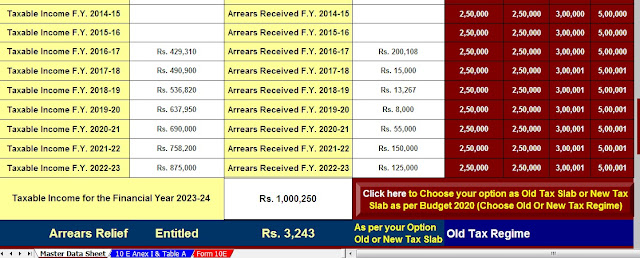

Arrears Relief U/s 89(1) as per the Income Tax Act with Auto Calculate Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 FY. 2023-24 as per Budget 2023

Arrears Relief U/s 89(1) as per the Income Tax Act | Taxpayers can claim a deduction under Section 89

of the Income Tax Act when they receive any part of their salary in advance or arrears. This rule also

applies to arrears of family pensions.

What is the relief under Section 89 of the IT Act?

If an employee receives back pay or compensation along with their wages, they often pay more in taxes.

If the employee had received the amount in the relevant year, the additional tax would have been

spread over the years, which would have significantly reduced the tax burden.

Fortunately, taxpayers can claim relief from backlogged wages or get a Section 89 advance. This

section was inserted under Chapter VIII (Rebates and Allowances) of the Income-tax Act, 1961.

A person can apply for Section 89 relief if they have wage arrears in the following situations:

Advice

Salary received from arrears or advances

Pension changes

Salary received at the end of the employment contract

Legal aid under section 89

The following situations qualify for assistance under Section 89 of the Internal Revenue Service:

Compensation for termination of employment

Borrow or advance your salary

Advice

When a pension is transferred

Calculation of relief under section 89

Step 1

Calculate the current year's tax by adding the liabilities to the gross income

Step 2

Then calculate the current year's tax by subtracting the liabilities from the total amount.

Step 3

Calculate the difference between the values from step 2 and step 1 (let M denote the difference)

Step 4

Calculate the tax liability for the year in which the liabilities are incurred

Step 5

Now subtract the debt from your gross income to calculate your tax liability for the year you incurred the debt.

Step 6

Calculate the difference between the two values in steps 5 and 4 (let N represent the difference)

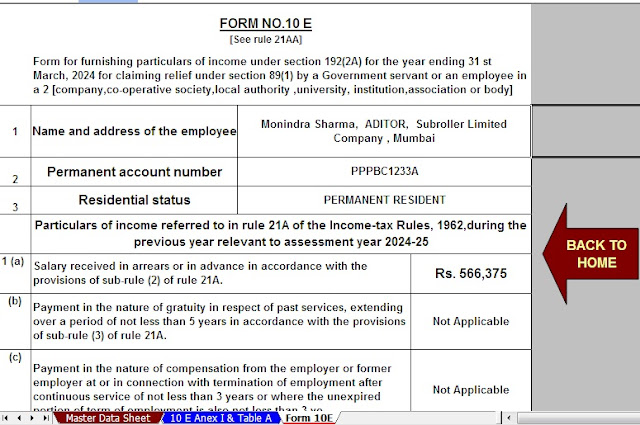

How do I claim a deduction under Section 89 of the Income Tax Act, 1961?

To claim a deduction under section 89 of the Income Tax Act, 1961, you have to fill out Form 10E on

the Income Tax website. Form 10E must be filed before the IRS issues it. For this process, your due

date confirmation will serve as proof of receipt of the delay. It is important to maintain a payment slip

if you want to claim tax deductions on deferred income.

Steps to File Form 10E

Here are the steps to file Form 10E to claim an exemption under Section 1961 of the Income Tax Act:

Step 1: Log in to the e-Tax Declaration website and provide your user ID and password.

Step 2: After logging click on the "e-file" tab and a drop-down menu will display. Click on "Income Tax Forms".

Step 3: Income tax forms will be displayed on the screen; A drop-down menu will open on the "Form Name" option. “FOR. 10E- The shape for the relief is 89”.

Step 4: Select the 'Assessment Year' for which you have given relief and select 'Online Preparation and Submission' under 'Submission'.

Step 5: After clicking on the “Continue” button, a new page will be opened for FORK. 10E. You will need to fill out the form by entering the relevant information and filling in the blue tabs.

Step 6: Click "Save Project" while filling out the form and click "Preview & Submit" after filling in.

No comments:

Post a Comment