What is Income Tax Form 16? With automatic income tax revised master of Form 16 Part A and B for F.Y.2020-21

What is Income Tax Form 16? Form 16 is nothing more than a salary certificate issued by your company that provides information about the salary you received in the financial year and the amount of TDS deducted from your salary.

In that case, the income from your annual salary exceeds the basic tax deduction limit; Then, your employer will be asked to deduct TDS from your salary and pay it to the Government of India. Employers provide 16 forms to their employees as proof of filing an income tax return. If your annual income is less than the discount limit, no TDS will be deducted from your salary.

Form 16 Part B

Form 16 Part B is issued by the annual employer, containing information on other income, discount allowance, arrears of salary, duty payable, etc., usually before June 15 of the following year. It immediately follows the fiscal year where the tax is deducted. No worries if you lose your 16 forms, you can get a duplicate issued by your employer without any hassle of hiring.

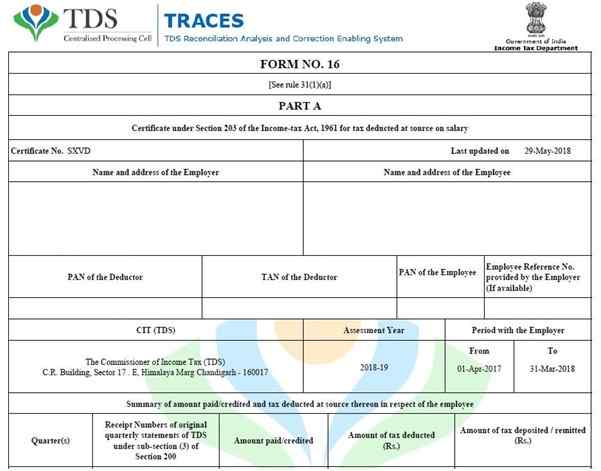

Form 16 Part A

The following is a list of important components of Form 16 Part A:

Dedicator’s information such as Tax Collection Account Number (TAN), Name, Permanent Account Number (PAN), Tax Exemption as well as deduction etc.

The employee returns to the employee (if any), or the balance paid by the employee.

Employee name Personal details such as full name, Permanent Account Number (PAN) etc.

All tax-related information like quantity, invoice number, demand draft number, check number etc.

The tax has been cut as per section 191A.

Recognition of the total number of taxes paid by the employer.

• Other information such as salary, total salary, net salary, park, deduction etc.

• Receipt of TDS has been given. If your employer only has one in a financial year, that particular employer will publish Form 16 for the entire fiscal year. If you change jobs and are employed by more than one company in a financial year, all employers will be issued a separate Form 16 for the period for which they are working.

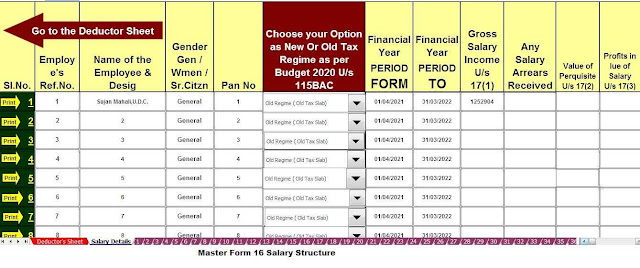

Download and Prepare 50 Employees Form 16 Part B for F.Y.2020-21 at once The main features of this Excel utility are: -

1) This Excel utility is your income tax account 115 BAC according to new and old tax rules.

2) This Excel utility can prepare 50 employees at a time in Form 16 Part B in a revised format.

3) Convert quantity to in-word automatically without any excel formula

4) This Excel utility automatically prevents double-entry of an employee's PAN number.

5) All income tax departments are available under Budget 2020 as well as Income Tax Act 1961

6) This Excel utility has the option of choosing a new or old tax system

Main Feature of this Excel Utility:-

$ This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B

$ Prevent double entry of Pan or Tax Number

$ All amended Income Tax Section as per Budget 2021 has in this Excel Utility.

$ Automatic Convert amount to the In-Words without any Excel Formula.

No comments:

Post a Comment