Download Auto Calculate 50 Employees Master of Form 16 Part B for the F.Y.2023-24 and A.Y.2024-25 with New income tax Slab for the 2023-24

Download Auto Calculate 50 Employees Master of Form 16 Part B for the F.Y.2023-24 and A.Y.2024-

25 with new income tax blocks for FY 2023-24, discounts: Finance Minister Nirmala Sitharaman

amended the new income tax plan blocks while presenting the 2023-23 Union budget to make it more

attractive.

She also announced that the new income tax system will be the default option for taxpayers, starting in

the 2023-24 tax year.

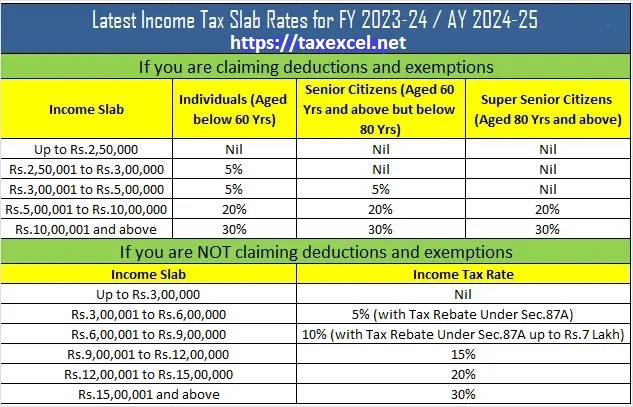

The new tax year will begin on April 2, 2023. Apart from announcing new slabs in the new income tax system, Nirmala Sitharaman has also allowed the salaried class or taxpayers to claim three deductions. Let's take a quick look at the deductions allowed in the new income tax system.

The new personal income tax deduction system, rules

1. New income tax rebate 2023-24: Standard deduction in New Tax Regime

In the wages and pensioners exemption, the government has provided a standard deduction of Rs 50,000 that can be claimed on salary and pension. The standard deduction is a flat deduction from gross pay, which means taxpayers do not have to file a separate application to claim the standard deduction.

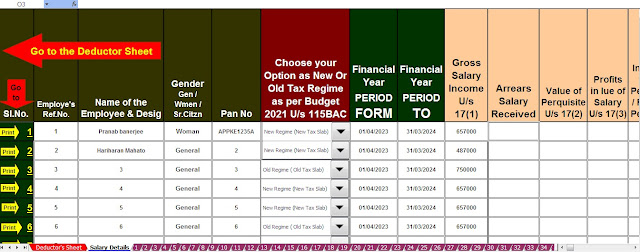

Feature of this excel utility:-

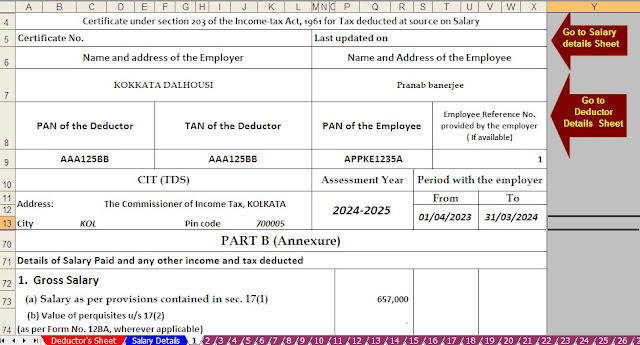

1) This Excel utility can prepare 50 employees at a time, Form 16, Part B, according to the 2023-24 budget

2) This utility can be used by government and non-government concerned

3) Calculate your income tax automatically according to the New and Old Tax Regime

4) This excel utility contains all the income tax sections according to the Income Tax Act.

5) This excel utility can only be used as an excel file

6) This excel utility can be used by anyone and is easy to use.

No comments:

Post a Comment