Standard deduction from salary and pensions| With Automated Income Tax Preparation Excel Based Software All in One for the Govt and Non-Govt Employees for the F.Y.2022-23

Standard deduction from salary and pensions| A standard deduction means a fixed deduction for people

who receive wages or retirement income. It was introduced in the 2018 budget in lieu of exemptions

from travel expenses and reimbursement of various medical expenses. In the 2021-22 tax year, the

default deduction limit is Rs 50,000. In this guide, we'll cover what deductions are available from a

person's wages and retirement income.

The standard deduction for employees

Standard Income Tax Deduction - 2019 Provisional Budget

The standard deduction replaced travel and medical expenses. This gives salaried taxpayers exemption from taxable income without any restrictions. The 2019 draft budget brought many benefits to salaried taxpayers. Among these benefits, one was an increase in the standard deduction. The standard deduction has increased from Rs 40,000 to Rs 50,000, a notable step in favour of taxpayers. This measure will help taxpayers reduce their taxable income at the same time.

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

What is the impact of the standard deduction on retirees?

The decision to allow standard deductions has provided significant benefits for retirees. These pensioners usually did not receive any allowances for transportation and medical expenses. However, the standard deduction will only be allowed for retirees if the pension is taxed as income from wages. If the income is from another source, there is no standard deduction.

What is the default deduction limit?

The amount of the standard deduction cannot exceed the amount of wages. The maximum amount of the deduction will be Rs. 50,000 rubles or equal to the amount of the salary, whichever is less.

How is the standard multi-employer deduction calculated?

There is no standard deduction for any reason. employers. The default deduction is the total limit for the full year, not none. employers.

Let's say Mr A worked for 2 employers during the 2019-20 fiscal year. In this case, you may be wondering how much the standard deduction r. might require

Option 1 BRL 50,000

Option 2 R$ 1,00,000 (Rs 50,000 for each employer)

The correct answer is option 1, i.e. Mr And can take advantage of the standard deduction up to Rs. 50,000/-

Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

What is the procedure for the standard deduction in the new tax regime?

The 2020 budget introduces a new tax regime (the tax year 2020-21) under which income will be taxed at lower rates. To take advantage of this option, the taxpayer would have to waive major tax credits and benefits, including the standard deduction.

Is the standard deduction part of Section 80C?

No, the standard deduction is not part of section 80C. Both the standard deduction and section 80C follow different rules and regulations that serve different purposes.

The standard deduction is a deduction for medical and travel expenses. While the deduction under section 80C allows you to deduct specific investments and expenses. To learn more about Section 80C

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

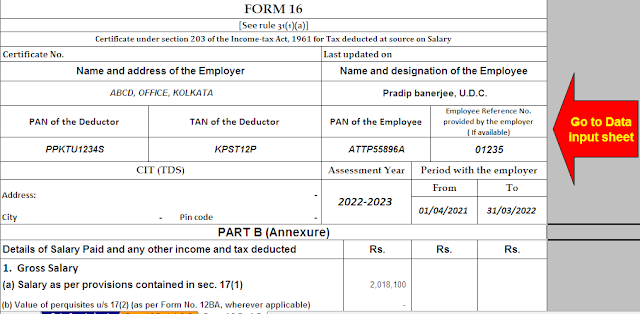

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

No comments:

Post a Comment