Treatment paid for the health of the self, family, and dependent parents can save tax on insurance premiums.

The limit for Section 80D exemption is:

25,000 for premium for self/family.

. Rs 50,000 for a premium paid for senior citizen parents.

In addition, health checkups up to Rs. 5000 are also allowed and included in the overall limit.

Deduction up to Rs 50,000 on medical expenses incurred by senior citizens (years above 60 years or older) or senior citizen parents, if they are not covered by any medical policy.

The taxpayer can claim a maximum rebate of Rs 50,000 including premium amount and medical expenses if he is a senior citizen

(60 years or more) In addition, if he pays the medical bills of his senior citizen parents, he can claim a rebate of up to an additional five thousand rupees. 5000

Your employer can pay a premium on your behalf and deduct it from your salary. Such premium paid is also eligible for discount under section 80D.

You may also, like- Prepare At a time 50 Employees Form 16 Part A&B in Excel for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Home Interest (Sections 80C and 24B)

Another key tool for tax savings is the interest on the home. Homeowners have the option to claim up to Rs 2 lakh as an exemption for a house building loan interest

In addition to the above, the principal component of a housing loan repayment can also be claimed as a rebate under Section 80C up to a maximum of Rs 1.5 lakh.

Deduction for higher studies (Section 80E)

The income tax law provides exemptions for interest in education. Notable conditions involved in claiming this amount of discount are that it should have been taken from a bank or financial institution for higher studies (in India or abroad) by the person or his spouse.Or children.

Exemption U/s 80G

Section 80G of the Income-tax Act, 1961 offers an income-tax exemption to an appraiser who contributes to a charitable fund. 50% or 100% deduction of donated amount with or without restriction.

You may also, like- Prepare At a time 100 Employees Form 16 Part A&B in Excel for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

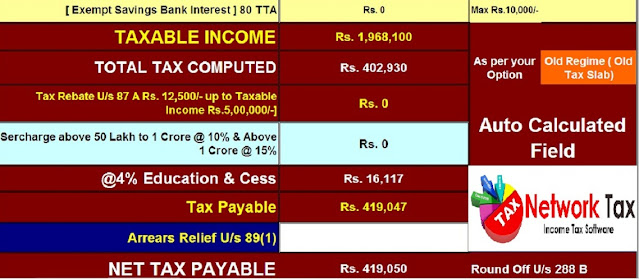

Savings Account Interest Discount (Section 80 TTA)

Section 80 TTA of the Income Tax Act, 1911 offers Rs.10,000 rebate on income earned from savings account interest.

Home Interest (Section 80EE)

Section 80EE allows homeowners to claim an additional rebate of Rs.50,000/-

Children's allowance

Employers can provide education allowances for your children as part of your salary. Such allowance received by the employer for the education of children is exempt from tax.

However, the employee can claim a maximum of Rs 1200 children per year per chile for a Maximum 2 Child & Hostel Allowances Rs.300 P.M. or 3600/- Per Year.

No comments:

Post a Comment