Section 80D – Get Tax Benefits on Health & Medical Insurance, With All in One TDS on Salary for Non-Govt Employees for F.Y.2016-17

Section 80D offers one of the best tax-saving benefits in India, which specifically provides deduction in taxable income to the extent of premiums paid on the purchase of health insurance or medical insurance / mediclaim products. A really wonderful feature of this deduction is that it even includes the premiums that you pay for the health insurance of your parents, children, and other family members. Not just that, tax benefit under Section 80D is over and above benefits under other sections such as 80C, 80CCC, 80CCD, 80CCD2, etc. Not using the benefit from Section 80D would be foolish since besides losing the tax benefit, it also means that you do not have any health insurance or medical insurance / media claim.

Section 80D – Eligibility for Deduction

The deduction of premium paid on Health Insurance or Medical Insurance / Mediclaim under Section 80D can be availed of by any Indian taxpayer at the level of Individual or HUF (Hindu Undivided Family). The person claiming the deduction has to be the one who pays the premium for all members. The family members for whom the taxpayer can claim the deduction under Section 80D are as follows.

Self

Spouse

Parents

Dependent Children (non-earning male students up to age 25 only, non-earning females only till they are married)

Please note that other family members can indeed be covered by a health insurance or medical insurance / mediclaim plan (both individual and family floater), but the premium paid for them cannot be included for tax benefit under Section 80D.

Brothers and Sisters

Uncles and Aunts

Father-in-law and Mother-in-law

Grandfathers and Grandmothers

Nephews, Nieces, Cousins

Any other relatives

Annual Health Check-Up Expenses for the entire family also covered

In addition to the above, effective from A.Y 2017-2018, the cost of annual health check-up incurred on eligible members are also covered to the extent of 5,000 for the entire family put together. It may not be enough as such, but it certainly helps.

Medical Expenses of Super Senior Citizens above Age 80 also covered

In addition to the above, effective from FY 2015-2016, medical expenses of octogenarians, nonagenarians, and centenarians, can be included. That is, medical cost is allowed for deduction under Section 80D for very senior citizens beyond 80 years of age. This is available up to the entire limit of 30,000 (explained below). This benefit is allowed only if they are not covered by any health insurance policy.

NRIs are also covered under Section 80D

Yes, NRIs can also claim this tax benefit. The limits are exactly the same.

Section 80D – Extent of Deduction in a Financial Year

The limits up to which the taxpayer can claim benefits under Section 80D depend on the coverage of health insurance and medical insurance / mediclaim plans.

Section 80D – Points to Note before Claiming Deduction

Medical Allowance : Tax Benefit under Section 80D is NOT the same as Medical Benefit which is part of your salary for which currently the limit is 25,000 for below 60 Years and Rs. 30,000/- above 60 Years. It is over and above the Medical Benefit, so you can claim BOTH – Health Insurance / Mediclaim under Section 80D and Medical Allowance under Section 10. They will appear separately in your Form 16.

Multiple Policies : You can claim for more than 1 health insurance policy. Do ensure you meet all the eligibility criteria for premiums paid for all the policies.

Top-up Health Policies : Top-up health insurance or medical insurance / medical plans are also eligible for the benefit.

Policy Proposer : It is not necessary that the taxpayer needs to be the proposer of the policy – she/he just needs to pay the premium to keep the policy in force.

Renewal Premium : You can indeed claim for renewal premium paid to keep a health insurance plan in force. Do ensure it meets all other conditions mentioned herein.

Health Check-Up Expenses : Health check-up deductions are all-inclusive for family members put together. That is, for all family members (self, spouse, dependent children, parents) together to the extent of 5,000. It is NOT for each family member – do note that.

Salary Deduction : In case, you are paying the health insurance premium through Salary Deduction, you are still eligible to claim benefit under this section, as long as it is not a Group Health Insurance plan.

Independent Parents : Under Section 80D, one cannot include premiums paid for independent children, i.e. children who are earning income. However, you can claim this benefit for earning spouse and earning parents, i.e. even if they not dependent on you.

Part Payment by Individuals : In the case of part payment by you and a parent, both of you can claim the deduction to the extent paid by each.

Section 80D – Exclusions

Mode of Premium Payment : Only the taxpayer, and not a third party, can pay the premium for all the family members for whom tax deduction is claimed. Cash payments are NOT allowed for tax benefit – any other mode including online, debit/credit cards, etc. are acceptable.

Exclusion of Service Tax : When claiming tax benefit, deduct the Service Tax and Cess portion from the premium amount.

Group Health Insurance and Group Mediclaim : Group Health Insurance premium provided by the company is NOT eligible for deduction under Section 80D. However, if you pay any premium to enhance the group cover for eligible members, you can indeed claim this contribution within the overall limits applicable for you.

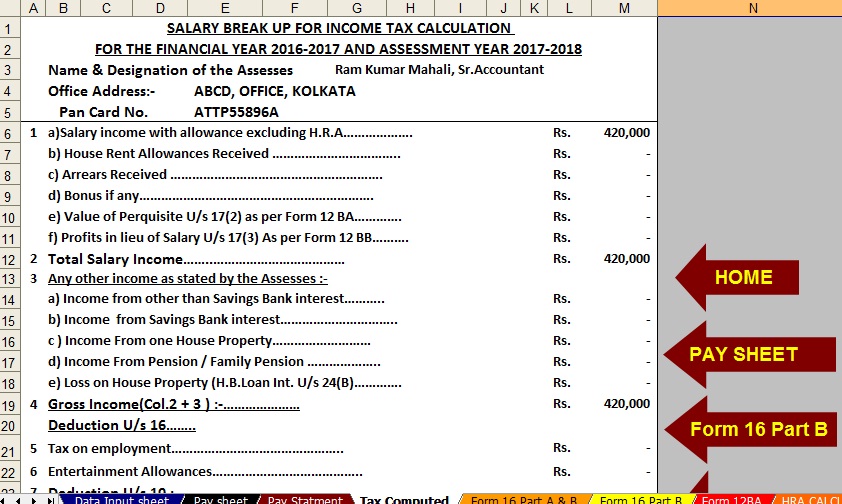

Download All in One Income Tax Preparation Excel Based Software for Only Private/Non-Govt employees for F.Y.20116-17 & A.Y.2017-18. [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure + Automatic H.R.A. Calculation + Automatic Form 12 BA + Automatic Form 16 Part A&B and Form 16 Part B for F.Y.2016-17]

As mentioned in the beginning, it is foolish not to use Section 80D tax benefit. Here’s a simple calculation.

A health insurance family floater product for a family of 2 adults (under age 45) and 2 children costs say Rs. 10,000 per annum (when you buy online) for a Sum Insured of Rs. 5 lakhs.

A health insurance family floater product for a family of 2 adults (under age 45) and 2 children costs say Rs. 10,000 per annum (when you buy online) for a Sum Insured of Rs. 5 lakhs.

· The biggest benefit is Health Insurance itself which is very beneficial.

· Add to that the benefit from Section 80D. If you are in the 30% Income Tax bracket, you straight away save Rs. 3,000

· Insurance companies generally offer free annual health insurance check-ups (costing Rs. 3000-4000 per person) to adults covered in the health insurance plan. This saves you another approximately Rs. 7,000 per annum!

So the 80D benefit and the benefit of Annual Health Check-up together compensate the premium of Rs. 10,000. Plus you get the benefit of Health Insurance from the policy renewable for your whole life! Which is what makes a health insurance product a must-have policy for every Indian family.

No comments:

Post a Comment