Tax Planning for F.Y.2021-22| With Automated Income Tax Preparation Software In Excel All in One Govt & Non-Govt Employees for the F.Y.2021-22

Tax Planning for F.Y.2021-22| According to the Finance Act,2020, when a person favours a

the new tax, no specific exemption (such as Section 80C, Section 80D, Section 80G, etc.)

can be claimed under Chapter VI-A of the Act. It may be claimed that only deductions can be made

under sub-section (2) of section 80CCD (notice the pension scheme employer contributes to

the employee's account.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Assam State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time Tax computed sheet as per new and old tax regime + Individual Salary Structure as per the Assam State Employees Salary Pattern + Auto Calculate H.R.A. Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

Persons with disabilities are exempt from maintenance including medical treatment of a dependent person (Section 80DD of the Act)

A resident who spends on the treatment and maintenance of a disabled person gets a retirement of Rs 75,000 and if a dependent is a disabled person and if that dependent is a severely disabled person then INR 125,000

Exemption on interest earned on higher education (Section 80E of the Act)

According to the Domestic Tax Act of India, when calculating a person's total income, certain financial institutions (including banks) pay interest separately on loans (tax payable out of their income) / charities for the higher education of themselves / their relatives. Appropriate discount is

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time Tax computed sheet as per new and old tax regime + Individual Salary Structure as per the Bihar State Employees Salary Pattern + Auto Calculate H.R.A. Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

The reduction for interest paid on the loan will be available before the following period:

tax year to year for a year where the taxpayer starts paying interest; Or

up to the interest on such loan is paid in full.

Discount for rent payment (Section 80GG of the Act)

Individuals who are paying rent for more than 10% of taxable income for a dwelling (furnished/unfinished) but have not received a house rent allowance from the employer can claim a discount of the following:

Rent - 10 % of taxable income; Or INR 5,000 per month (or INR 60,000 annually); Or 25 per cent of taxable income

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the West Bengal State Employees for theF.Y.2021-22 [This Excel Utility can prepare at a time Tax computed sheet as per new and old tax regime + Individual Salary Structure as per the West Bengal State Employees Salary Pattern + Auto Calculate H.R.A. Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

Savings Account Deposit Interest Exemption (80 TTA by Act)

Additional discount up to INR10,000 per annum on interest on deposits (excluding time deposits) in savings accounts at designated banks, co-operative societies and post offices for individuals / HUFs from 2012/13 to tax F.Y. 2012-13.

Deposit interest on deposits for senior citizens (Section 80TTB of the Act)

Interest on deposits with specific banks, co-operative societies and post offices (including annual deposits) up to INR 50,000 per annum for senior citizens from tax year / 1999 on wards. However, no waiver will be allowed under section 80TTA in this case

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Government (Private) Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time Tax computed sheet as per new and old tax regime + Individual Salary Structure as per the Non-Govt Employees Salary Pattern + Auto Calculate H.R.A. Calculation U/s 10(13A) + Automated Form 12 BA + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

Exemption for persons with disabilities (Section 80U of the Act)

INR75,000 is available for a disabled resident and a

Discount for interest on the home property (a) 24 (b)

Deduction of interest payable on, construction, repair etc. for self-occupied house Rs. 2 lacks.

* Where the property has been acquired or constructed with borrowed capital, the interest payable on the borrowed capital for the period at which the property was acquired or constructed prior to the previous year, if any has been deducted by any part thereof. Under any other provision of this Act, under this section deductions, will be made in equal installments for the previous year and immediately for the following 4 years.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time Tax computed sheet as per new and old tax regime + Individual Salary Structure as per the Jharkhand State Employees Salary Pattern + Auto Calculate H.R.A. Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

* If a person owns more than one home during F.Y. the maximum home property loss compared to other fixed income is INR Rs. 200,000 in the same financial year alone. Balance House Assets Decreased Assets Decreased Assets can be advanced for a maximum of 8 F.Y to match the income.

* As provided by the Finance Act 2019, the taxpayer may consider the property of two houses owned by them as self-acquired property. Accordingly, there is no need to pay tax on fictitious rent from such second self-occupied / vacant property. In addition, the total tax deduction for interest payable on housing loans for both the mentioned self-occupied / vacant properties will be limited to INR 200,000 / - per tax year.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time Tax computed sheet as per new and old tax regime + Individual Salary Structure as per the Andhra Pradesh State Employees Salary Pattern + Auto Calculate H.R.A. Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

* The Finance Act of 2020 proposes that where taxpayers opt for a new tax discipline, no exemption will be available for interest payments and principal payments. Moreover, any foreclosure loss will not be available for set-off against income from home property. * Under the Finance Act, 2020, it is proposed to offer a rebate of R 150,000 on interest on affordable housing, i.e. housing loans below INR 4.5 Lakh (for approved loans from 1 April 2019 to 31 March 2020) and extended loans approved for 1 March 2021.

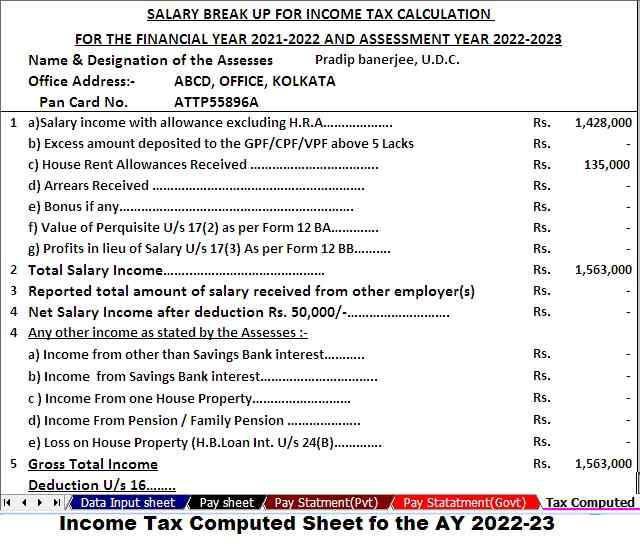

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

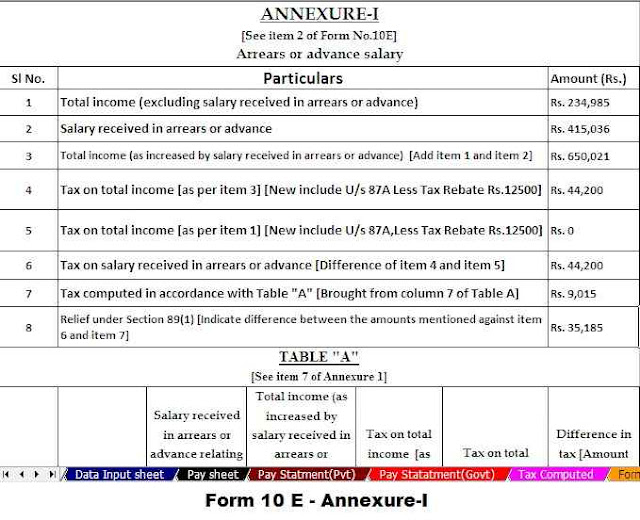

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

No comments:

Post a Comment