Why is PPF still the best investment / savings? With Automatic Income Tax Revised Form 16 Part A&B and Form 16 Part B for the F.Y.2021-22

Why is PPF still the best investment / savings? There are many savings investments such as Bank FDR, Postal Deposit, PPF, Gold, Silver, Real Estate, NPS etc. But if we analyze the advantages of the PPF, it is Number One in Savings Schemes / Investments / Tax Savings Instruments.

GPF or General Provident Fund is a savings scheme available to government employees. The EPF or Employees' Provident Fund is a savings scheme available to employees of private organizations. The PPF or Public Provident Fund is available to everyone, whether they are employees, self-employed or dependent.

It is important that the Indian government supports the PPF scheme. Hence, it is one of the safest investment plans available for individuals. The Public Provident Fund program offers guaranteed and risk-free returns.

The Public Provident Fund (PPF) is one of the most preferred long-term investment vehicles for investors who have a zero risk appetite. In this investment, the investor not only manages an insured yield but also gets exemption from income tax on investments of up to Rs 1.5 lakh in a particular financial year.

However, if the investor has run out of his Rs.1.5 Lakh Investment limit of 1.5 lakh PPF and he still has excess money, he can open a PPF account in his wife's name and contribute to his he PPF account. Therefore, he can double his PPF investment limit, although he will be entitled to an income tax exemption of Rs. 1.5 lakh only under section 80C of the Income Tax Act. PPF interest income is completely exempt from income tax under Section 10 (11) of the Income Tax Act and therefore has no effect on tax liability. Husband.

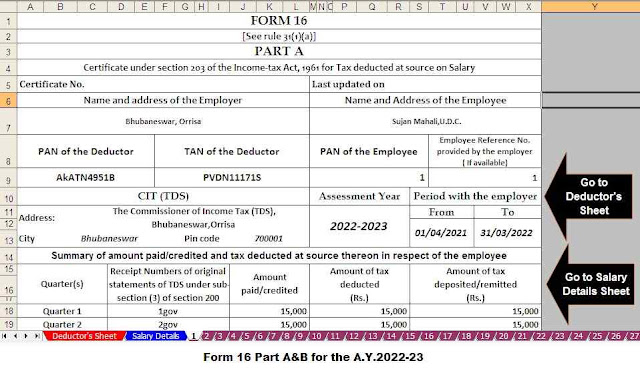

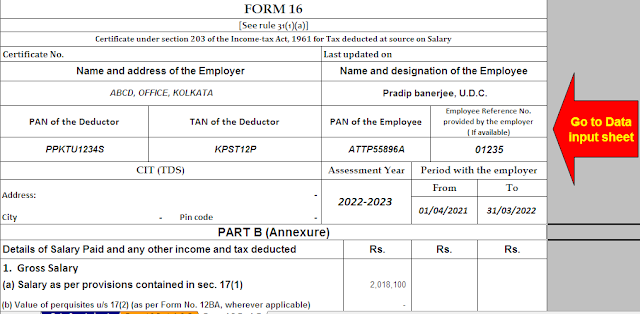

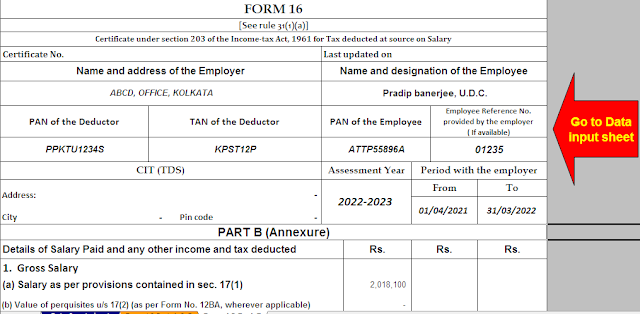

Download One by One Preparation Automated Income Tax Form 16 Part B in Excel for the F.Y.2021-22

Parents can open a separate PPF account in the name of the minor child in addition to the account in their own name. HUF is not authorized to open a PPF account. No one may open more than one PPF account in their own name. If a depositor opens more than one PPF account, the second and subsequent open accounts are considered irregular / unpredictable.

Public Provident fund (PPF) matures in 15 years. PPF allows the investment of a minimum of Rs 500 and a maximum of Rs 1,5 lakh for each financial year. Therefore, there is a minimum investment flexibility of only Rs. 500 / - per year. The investment can be made in a single installment or in a maximum of 12 installments. It is not mandatory for the depositor to close the PPF account after the expiration of 15 years. It can be extended indefinitely in blocks of five years. If a PPF account holder decides to continue with new contributions, he can withdraw up to 60% of the account balance at the start of any extended period - a five-year block.

It is important that in the event of the death of the subscriber the PPF account is automatically closed and any amount deposited in that PPF account after the death no other person subscriber will not received to any interest.

It is important that the partial withdrawal is allowed from the sixth financial year following the opening of the PPF account. There are no fees on partial / premature withdrawal from the PPF account. You can withdraw 50% of the amount deposited into your account.

It is relevant to refer to Section 9 of the Public Provident Fund Act, 1968, which states that any court order or order for the recovery of any debt or liability incurred by any person's account cannot be attached under. holder.

So far the Public Provident Fund (PPF) earns 7.10% interest, which is higher than the fixed deposits of post offices, which earn 5.5-6.7%. The interest on the public pension fund is compounded annually. The savings bank's interest is around 4% while FD's earnings are around 5-5.5%. The 5-year national savings certificate offers an interest rate of around 6.8% while the Kisan Vikas Patra offers an interest rate of 6.9%. So we see that the PPF interest is high and safe.

Some people want to compare PPF with LIC. The two are not comparable as they are two different investments and meet different needs. LIC Life takes care of risk and savings while PPF is a pure investment with high returns. Insurance is for protection against risk, while investment is for a secure future. Both are eligible for the deduction under section 80C of the Income Tax Act. The maturity amount is tax free in both PPF and LIC.

No comments:

Post a Comment