All employees get a tax exemption of Rs 50 thousand U/s 16(ia) in any tax regime.| With Auto Calculate Income Tax Preparation Software in Excel All in One for the Govt and Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25 as per Budget 2023

All employees get a tax exemption of Rs 50 thousand U/s 16(ia) in any tax regime.| If you are also a

taxpayer, then this information will be very useful to you. As everyone knows, this time the

government gave a big relief to the taxpayer in the budget. The government announced that those

earning less than Rs 7 lakhs will not have to pay income tax. However, this benefit will only be

available to those who opt for the new tax regime. The Finance Minister has increased the income tax

exemption limit to Rs 7 lakh in the new tax regime, which was earlier Rs 5 lakh. While under the

previous tax regime, income up to Rs 2.5 lakh was tax-free.

You may also like- Master of Form 16 Part B in Excel for the Financial Year 2022-23 and Assessment Year 2023-24[This Excel Utility can prepare at a time 50 Employees form

16 Part B]

However, under the old tax regime, there is a provision for several standard deductions and exemptions on certain items. These benefits were not provided under the new tax regime. But let us tell you that this time the standard deduction has also been included in the new tax system. That is, regardless of the new or old tax regime, all taxpayers can benefit from the Rs 50,000 tax credit.

He gets a tax exemption of 50 thousand

Explain that a taxpayer can claim up to Rs 50,000 for a standard deduction whereas any employee with an income of Rs 15.5 lakh or more will get a benefit of Rs 52,500 as a standard deduction. Under the new tax regime,

You may also like- Master of Form 16 Part

A&B in Excel for the Financial Year 2022-23 and Assessment Year 2023-24[This Excel Utility can prepare at a time 50 Employees form

16 Part A&B]

What is the standard deduction?

The standard deduction was introduced in the budget for the year 2018. Earlier, the limit was Rs 40,000 which was increased to Rs 50,000 the following year. The purpose of this is to maximize income to employees by giving them tax exemption. The standard deduction is a deduction taken from an income taxpayer’s income and then tax is calculated on the remaining income.

Employees and retirees are already being given the opportunity to enjoy tax exemption through standard deductions. Suppose the annual income of an employed person is Rs 8 lakh. In such a situation, if a standard deduction benefit up to Rs 50,000 is available in the total package, their tax will be calculated at Rs 7,50,000 instead of Rs 8 lakh.

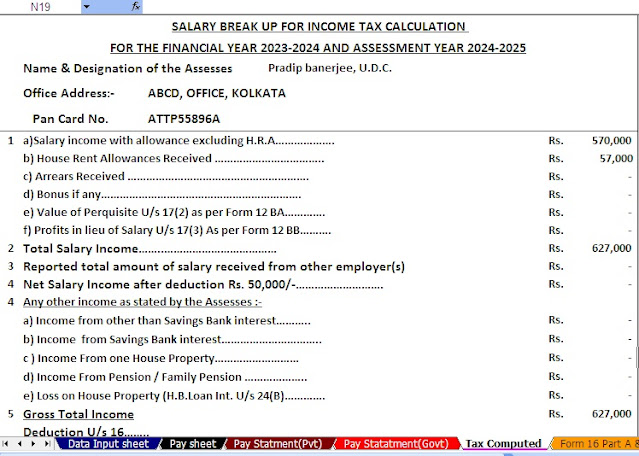

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

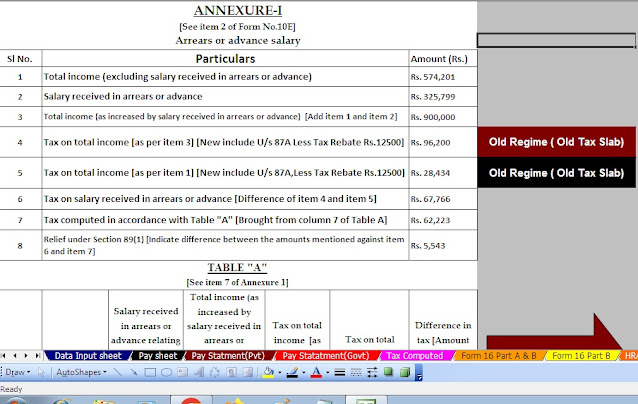

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

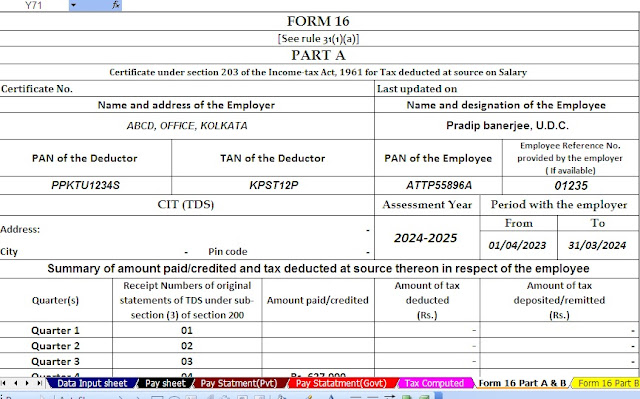

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24

No comments:

Post a Comment