Relief for taxpayers who marginally earn more than Rs 7 lakh as per Budget 2023 | With Auto Calculate Income Tax Preparation Software All in One for the Government and Non-Government Employees for the F.Y.2023-24 and A.Y.2024-25

Relief for taxpayers who marginally earn more than Rs 7 lakh as per Budget 2023| People earning

income marginally above the maximum tax of Rs 7 is required to pay tax only on differential income.

Providing relief to taxpayers opting for a new tax system, the government amended the Finance Bill 2023 and passed it in the Lok Sabha.

Explaining

the clause, the Finance Ministry said that under the new tax regime effective

from April 1, if a taxpayer has an annual income of Rs 7 lakh, he is not taxed.

But if you have an income of Rs 7,00,100/pay a tax of Rs 25,010.

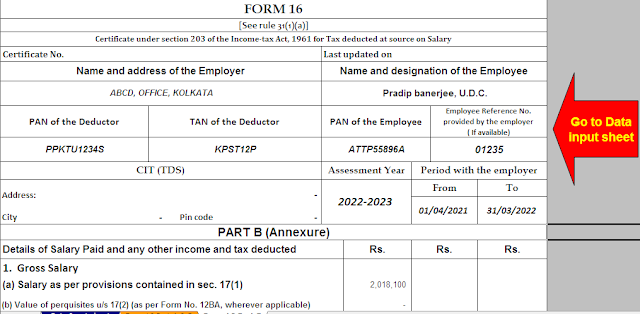

You may also like:- Automated Income Tax Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24(This Excel Utility can prepare at a time 50 Employees Form 16 Part B)

Therefore, the additional income of Rs 100 results in a tax of Rs 25,010. Thus, marginal relief is

proposed so that the tax paid by one does not exceed the income that exceeds Rs 7 lakhs (Rs 100 in this

case), the ministry said.

The 2023-24 budget has announced a tax rebate whereby those with an annual income of up to Rs 7 lakh will not be taxed under the new tax regime. It was a move that experts say prompted payroll taxpayers to switch to a new tax system that provides no investment relief.

Under

the new revamped tax system, Rs 3 lakhs worth of income will not be charged.

Income between Rs 3-6 lakh will be taxed at 5%; Rs 6-9 lakh at 10%, Rs 9-12

lakh at 15%, Rs 12-15 lakh at 20%, and income of Rs 15 and above will be taxed

at 30%. In addition, the new system allowed a standard discount of Rs 50,000.

You may also like:-

Automated Income Tax Form 16 Part A&B for the Financial Year 2022-23 and

Assessment Year 2023-24(This Excel Utility can

prepare at a time 50 Employees Form 16 Part A&B)

Now, the government has introduced amendments to the Finance Act 2023, which has given a "marginal exemption" to taxpayers who have an annual income of just over Rs 7 lakh.

Although the government has not specified the income threshold that would be eligible for the marginal exemption, tax experts said that based on the calculation, individual taxpayers with an income of Rs 7,27,777 will benefit from this exemption.

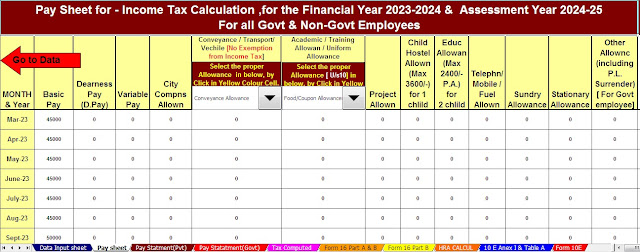

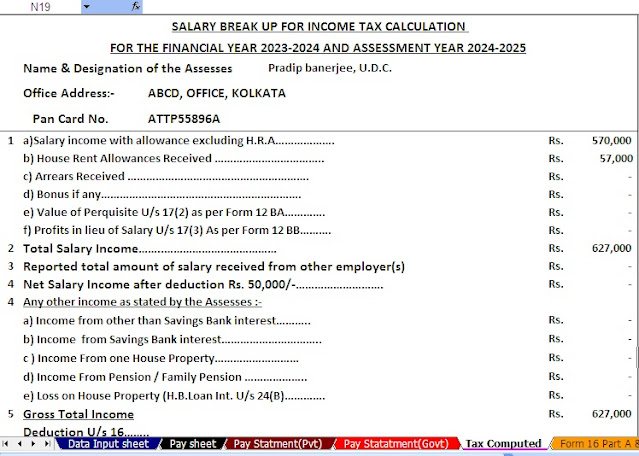

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

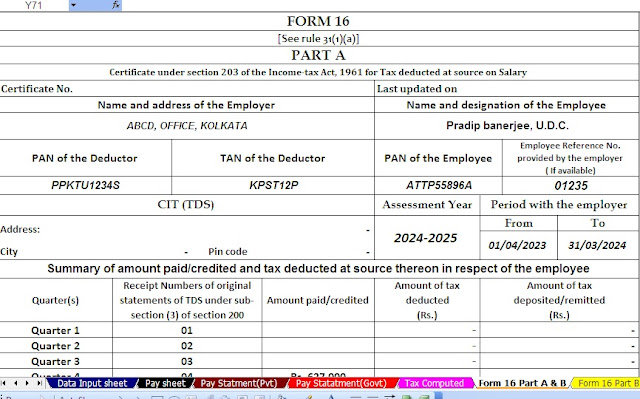

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24

No comments:

Post a Comment