Income Tax salary arrears relief U/s 89 of the Income Tax Act, 1961.With Automated Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22

What is income tax relief under section 89(1) of the Income Tax Act, 1961?

For the purpose of income tax law, income tax is levied on the total income earned or received by the assessee in the previous year. There are some cases where the past due employee is paid as salary arrears in the current year.

In this case, the income tax paid by the employee will, in this case, be higher than the current year. This may be due to a change in the slab rate applicable to the assessor which will cause their slab rate to change to a higher tax slab.

Tax relief under section 89 enables us to deal with such situations. It provides relief in cases where the employee is in a high tax bracket at the time of receipt of the previous year's payment.

How to calculate tax relief under section 89 (1) regarding salary arrears?

Detailed steps for calculating relief under Article 89 is given below:

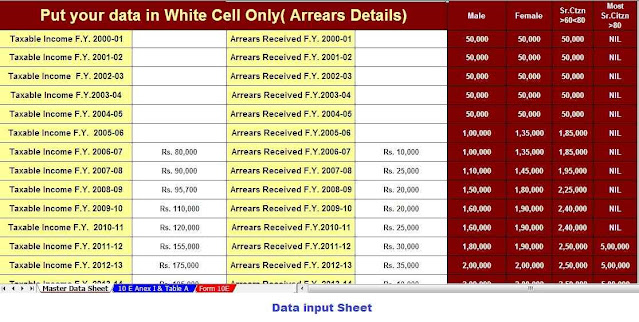

Step 1: First calculate the tax payable on the total income including the arrears of the year in which it is received.

Tax calculate as payable on total income excluding arrears amount in the year of receipt. As evidence, the employer provides the employee with outstanding documents that will specify the additional amount received.

This amount needs to be deducted from the total salary mentioned in Form 16 of the employee. If there were no arrears, the tax account would give us liability in one case.

Step 3: Calculate the difference between step 1 and step 2 This will be taxed on the additional salary included in the total income.

Step 4: Calculate the tax payable for each previous year with additional arrears:

On total income including additional arrears

On total income excluding additional arrears

Step 5: Calculate the difference between the amount calculated in step 4 This will calculate the actual tax liability of the previous year for receipt of arrears in the current year.

Step:: The additional amount of step at over on step over will be the amount of tax relief allowed under section under no. No need to.

Examples of how income tax relief can be calculated.

Now make out the above points with the help of an example. Suppose Anima got it

Previous Year | Taxable Salary |

2011-12 | 7,00,000 |

2012-13 | 8,00,000 |

2013-14 | 9,00,000 |

In view of the above information, we will now try to estimate the tax payable for relief and assessment year 2021-22 under section 89 that Anima's salary in the previous year of 2020-21 was Rs. 12,00,000.

.

Previous Year | Amount received |

2011-12 | 1,00,000 |

2012-13 | 1,50,000 |

2013-14 | 1,50,000 |

Computation of Tax Payable For the Assessment Year 2021-22

Particulars | Inclusive of salary arrears | Exclusive of salary arrears |

The current salary of Amit | 12,00,000 | 12,00,000 |

Add: Arrears of Salary | 4,00,000 | nil |

Taxable Salary | 16,00,000 | 12,00,000 |

Income tax on the above | 3,04,200 | 1,79,400 |

Health & education cess @4% | 12,168 | 7,176 |

Total tax payable | 3,16,368 | 1,86,576 |

Computation of Tax Payable For The Previous Assessment Years:

Computation for the Assessment Year 2011-12

Particulars | Inclusive of salary arrears | Exclusive of salary arrears |

The current salary of Amit | 7,00,000 | 7,00,000 |

Add: Arrears of Salary | 1,00,000 | nil |

Taxable Salary | 8,00,000 | 7,00,000 |

Income tax on the above | 94,000 | 74,000 |

Education Cess & SHEC @3% | 2,820 | 2,220 |

Total tax payable | 96,820 | 76,220 |

How to claim relief under Income Tax Act, 1961?

The tax flow of arrears of income is recalculated according to the tax slab applicable for both years. This means that the tax flow will be calculated for the year of receipt and the year related to the income.

To claim relief under Section 89, the Income Tax Department has made it mandatory to file Form 10E. In a case where the employee has claimed relief under section 89 but has not submitted Form 10E, the claim will not be granted and the employee will be informed accordingly.

Calculation of Income Tax Relief Under Section 89:

Particulars | Amount | Amount |

Tax payable on arrears in AY 2021-22: |

|

|

Tax payable on income including arrears | 3,16,368 |

|

Tax payable on income excluding arrears | 1,86,576 | 1,29,272 |

Tax payable in respective years on arrears: |

|

|

Tax payable on income including arrears(96,820+1,41,110+1,49,350) | 3,87,280 |

|

Tax payable on income excluding arrears(76,220+94,760+1,13,300) | 2,84,280 | 1,03,000 |

Relief under section 89 |

| 26,272 |

No comments:

Post a Comment