Highlights of Budget 2022 | With Automatic Income Tax Form 16 + Arrears Relief U/S 89(1) + Automatic Income Tax Preparation software All in One in Excel for the F.Y.2021-22

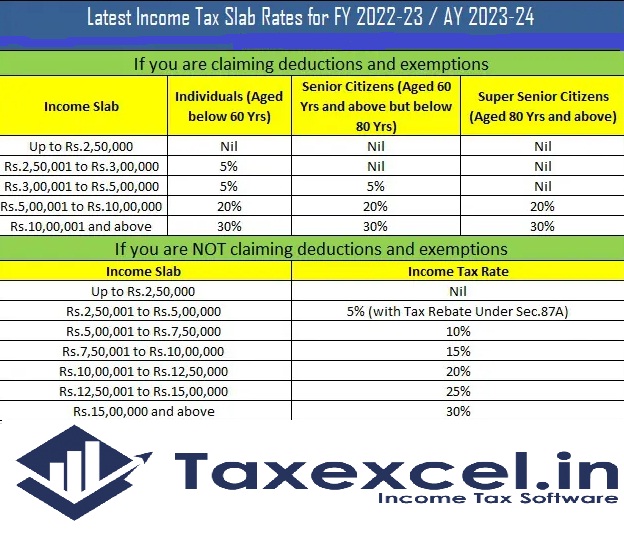

Highlights of Budget 2022. No change latest income tax slab rates for F.Y 2022-23 & A.Y 2023-24

after Budget 2022. There are any changes in the income tax rates applicable to individuals? Let's see

the details.

In this post, my focus is to share with you the latest Income Tax Slab Rates and applicable Security Transaction Tax (STT) for FY 2022-23 / the Year 2023-24.

Highlights of Budget 2022

#No change in tax slab

No change in tax slab

# Revised tax filing if you have missed some information

If you have missed sharing certain tax information while filing ITR, you can do so by revising it within 2 years from the end of the relevant assessment year.

What is the income tax slab rates for F.Y 2022-23 & A.Y 2023-24 after Budget 2022? Let's see the details. First, let's understand the difference between gross income and total income.

Many of us get confused in understanding what is gross income and what is total income or taxable income. In addition, we calculate income tax on gross income. This is completely wrong. Income tax will be chargeable on the total income.

Gross total income(GTI) means the total income under the heads of salary, income from house property, profits and gains of business or profession, capital gains or income from other sources.

Total income or taxable income means gross total income less the amount allowed as deduction under section 80C to 80U.

Therefore your total income or taxable income will always be less than your gross total income.

No changes were proposed with respect to income tax slab rates in this Budget 2022. Hence the old rates will continue for the FY 2022-23/Assessment Year 2023-24.

Here are two types of Income Tax slabs.

1. Who are wishing to claim tax deductions and exemptions?

2. Who are do not wish to claim tax deductions and exemptions.

I explain both the slabs as below.

Now, if you want to opt for the new tax regime, you have to forget about the deductions or exemptions below.

(i) The granting of vacation travel contained in clause (5) of section 10;

(ii) The home rental allowance contained in clause (13A) of section 10;

(iii) Certain indemnities contained in clause (14) of section 10;

(iv) The allowances to MPs / MLA contained in clause (17) of section 10;

(v) The income allowance of a minor in clause (32) of section 10;

(vi) Deduction of the standard deduction, the representation allowance and the labour / professional tax as due

Section 16;

(vii) Interest under section 24 in connection with self-employed or vacant properties in subsection (2) of section 23.

(The loss on the capital of income from real estate properties for rent cannot be attributed to any other title and can be carried forward as per current legislation);

(ix) Further reduction referred to in clause (ii) of paragraph (1) of Article 32;

(x) Deduction under sections 32AD, 33AB, 33ABA;

(xi) Paragraph (ii) or paragraph. Various deductions for donations or scientific research expenses granted

(iia) or subsection (iii) of subsection (1) or subsection (2AA) of section 35;

(xii) Deduction from the family pension under clause (iia) of section 57;

(xiv) Any deductions under Chapter EIA (such as sections 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA,

However, the deduction under

You can apply for subsection (2) of section 80CCD (employer contribution to the employee's account in the notified pension scheme) and section 80JJAA (for new employment).

However, there are some deductions you can still claim using the new tax regime and they are detailed below.

1. Pension benefits, gratuities, etc.

2. Changeover of the pension

3. Leave the collection in retirement

4. Compensation for dismissal

5. VRS Benefits

6. EPFO: Employer Contribution

7. Advantages of withdrawing NPS

8. Scholarship for education

9. Payment of prizes established in the public interest

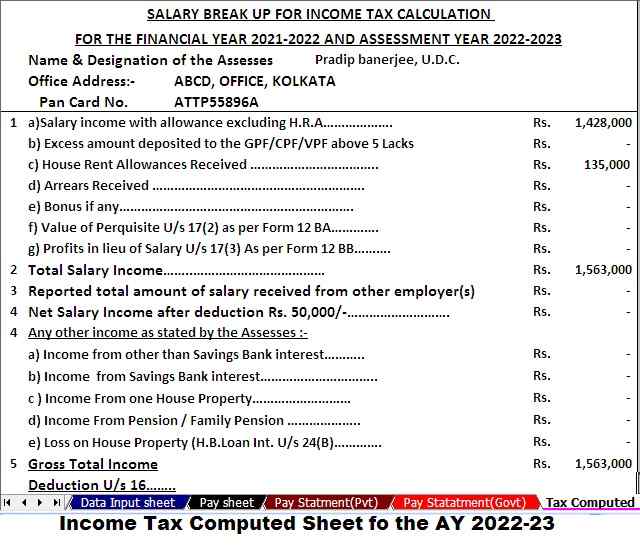

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

No comments:

Post a Comment