ITR-1 Filing Process in New Electronic Income Tax Return Portal 2.0 without download JSON Format for the A.Y.2023-24

ITR-1 Filing Process in New Electronic Income Tax Return Portal 2.0

You need to download JSON-based offline support for the ITR archive. ITR-1 can be archived

also online.

The following steps help you upload your ITR-1

to the New e-Filing 2.0 portal

Step 1: After login, click on Dashboard to find the page

where we can register our return

(Click File Now)

Step 2: Select the assessment year

Step 3: After selecting the assessment year, we need to

select the archive mode

Step 4: After step 3 you will see the refund option (Fresh

Income Tax Return or Saved Income Tax Bill) Back), you can choose to start a

new archive

Step 5: In this step, you can select the rated status

Step 6: This step offers an option to select the ITR form

i.e. ITR 1 or ITR 4 (if the assessed receives any).

Difficulty in selecting the ITR form is to click on the continue button which helps the assessee to make a decision Form.)

Step 7: Select ITR 1 and click Continue with ITR 1

Step 8: After completing the above step 7, you will see this

screenshot on the screen, so Let’s Get started

Step 9: Are you filing a tax return for any of the following reasons? (you can choose any or More reasons, if not there you can choose another option)

Step 10: After the 8-step pop-up, a message will appear on

your screen (we are filling your mind with Information from Income Tax

Department. Please verify that the details in each section are correct. Right

to continue.)

Step 11: (Personal Information) Your personal information

will be automatically filled. Also, it

can be changed if you want

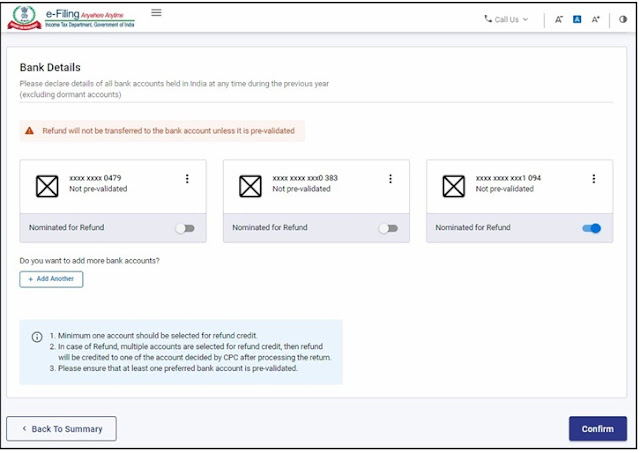

1. At least one account must be selected for loan repayment.

2. In case of refund multiple accounts are selected for

refund credit and then

After processing the refund will be credited to one of the

accounts decided by CPC

return

3. Make sure at least one preferred bank account is

pre-approved.

4. Please select the Nature of Work from each of the

following

State government

A public sector

enterprise

Pensioners

Different

Not Applicable (eg

Family Pension etc.)

After you fill in your personal information, a verified icon

will appear next to your personal information

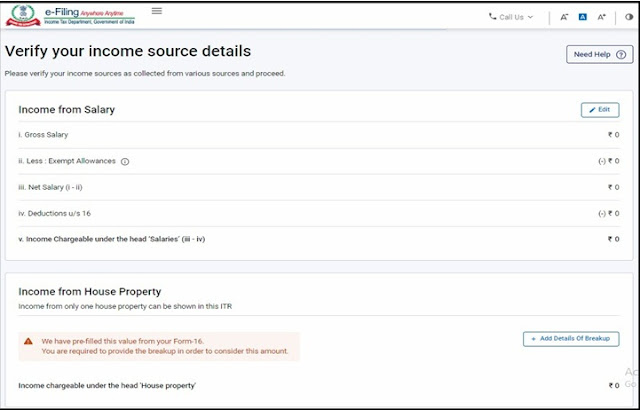

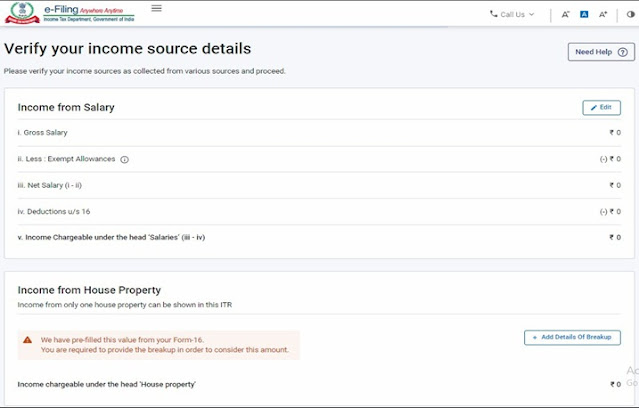

Step 12: (General Input) Your personal information will be

automatically filled in. You can change it if you want

You will also be asked to enter the remaining/additional

details

Exempt from income, if any.

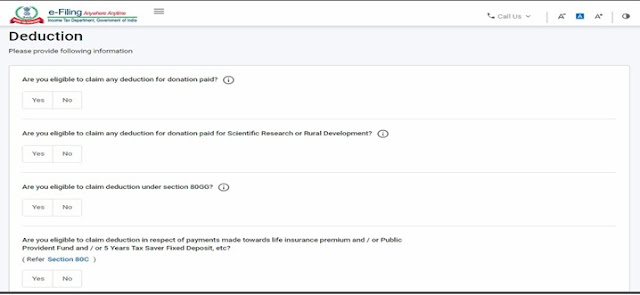

Step 13:

Or 80D etc. life insurance, medical premium, pension funds,

provident funds,s, etc.

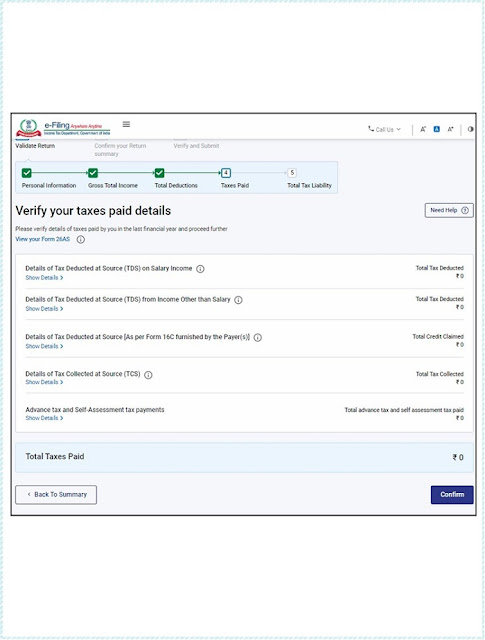

Tax details include salary/other remuneration TDS, Payable,

TCS, tax advantage, and self.

Rate of appreciation.

Step 15: (Total Tax Liability)

If you have a tax liability, you can choose to pay now or pay later.

It will be better

to choose the Pay Now option. Check BSR Code and Challan Serial carefully

Number them and include them in the payment details.

If you choose to

pay later, you can pay after filing your income tax return, but there is one.

Debts may involve the risk of being considered a creditor

and liability for interest on taxes owed

To appear

Step 16: After checking all the information, you can proceed

to Check. Verification of your return is mandatory.

E-Check (suggested option is E-Check) is the easiest way to

check your ITR - it's quick,

The printed and signed physical ITR-V is more secure than sending it to a CPU

No comments:

Post a Comment