How to save tax | With Automated Income Tax Preparation Software in Excel for the Govt & Non-Govt Employees for the F.Y.2021-22 with Old and New Tax Regime.

The Income Tax Administration has provided taxpayers with various deductions and benefits that can

be deducted from taxable income in accordance with Section 80 of Chapter VIA to reduce the tax

burden.

In all of this, there are some deductions that you get through investing, but there are some deductions that you get without investing, but some deductions that you make through daily expenses.

The most popular is the deduction below 80C; there are several other deductions that can reduce taxpayer tax liability even without solely saving on tax savings instruments. Some of them are as follows

The main feature of this Excel Utility:-

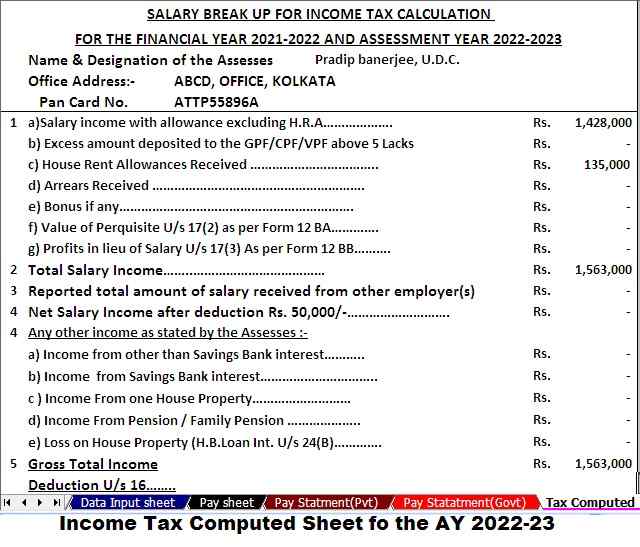

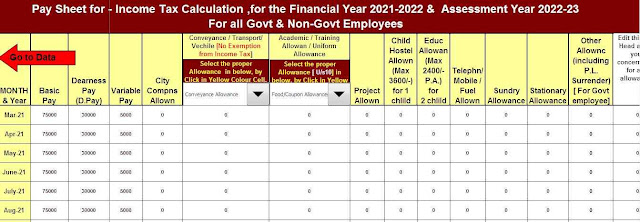

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Private Employee’s Salary Structure.

4) Automated Income Tax Form 12 BA

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

7) Individual Salary Sheet

You can pay a maximum of Rs. For the education for a maximum of two children. 1.5 lakh In accordance with Section 80C of Income Tax, 1961 You can save up for interest on a loan for your child's education for 8 consecutive years under Section 80E.

2. Interest paid on a home loan

For first time home buyers up to Rs reduction. 50,000 EMI on the interest rate for interest paid on home loan under 80EE. However, the advance amount can not exceed Rs. 35 lakhs, while the value of the residential property should not exceed 50 lakhs

Self-employed salaried people who do not own a home can benefit from an HRA deduction of at least 40-50% of the total amount under the HRA deduction under Section 10 (13A) of the Income Tax Act. Salary Amount (50% in the case of metropolitan areas) Actual amount received as HRA Amount of rent minus 10% of an employee's salary.

4. Medical expenses of senior citizen parents

If your parents are over the age of 60 and are not covered by any health insurance policy, you can claim a deduction from their medical expenses. You can request the maximum reduction limit. 50,000 In accordance with Section 80D of the Income Tax Act.

The main feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Private Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

7) Individual Salary Sheet

No comments:

Post a Comment