Auto Calculate Income Tax Software All in One in Excel for the Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25 with U/s 87A Rebate in New Tax Regime as per Budget 2023

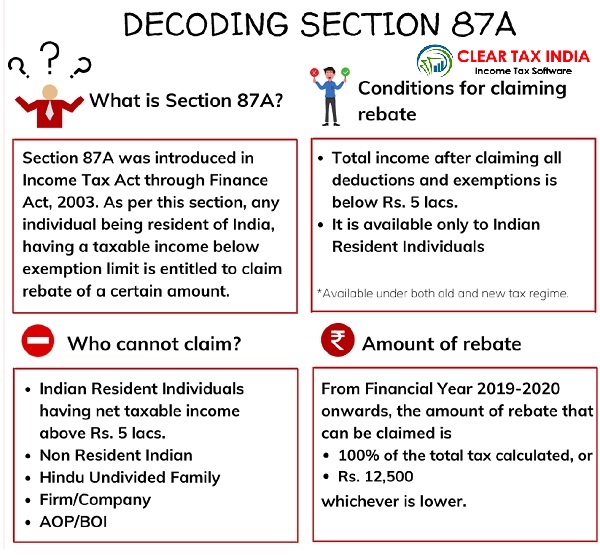

Find out what the 2023 Budget proposes about Section 87A in New Tax Regime

The 2023 budget announced that people will not have to pay any tax if their taxable income does not exceed Rs 7 lakhs in a tax year. The maximum reimbursement limit available under section 87A of the Income Tax Act 1961 has been increased to Rs 25,000 from Rs 12,500 in the 2023 budget.

Who is eligible for this section 87A rebate?

Pursuant to the Income Tax Act, reimbursement under section 87A is only available to resident individuals. Taxpayers such as Non-Resident Individuals (NRIs), Hindu Undivided Families (HUFs), and Corporations are not eligible for reimbursement under Section 87A.

Normal deduction introduced in the new tax

regime

Furthermore, Budget 2023 has extended the standard deduction of Rs 50,000 for wage earners, pensioners, and family pensioners. Previously, the standard deduction was only available under the old income tax regime.

New Income Tax Table 2023-24: No tax if

income up to Rs 7.5 lakh

As a result of deduction, refund, and adjustment in income tax blocks announced in Budget 2023, wage earners, pensioners, and family pensioners will not have to pay any tax if their income is up to 7.5 lakh rupees.

Do not confuse this with a basic waiver

limit

Do not confuse this discount with the base waiver limit. The 2023 budget raised the base exemption threshold to Rs 3 lakh from Rs 2.5 lakh currently. However, those who have an income of up to Rs 7.5 lakh are not required to pay any income tax under the new tax regime as they will be able to claim refunds and deductions.

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Sections as per Budget 2023

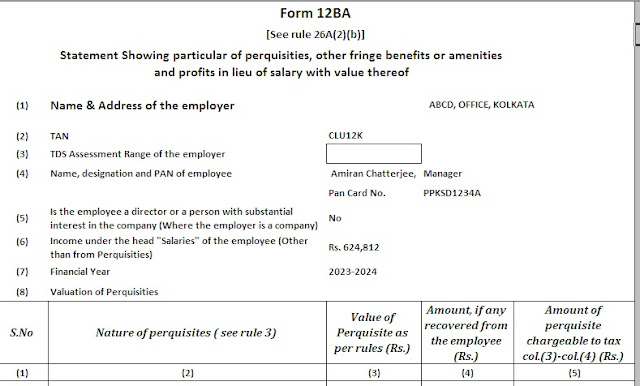

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

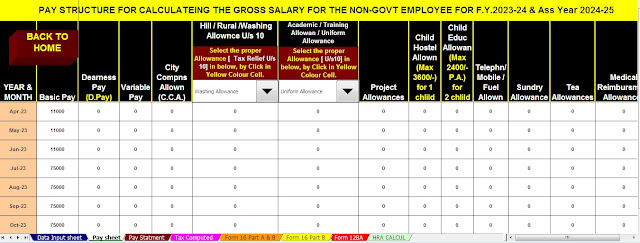

Individual Salary Structure as per the Non-Govt (Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24

10)

Automatic Convert the amount into the in-words without any Excel Formula

No comments:

Post a Comment