Tax Benefits on home loan: Sections 24 and 80EEA and 80C With Automated Income Tax Calculator All in One in Excel for the Govt & Non-Govt (Private) Employees for F.Y.2021-22 as per Budget 2021

Tax Benefits of Home Loan: Sections 24, 80EEA and 80C |There are two segments to home installment: Principal implies head's installment and reimbursement of interest. Since there are two separate parts to the second installment, the tax benefits on home advances are represented by various sections of the Income-tax Act and are liable to tax exemptions under various sections when recording an annual tax return.

Home loan tax benefits

The benefits of a home advance can be guaranteed as follows

Section 24 (b) – H.B.L. Interest. Maximum of Rs. 2 lakhs

Section 80 C-H.B.L Principal most extreme Rs. 1.5 lakh

Section 80EEA-H.B.L's interest installments

You may also, like-Prepare One by One Income Tax Form 16 Part A&B and Part B for the F.Y.2020-21

Coming up next are the tax benefits that can be asserted on a home under these classes: -

Section 80C: Tax benefits on home apparatuses (principal amount)

The amount paid by an individual/HUF as an installment of the principal amount of lodging is permitted as tax exemption under Section 80C of the Income Tax Act. The greatest tax exemption permitted under Section 80C is Rs 1,50,000.

This tax exemption incorporates absolute exemptions supported under section 80C and incorporate tax amounts put resources into PPF accounts, tax-saving fixed stores, value arranged common assets, public reserve funds testaments, senior resident security plans, and so on

You may also, like- Prepare at a time 100 Employees Automated Form 16 Part B for the F.Y.2020-21

Under Section 80C this tax the exemption is paid based on installment for the year fixed for stamp obligation and the amount paid as the enrollment expense is likewise permitted as tax exemption under section 80C regardless of whether the appraiser has not taken a credit.

Notwithstanding, the home credit office under this section for reimbursing the key piece of the home advance is permitted solely after the culmination of the development work and the issuance of the fulfillment testament. No waiver will be taken into consideration the impotent’s installment for the year where the property was under development under this section.

You may also, like- Prepare at a time 50 Employees Automated Form 16 Part B for the F.Y.2020-21

Furthermore, in the event that you want to buy an under-development property, it is estimated lower than the finished property, you are likewise mentioned to note here that GST is additionally collected on the under-development property. Nonetheless, no help charges are exacted on properties on which development has been finished.

House property ought not to be sold inside 5 years

Section 80C additionally expresses that for the situation where the assessee has claimed the monetary establishment under which the property has been moved under section 80C before the expiry of the time of 5 years from the finish of the monetary year. No markdown or tax advantage can be given on a home credit under 80C. The aggregate sum of all-out tax exemption previously asserted in earlier years is the amount of property sold for the current year and the assessee will be obligated to pay tax on such public pay, for example,

You may also, like- Prepare at a time 50 Employees Automated Form 16 Part A&B for the F.Y.2020-21

Tax advantage on home advance (amount of interest)

The home tax advantage can be asserted as a refund under the recently embedded section 80EEA (2020 Budget Amendment) under Section 24 to pay interest on the home advance.

Section 24: Income tax advantage on interest on buy/development of the land

Tax benefits on homeowners are permitted to be absolved under Section 24 of the Income Tax Act for installment of interest. Pursuant to Section 24, the pay got from the home property will be decreased by the amount of interest paid on the advance taken with the end goal of procurement/development/fix/reestablishment/reproduction of the property.

The greatest amount of tax exemption permitted under section 24 of a self-involved property ought to be a limit of Rs. 2 lakhs (Increased from 1.5 lakhs in the 2014 spending plan to 2 lakhs)

In the event that the property for which the house has been obtained isn't self-involved, as far as possible has not been fixed for this situation and the taxpayer will actually want to benefit tax exemption in the amount of full interest under section 24.

If it's not too much trouble, NOTE: If a property isn't self-involved by the proprietor because of the way that it is because of his work, business, or calling somewhere else, he should be in a spot not possessed by him somewhere else. The amount of tax exemption permitted under section 24 ought to be Rs. Just 2 lakh rupees.

You may also, like- Prepare at a time 100 Employees Automated Form 16 Part A&B for the F.Y.2020-21

It is likewise critical to take note that this tax deduction on interest under section 24 is deductible based on payable, for example, based on withdrawal. In this way, the exemption under section 24 can be guaranteed on a yearly premise despite the fact that no installment has been made for the year when contrasted with Section 80C which permits exemption just based on installment.

Moreover, if the property isn't gained/worked after the finish of the procured monetary year, the interest advantage will be diminished from Rs 2 lakh to Rs 30,000. (Expanded cutoff from 3 years to 201 years-1. Five years from monetary year).

Classification 80EEA: Income Tax Benefits on Home Interest (First Time Buyers)

Interest discount can likewise be asserted under 8080EEA, which is more than the refund or more, Rs 24,000/ - is permitted to be guaranteed under section 24. Rs 2 lakh or more Rs 1.5 lakh under deduction section 80C is likewise permitted

This exemption from Section 80EEA will be relevant just in the accompanying cases: -

1. This markdown will be permitted if the stamp obligation worth of the bought property is not as much as Rs. 45 lakh.

2. The note ought to be supported between first April 2019 and 31st March 2021. The over 3 sections identifying with Home Benefit Tax Benefit are summed up as follows: - 1) Discount 24 (B) Rs. 2 Lakh 2) Exemption U/s 80 C Rs. 1.5 lakh as the amount of HBL The principal amount and 3) Exemption U/s 80EE Rs. 1.5 lakh at home loan interest

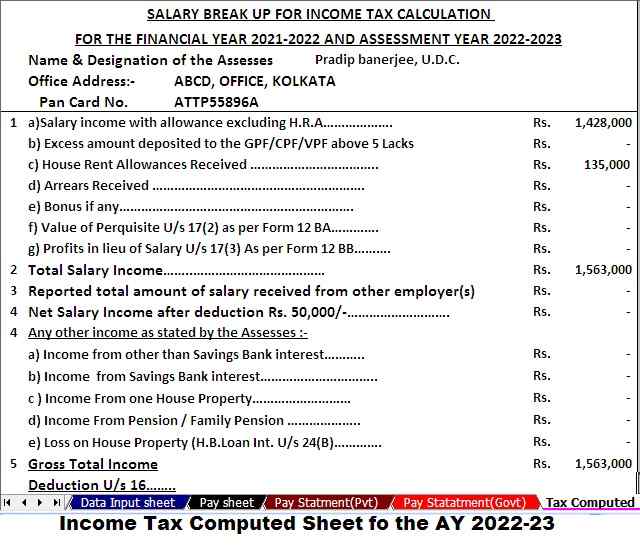

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Automated Income Tax House Rent Exemption Calculation U/s 10(13A)

8) Automatic converts the amount into the In-Words, without any Excel Formula.

No comments:

Post a Comment