Income tax benefits are available for education. With Auto-Fill Income Tax Preparation Software in Excel All in One for the Govt and Non-Govt Employees for the F.Y.2021-22

Income tax benefits are available for education. The pace of geometric progress in education has the potential to improve the quality of life of individuals. The government provides some relief to the taxpayers in this case. Let's discuss with education the benefits available under the Income Tax Act of India.

Exemption under Section 80C for the cost of full-time education.

You can claim discounts up to money. In the case of full-time education in

The pace of geometric progress in education has the potential to improve the quality of life of individuals. The government provides some relief to the taxpayers in this case. Let's discuss with education the benefits available under the Income Tax Act of India.

Exemption under Section 80C for the cost of full-time education in

You may also, like- Auto-Fill Income Tax Preparation Software All in One in Excel for the Non-Government Employees for the F.Y.2021-22

Income tax benefits are available for education. You can claim discounts up to money. In the case of full-time education in

This deduction is only allowed for tuition fees and other payments such as a donation or development fee in whatever name the payment is made is not eligible for this discount. If your child over the age of two is receiving full-time education, you can only claim this discount for two children of your choice. However, if your spouse also works, the other parent can claim a discount for the other children as well. If the fee paid for two children exceeds the limit of Rs.1.50 lakh, an additional fee can be claimed by another guardian. There is no impediment for both parents to claim an exemption for the same children but the double deduction for the same expenditure is not allowed. Please note that deductions under section 80C are only available for full-time education so this deduction cannot be claimed for any correspondence course.

You may also, like- Automated Income Tax Preparation Software in Excel for the Assam State Government Employees for the F.Y.2021-22

Tax benefits for interest paid on education. In addition to the above benefits of tuition fees, a person can claim a deduction for interest paid on an education loan taken for financing higher education of certain relatives under relatives U/s 80E. Higher education for this purpose means any educational course after completion of the senior secondary examination. You can also claim for this child for whom you are a legal guardian.

This discount can be claimed for eight consecutive years starting from the year you start providing the service. It may be noted that these deductions can only be claimed on a payment basis. So if you pay interest arrears on your education loan in a certain year, you can claim the full interest paid within the year regardless of the year in which the interest relates. Unlike a home loan where you can claim a discount up to a certain limit, there is no financial limit to claim a deduction for the interest on an education loan.

In addition, you can claim this discounted education loan for part-time and full-time courses as opposed to deductions under 80C under tuition fees. It is interesting to note that this discount is available for loans taken for education anywhere in the world, as opposed to discounts for tuition where the educational institution is located in

In order to be eligible to claim this deduction, you have to take any loan from any financial institution or approved charity. Financial institutions for this purpose include any bank or any other institution approved by the government. Charities must also be recognized by the central government. So if you borrow education funds from your friends or relatives, you cannot claim this discount.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees for the F.Y.2021-22

If you get an education loan in

In addition to the two benefits described above that are available to all taxpayers who are either salaried or self-employed, tax laws also allow certain employees to be exempted from certain allowances paid by the employer. The first such exemption is the education allowance received from your employer. 100 / - per month for your two children.

The second such exemption allowance is the hostel allowance which is paid by the employer at the maximum rate of Rs. 300 / - is limited to a maximum of two children per child. It is important to note that the allowance will only be considered a discount if it is spent against the allowance paid by your employer. Furthermore, you cannot claim these discounts unless your employer pays you such allowances as a component of your salary.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax House Rent Exemption Calculation U/s 10(13A)

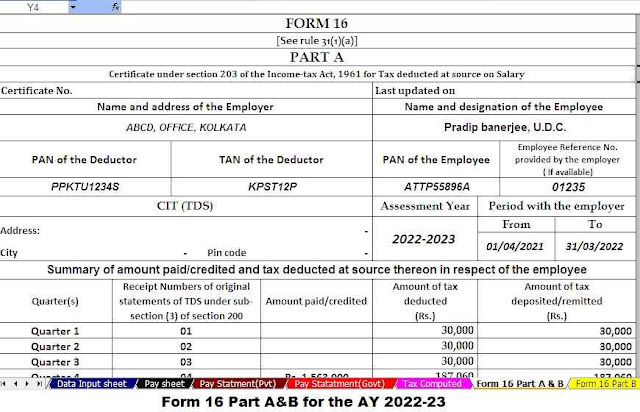

6) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

7) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

No comments:

Post a Comment