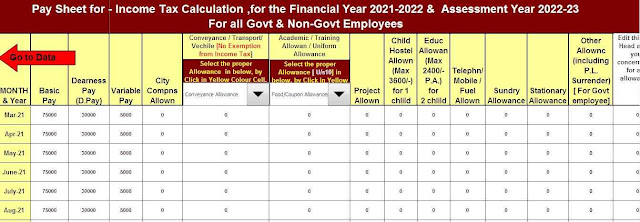

Five key elements of the 2022 Budget | With Automatic Income Tax Preparation Software All in One for the Non-Govt Employees for F.Y.2021-22 and Automatic Income Tax Master of Form 16 Part A&B and Part B for the F.Y.2021-22

Five key elements of the 2022 Budget | FM has made a number of other statements that have a direct

impact on the general public and the payroll community, although it hasn't made any statements to the

Income Tax Department.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

Here are five key tax points that pertain to the common man and the wage category

FM introduced a new updated ITR Return Filing Window

To provide an opportunity to correct such errors, This updated declaration can be submitted within two years from the end of the relevant evaluation year. Currently, if the department discovers that it has lost revenue to the evaluator, it goes through a lengthy evaluation process.

With this proposal, however, now comes the confidence to the taxpayer, which allows the assessor to declare for himself the income previously lost at the time of the declaration.

Full details of the proposal are set out in the Finance Act. This is a decisive step in the direction of voluntary tax compliance.

Tax exemption for people with disabilities

Parents or guardians of a disabled person can take out an insurance plan for that person. The current legislation provides for an exemption for parents or guardians only in the event that the disabled person, upon the death of the member or parents or guardians, has a lump-sum allowance of annuity available.

Dependents with disabilities may also have to pay annuities or lump-sum payments during the lifetime of their parents/guardians. "FM said to allow a yearly income and a lump payment for taxpayers with disabilities who are dependent on their parents/guardians for the entire life of their parents/guardians over the age of sixty," said FM.Equality between state and central government employees

Currently, the central government contributes 14% of its employees' salary to level 1 of the National Pension System (NPS). This is allowed as an exception in the calculation of employment income. 23 However, in the case of state employees, such an exemption is only allowed up to 10 % of the salary.

FM propose to increase the tax exemption limit on the employer contribution to the NPS contribution of state government employees from 10% to 14%. This will help improve performance. state government employees' retirement benefits and put them on par with central government employees,

”FM said.

A scheme for taxing virtual digital assets

It is also noted that there has been a dramatic raised in transactions in virtual digital assets. The extent and frequency of these transactions made it mandatory to provide for a specific fiscal policy. Consequently, in order to tax virtual digital assets, FM proposes to impose a tax of 30% on any income generated from the transfer of any virtual digital asset.

No deductions will be permitted in respect of any expenses or allowances other than the acquisition cost in calculating such income. Furthermore, the loss caused by the transfer of a virtual digital asset cannot be attributed to other income.

TDS on payments made in connection with the virtual digital ownership transfer

In addition, to capture transaction details, FM also proposes to provide TDS at a rate of 1% above the monetary threshold on payments made in connection with the virtual digital ownership transfer. It is also proposed that the gift of a virtual digital asset be taxed at the hands of the recipient.

No comments:

Post a Comment