Exemption from Section 87A for the F.Y.2021-22 | With Automated Income Tax Form 16 Preparation Software in Excel for the F.Y.2021-22

Exemption from Section 87A for the F.Y.2021-22| Pursuant to the 2019 Finance Act, the tax exemption limit under Article 87A has been revised to Rs 12,500 for the 2019-20 fiscal years. This tax exemption applies when the taxable income of an individual (including the elderly) is less than or equal to Rs 5 lakh.

The F.Y. 2020-21 financial year also kept this section 87A tax exemption unchanged for 2021-22.

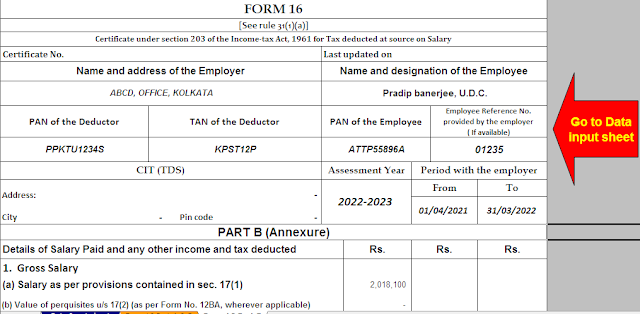

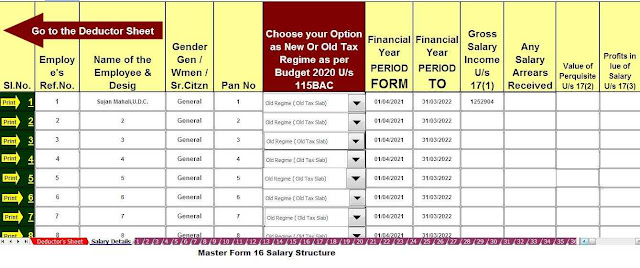

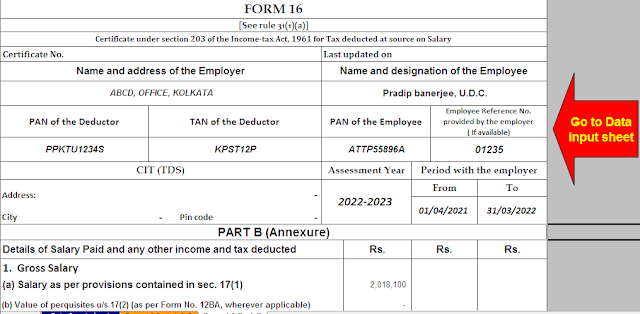

Download & Prepare One by one Automated Form 16 Part A&B and Part B for the F.Y.2021-22

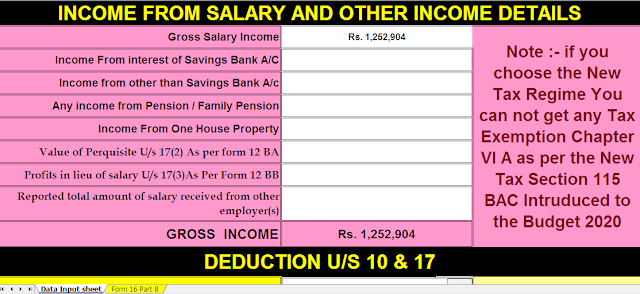

The 2020 Finance Act introduced a new tax system, offering an alternative lower rate of income tax for individuals with fixed rates of 10%, 20% and 30%, as well as fixed rates of 15% and 25%.

Under the recently proposed lower income tax system, people who want to pay their taxes will have to forgo almost all the tax breaks that are required in the old tax structure.

Therefore, all the exceptions for the VIA chapter (for example, sections 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGIA, 80-GIA, 80-80-IB , 80- IBA, etc.) Whoever chooses a new tax regime cannot be claimed.

But what about the income tax exemption of 12,500 under 87A? Can you apply for an exemption from Section 87A under the new tax regime for AH 2021-22?

Download & Prepare One by one Automated Form 16 Part B for the F.Y.2021-22

Let's first understand what tax exemption means?

What is the tax exemption?

A tax exemption is a tax refund when the tax liability is less than the tax paid or payable, which is called a person's income tax exemption.

Section 87A 2021-22. The modalities and applicability of the exemption pursuant to art

Now that you understand what a tax exemption is, let's move on to our "core question" of whether you can qualify for the Section 87A exemption of Rs 12,500 in the old as well as the new tax systems.

The U/s 87A threshold limit for fiscal year 2020-21 / fiscal year 2021-22 is Rs 12,500. This means that if the total tax payable is less than Rs 12,500, that amount will be deducted in accordance with section 87A. This exemption applies to the total amount of tax before adding the Cess on Education (4%).

Download & Prepare at a time 50 Employees Automated Form 16 Part A&B for the F.Y.2021-22

Only individual taxpayers earning a net taxable income of up to 5 lakhs are eligible for tax exemption under 87A.

The tax exemption under Article 87A is limited to a maximum of Rs 12,500. If the calculated tax payable is less than Rs 12,500, which is Rs 10,000, the tax exemption will be limited to that lower amount, which is Rs 10,000.

The taxpayer must first add up all income, such as wages, family income, capital gains, business or corporate income and income from other sources, then deduct the amount of tax deducted under sections 80C to 80U and the section 24 (b). Will Mortgage Interest) come with net taxable income. (If you opt for the new tax system, you will not be able to claim income tax deductions below 80c, 80d, etc.)

Tax exemption of Rs 12,500 if the above net taxable income is less than 5 lakh.

Download & Prepare at a time 50 Employees Automated Form 16 Part B for the F.Y.2021-22

No comments:

Post a Comment