Download and Prepare at a time 50 or 100 or One by One Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22 as per Old and New Tax Regime

What is Form 16 of Certificate? Automated Income Tax Form 16 along with Part A and B for the financial year 2021-22 as per section 115 BAC

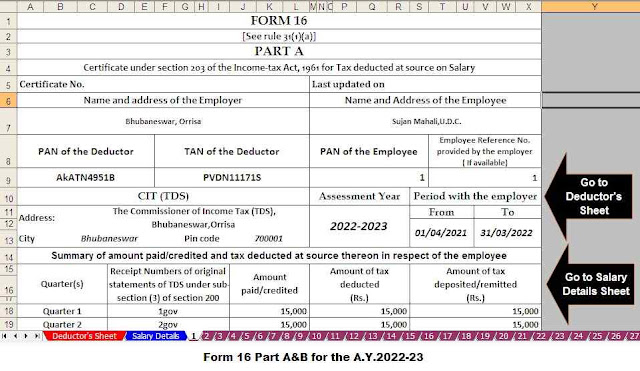

Form 16 is an income tax certificate issued by an employer giving details of how much tax was deducted and when it was submitted to the IT (Income Tax) department. It is issued as proof of tax deduction and filing. Form 16 can also be considered as salary TDS certificate. It is also considered the source of proof of employee's tax return. Form 16 consists of two parts, Part A and Part B.

16. Part A of Form 16

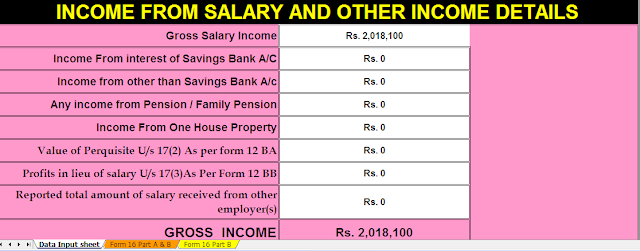

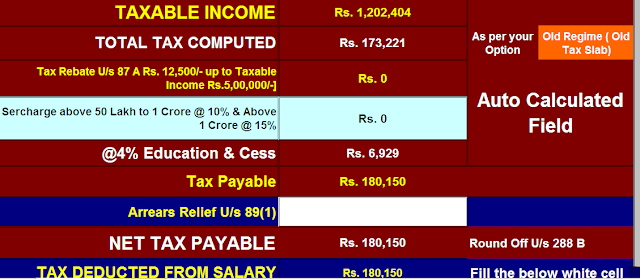

Part A of Form 16 contains the details of withholding tax on salary. This includes the name and address of the employer, PAN (Permanent Account Number) and TAN (Tax Collection and Deduction Account Number), amount deposited and summary of taxes deducted.

16. Part B of

It must be issued by the employer. Contains details of pay break. It also includes deductions allowed under the Income Tax Act (Chapter VI A).

Eligibility for Form 16

As per the rules issued by the Ministry of Finance, Government of

Download all types of Form 16 for the financial year 2021-22 from the link given below.

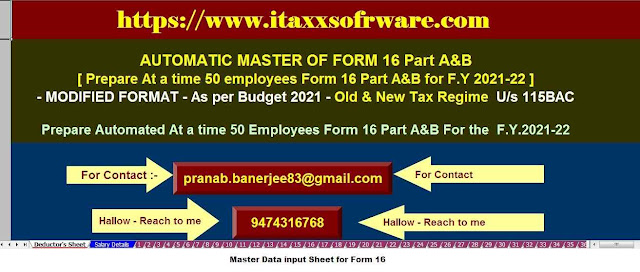

Automated Form 16 Part B and Part A&B for FY 2021-22 & Ass Yr 2022-23

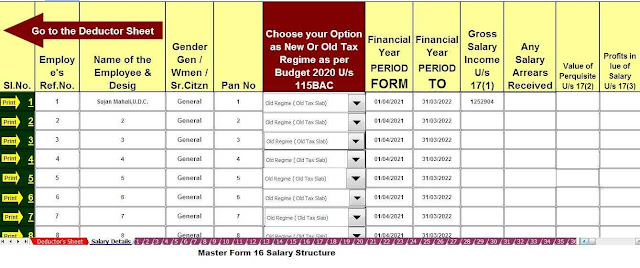

1)One by One Preparation Automatic Form 16 Part A & B and Part-B for the Financial Year 2021-22 and Ass Year 2022-23 (Click here to Download the Utility]( This Excel Utility can use New and Old Tax Regime U/s 115BAC as per Budget 2021)

2) One by One Preparation, Automatic Form 16 Only Form 16 Part B for the Financial Year 2021-22 and Ass Year 2022-23, [Click here to download the Utility] ( This Excel Utility can use New and Old Tax Regime U/s 115BAC as per Budget 2021)

3) Master of Form 16 only Part-B for the Financial Year 2021-22 and Ass Year 2022-23, ( which can prepare at a time 50 employees Form 16 Part B) which Click here to download Utility] ( This Excel Utility can use New and Old Tax Regime U/s 115BAC as per Budget 2021)

4) Master of Form 16 Part B for FY 2021-22 and Ass Year 2022-23 ( This Utility can prepare at a time 100 employees Form 16 Part B [ Click here to Download the Utility ] ( This Excel Utility can use New and Old Tax Regime U/s 115BAC as per Budget 2021)

5) Master of Form 16 Part A&B FY 2021-22 and Ass Year 2022-23,[ This utility prepare At a time 50 employees Form 16 Part A&B ] Click here to Download the Utility] ( This Excel Utility can use New and Old Tax Regime U/s 115BAC as per Budget 2021)

6) Master of Form 16 Part A&B (This utility can prepare at a time 100 employees Part A&B) for 2021-22 and Ass year 2022-23 [Click here to download the Utility] ( This Excel Utility can use New and Old Tax Regime U/s 115BAC as per Budget 2021)

No comments:

Post a Comment