Tax benefits on home loans| With Automatic Salary Arrears Relief Calculator U/s 89(1) with Form 10 E from F.Y.2000-01 to F.Y.2021-22 (Up-to-date Version}

Tax benefits on home loans. Union Finance Minister Nirmala Sitharaman in her budget speech proposed to extend the deadline for getting additional concessions for repaying interest on home loans till March 31, 2022. This comes after the government extended the deadline to March 31, 2021, in the previous budget.

While a housing loan can help you get a home for yourself, it can also be a costly affair. But the various tax benefits that come with this type of loan help you save money every year. See how you can make the most of these benefits.

Tax Benefits on Home Loans (F.Y 2021-22)

The following table gives you tax benefits under the relevant sections of the Income-tax Act, 1961.

New Update (Union Budget 2021-2022)

Here is an update from the latest budget presented by Union Finance Minister Nirmala Sitharaman on 1 February 2021:

The eligibility period has been extended till March 31, 2022, to claim an additional deduction for the interest of Rs 1.5 lakh on a loan taken to buy an affordable home.

The eligibility to claim tax left for affordable housing projects has been extended for another year. The new deadline is March 31, 2022.

A new tax rebate was proposed for the advertised affordable rental housing projects to promote the provision of affordable rental housing for migrant workers. Home Loan Tax Benefit Under Section 80C - Main Deduction. Section 80C relates to the deduction of principal amount:

For both self-acquired and late-out properties, you can claim a maximum of Rs 1.5 lakh per annum from taxable income on basic payments.

Stamp duty and registration charges may be included. These benefits can avail only one time.

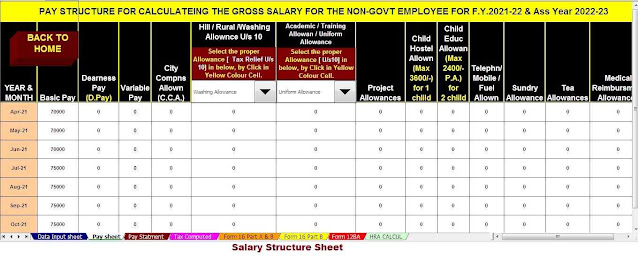

You may also, like- Automatic Income Tax Preparation Excel Based Software All in One for the Non-Govt Employees for the F.Y.2021-22.[This Excel Utility prepare at a time Tax Computed Sheet + Individual Salary Structure as per all Non-Govt employees salary pattern+ Automatic H.R.A. Exemption Calculation U/s 10(13A} + Automatic Form 12 BA + Automatic Form 16 Part A&B and Part B for F.Y.2021-22]

To claim this, you must first complete the construction of the property.

Your home should not be sold within 5 years of your possession to claim this deduction

If you sell your home within 5 years of occupancy, any deductions claimed will be refunded in the year you sell it. This amount will be added to your income for the year of sale.

Tax benefits under section 80EE

It has been proposed to increase the income tax benefit by Tk 1.5 lakh for paying interest

You can get discounts up to Rs.3.5 lakhs

The benefit can be availed on and above the existing exemption of Rs. 2 lakhs under Section 24 (b)

The value of the property must be less than Rs 45 lakh.

Deduction for a joint home loan

If two or more persons take a housing loan, then each of them is eligible to claim a deduction on interest paid up to Rs 2 lakh. Up to Rs 1.5 lakh, tax can also be deducted on the principal paid for each. However, all applicants must be co-owners of the property to claim this discount. Therefore, a joint home loan can give you more tax benefits.

Tax benefits on home loan for owning a second property.

Under the present provisions, the tax benefit is applicable on interest payable. It has been suggested that the second self-occupied home may also be claimed as a self-occupied one to help borrowers save more on taxes.

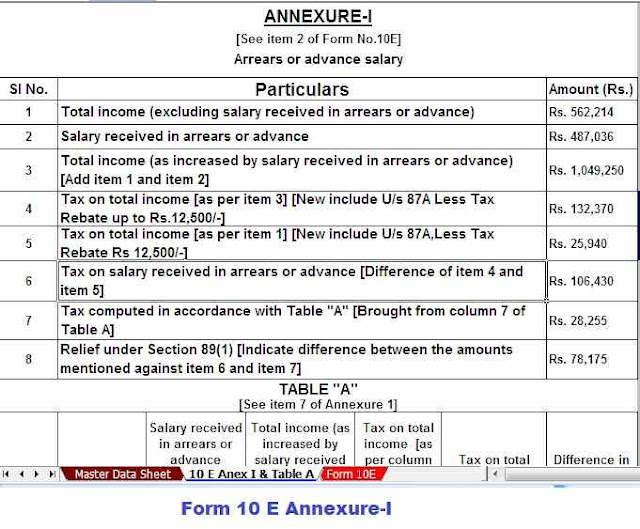

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) along with Form 10E from the Financial Year 2000-01 to Financial Year 2021-22 (Up-to-date Version)

No comments:

Post a Comment