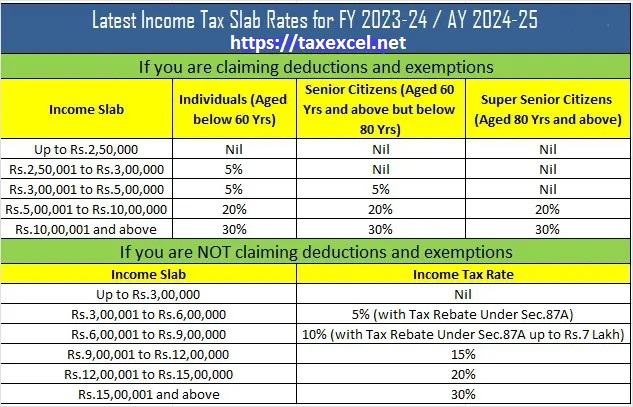

Six income tax exemptions allows in the New Tax Regime as per Budget 2023 with Automated Income Tax Calculator for the Assessment Year 2024-25 As per Budget 2023

Six income tax exemptions allowed in the New Tax Regime as per Budget 2023 | The new tax system

may have been introduced as a simpler, less burdensome alternative for taxpayers, but it is not

necessarily without tax elimination.

From the financial year 2023-2024, the new regime will become the standard tax system. That is, the rates and rules of this system will apply unless you explicitly choose the former regime, which offers various exemptions.

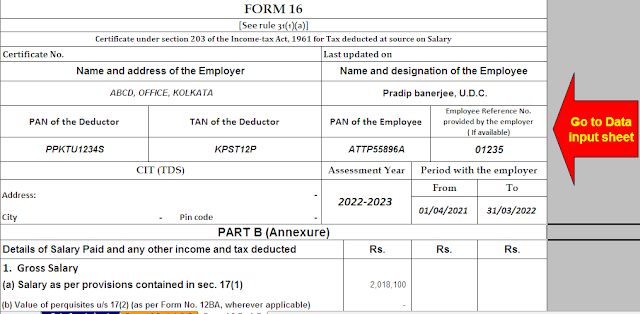

You may also like: - Automatic Income Tax Master of Form 16 Part B for the Financial Year 2022-23[ This

Excel Utility can prepare at time 50 Employees Form 16 Part B]

However, before you make a final decision, you should also find out what tax exemptions you will be entitled to even under the new tax regime. Here are six such tax exemptions under the new regime (and the old regime, too).

Standard deduction

of Rs 50,000

Introduced in the 2023 Budget to make the new regime more attractive to taxpayers, it is the most prominent tax benefit offered under the system. It is assigned by default; therefore you do not have to take any action or show evidence to be eligible to claim this deduction.

However, not all taxpayers are eligible. Like the old system, there are only salaried employees and pensioners. Entrepreneurs or self-employed individuals cannot enjoy this tax benefit. Family pensioners (who receive a pension after the death of the pensioner) are also entitled to the deduction.

You may also like: - Automatic Income Tax Master of Form 16

Part A&B for the Financial Year 2022-23[ This

Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Employer’s contribution to Employee’s NPS

This is one of the lesser-known tax benefits available under both regimes. While some tax deductions linked to the National Pension Scheme – Rs 1.5 lakh under section 80C or above and Rs 50,000 under 80CCD (1B) – have no place in the new regime, this deduction will be retained.

An employer’s contribution to the National Pension System (NPS) of up to 10% (14% of public servants) of the employee’s basic pay plus benefit for dependents is allowed as withholding under Section 80CCD(2). “Employer contributions are tax-free like rent and other expenses.

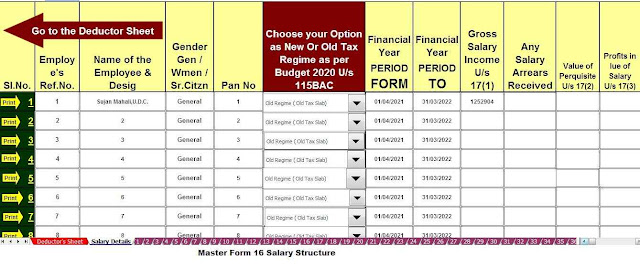

You may also like: - Automatic Income Tax Master of Form 16 Part B for the Financial Year 2022-23[ This Excel Utility can prepare at a time 100 Employees Form 16 Part B]

However, the tax-free limit for benefits received from employers has capped at Rs 7.5 lakh per annum. If the total amount of benefits exceeds this limit, the excess is treated as taxable employee benefits.

