Save tax for salaried people Includes automatic income tax preparation software in Excel for government and private employees for F.Y.2021-22

Save tax for salaried people,Central Budget 2021 results

Exemption from ITR filing for senior citizens aged 75 years and above, only pension and interest income.

B. The Income Tax Department has introduced pre-filled ITR with additional details to facilitate the return filing process.

C. The deadline for submission of delayed and amended returns has been reduced to 3 months. This means that the IT department has to process the returns and send a notice under section 143 (1) by 31st December.

Picture of tax exemption

It is important to understand what your tax slab and each of your pay segregation elements mean. This can help you determine how to save tax.

Category I - Understanding your payslip

Basic salary

It’s a specific component of your paycheck and it forms the basis of other parts of your paycheck, hence the name. For example, HRA is defined as the percentage of this basic salary (as considered by the company). Your PF is deducted 12% of your basic salary. This is usually a large portion of your total salary.

House rent allowance

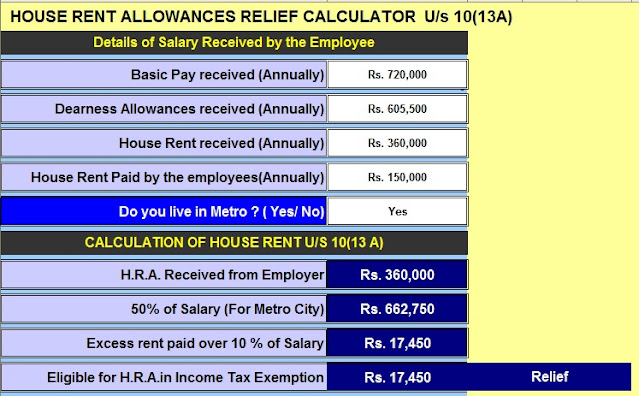

Salary earners, who live in rented houses/apartments, can claim house rent allowance or HRA for a tax deduction. The Income Tax Act prescribes a procedure for calculating HRA which can be claimed as an exemption.

Download Auto Home Rental Calculator U / s 10(13A) in Excel

Case Study: Manika works at an MNC in

How can Manika use this allowance?

Malaika can rent to her parents and claim the allowance if they own the land they currently live on. All he has to do is enter into a rental agreement with his parents and transfer money to them every month.

Also, keep in mind that your HRA will be fully taxable if you receive and do not rent an HRA.

Paid workers can get concessions for travelling in

Bonus

Performance Incentive, whatever its name may be, is 100% taxable. Performance bonuses are usually linked to your valuation rating or your performance over a period of time and are based on company policy.

Employee Contribution to Provident Fund (PF)

Future Fund or PF is a social security initiative of the Government of India. Both the employer and the employee make an equivalent contribution of 12% of the employee's basic salary per month towards the employee's pension and provident fund. About 8.65% interest is accrued from FY 2018-19 (previously it was 8.55% for FY 2017-18). This is a retirement benefit that must be paid by companies with more than 20 employees in accordance with the EPF Act, 1952.

Standard deduction

Standard deduction U/s 16(ia) was first reintroduced in the 2018 budget. This deduction replaces transportation allowance and medical allowance. Employees can now claim a flat for Rs. 50,000 (before Budget 2019, it was Rs. 40,000) deducted from the total income, resulting in lower tax costs.

Professional tax

Occupational tax or employment tax is a tax levied by a state, just like the income tax levied by the central government. The maximum amount of professional tax that can be levied by a state is Rupees Two Thousand Five Hundred. It is usually deducted by the employer and submitted to the state government. On your income tax return, professional tax is deducted from your salary income.

Relief under section 89 (1)

If you have to get any arrears salary you can avail this section 89(1)

Calculate tax relief yourself

A. Calculate the tax payable on the total income including the additional salary in the year received.

B. Calculate the tax payable on the total income after deducting the extra salary in the year received

C. Calculate the difference and steps 1 and step 2

D Calculate the tax payable on the total income of the year related to the arrears including E Calculate the difference between step 4 and step 5

F The additional amount in step 6 in step 3 is the tax relief that will be granted.

Note that if the amount in step 6 exceeds the amount in step 3, no relief will be allowed.

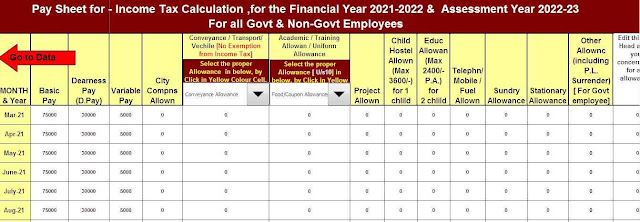

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

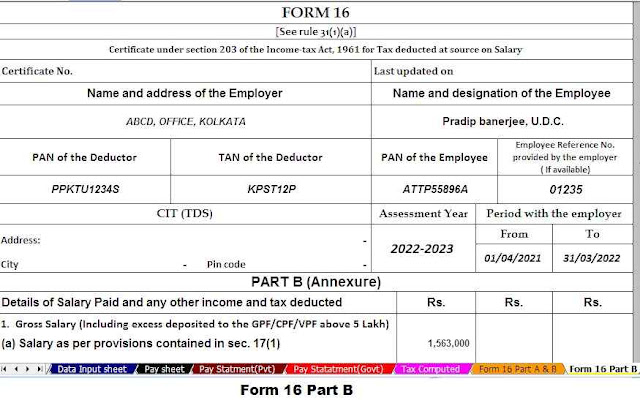

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula

No comments:

Post a Comment