Income Tax Section 80CCD(1B)with Auto Calculate Income Tax Preparation Software in Excel for the Govt & Non-Govt Employees for the F.Y.2023-24

Introduction

Income tax can be a complex subject, but understanding provisions like Section 80CCD(1B) can significantly impact your financial planning. Therefore, This article will unravel the nuances of this section, providing insights, benefits, and practical advice.

1. What is Section 80CCD(1B)?

In other words, Section 80CCD(1B) refers to a specific subsection of the Income Tax Act, which deals with contributions made towards the National Pension System (NPS). In other words, This section allows an additional deduction of up to Rs. 50,000 over and above the limit of Section 80C.

2. Eligibility Criteria

To avail of the benefits under Section 80CCD(1B), you must meet the following criteria:

- You must be a taxpayer in India.

- You must contribute to the NPS.

- The contribution must be made over and above the limit specified in Section 80C.

3. Maximum Deduction Allowed

However, Under Section 80CCD(1B), you can claim a deduction of up to Rs. 50,000 in addition to the deductions available under Section 80C. Above all, This can lead to substantial tax savings.

4. Benefits of Section 80CCD(1B)

a. Dual Tax Benefit

In addition, Contributions made under this section offer a dual tax benefit – they reduce your taxable income and qualify for a deduction under Section 80C.

b. Retirement Planning

After that, By investing in NPS through Section 80CCD(1B), you are building a corpus for your retirement, ensuring financial security in your golden years.

5. How to Claim Deduction

Similarly, To claim the deduction under Section 80CCD(1B), you need to specify the amount contributed to the NPS in your income tax return.

6. Common Misconceptions

However, there are a few misconceptions about Section 80CCD(1B):

- It's only for government employees: False. Anyone can benefit from this section.

- The entire NPS contribution is deductible: Not true. Only the amount contributed under this section is eligible for the deduction.

7. Frequently Asked Questions (FAQs)

Q: Can I claim both Section 80CC and 80CCD(1B) deductions?

Yes, you can claim deductions under both sections, but the combined deduction cannot exceed Rs. 1.5 lakh.

Q: Is there a lock-in period for investments under Section 80CCD(1B)?

Yes, there is a lock-in period. The amount invested cannot be withdrawn before retirement.

Q: Can NRI individuals claim deductions under Section 80CCD(1B)?

No, NRIs are not eligible for deductions under this section.

Q: Can I change my NPS contribution amount during the financial year?

Yes, you can change your contribution amount, but keep in mind that the deduction is limited to Rs. 50,000.

Q: Do I need to provide any proof of NPS contribution while filing taxes?

Yes, it's advisable to keep records of your NPS contributions for tax verification purposes.

Q: Can I invest more than Rs. 50,000 in NPS?

Yes, you can invest more, but the deduction under Section 80CCD(1B) is capped at Rs. 50,000.

In conclusion,

However, Understanding and utilizing Section 80CCD(1B) can be a valuable asset in your tax planning. By making additional contributions to the NPS, you not only save on taxes but also secure your financial future. So, take advantage of this provision and make the most of your hard-earned money.

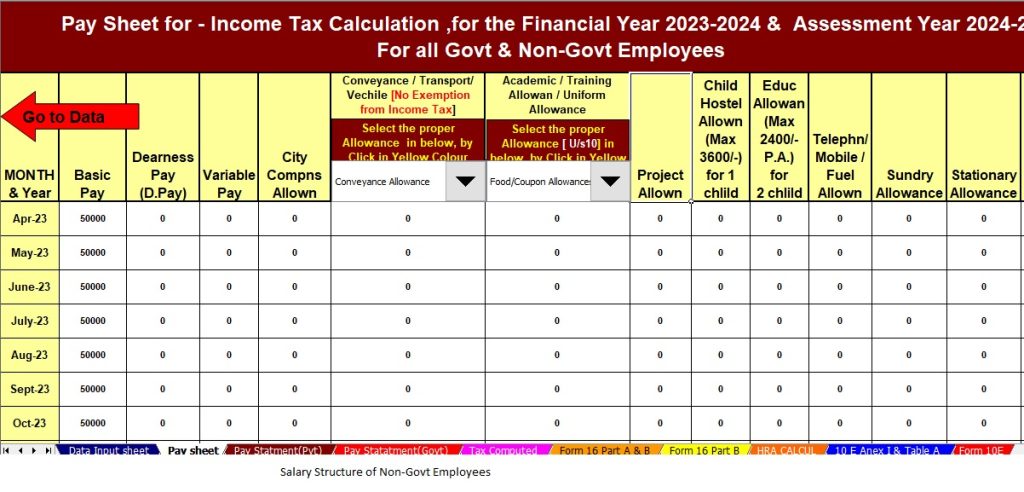

Download Automated Income Tax Preparation Excel-Based Software All in One for the Government & Non-Govt (Private) Employees for the F.Y.2023-24 and A.Y.2024-25

In other words, Features of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) For instance, This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) For instance, Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) For instance, Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) For instance, Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24

7) Individual Salary Sheet

No comments:

Post a Comment