Existing employees can also renegotiate with their employers and HR to restructure their pay to enjoy this new financial year benefit.

Employer EPF

contribution of up to 12% of the basic salary

The employer contributes 12 % of your basic salary to your employees’ provident fund (EPF) account. This amount too is exempt from tax provided the total retirement benefits you receive from your employer do not exceed the limit of Rs 7.5 lakh in a year.

Tax deduction on life insurance proceeds

Aside from gullible insurers who fall prey to questionable sales pitches, high-net-worth individuals often prefer life insurance policies with a linked unit, which value tax-free term returns as a major asset. This benefit is also present in both regimens.

However, there are some caveats if you buy policies bundled with an investment, such as linked unit insurance (ULIP) or endowment insurance.

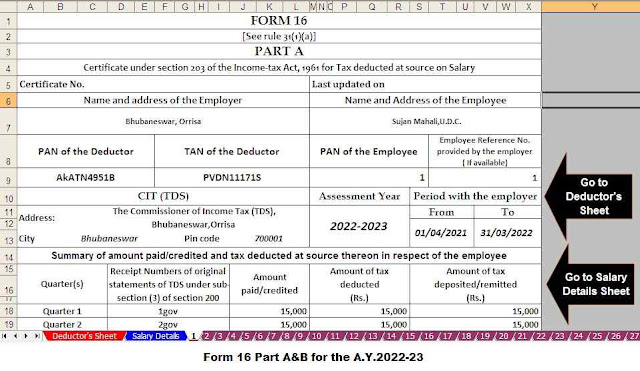

You may also like: - Automatic Income Tax Master of Form 16

Part A&B for the Financial Year 2022-23[ This

Excel Utility can prepare at a time 100 Employees Form 16 Part A&B]

From the financial year 2021-22, the government has introduced restrictions on the maturity yields of Ulips. So, if you pay total premiums above Rs 2.5 lakh for policies purchased after February 1, 2021, the term yield will be subject to tax. Budget 2023 added similar restrictions to traditional non-ULIP policies, especially endowment plans. If the total amount of premiums of such policies purchased after April 1, 2023, exceeds Rs 5 lakh, the income earned at the end of the term of office will be taxable.

In all cases, income received by designated family members upon the death of the insured is tax-free.

PPF or Sukanya Samriddhi Yojna maturity continues

You do not have to pay tax on the final income from investments in Public Provident Fund (PPF) and Sukanya Samriddhi Yojana. However, under the new regime, investments in these accounts are not eligible for section 80C deductions of up to Rs 1.5 lakh offered by the old regime.

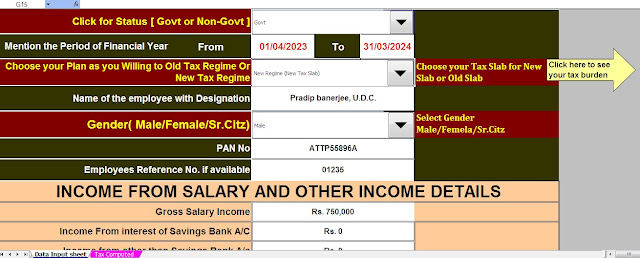

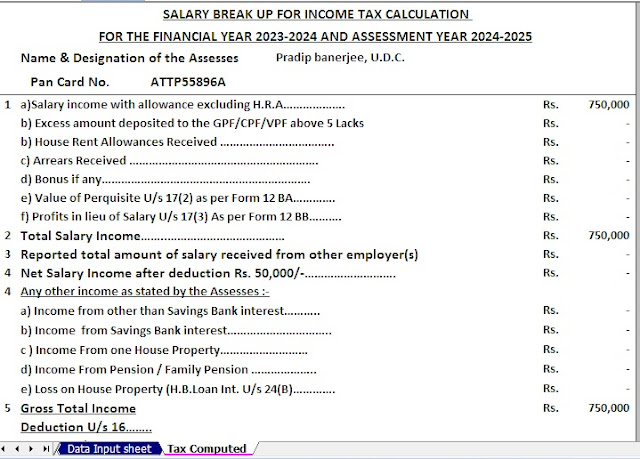

Download the Income Tax Calculator in Excel for the Financial Year 2023-24 and Assessment Year 2024-25 as per Budget 2023[New and Old Tax Regime]

No comments:

Post a Comment