Download Automated TDS on Salary All in One for Bihar State Employees for F.Y.2017-18

As the Income Tax Slab has already changed by the Finance Budget for the Financial Year 2017-18.

Tax Rate up to Rs. 2.5 Lakh is NIL

Below Taxable Income 5 Lakh the Tax Rate @ 5% instead the previous financial year 2016-17 was @ 10%. Who's Taxable Income above 5 lakh the rate of Tax @ 20% below 60 years age.

Given below the Automated Income Tax Preparation Excel Based Software All in One TDS on Salary for Only Bihar State Govt employees for the Financial Year 2017-18.

Main Feature of this Excel Utility :-

- In built the Salary Structure as per the Bihar State Employees Salary Pattern

- Individual Income Tax Computed Sheet

- Individual Salary Sheet

- Automatic House Rent Exemption Calculation U/s 10(13A)

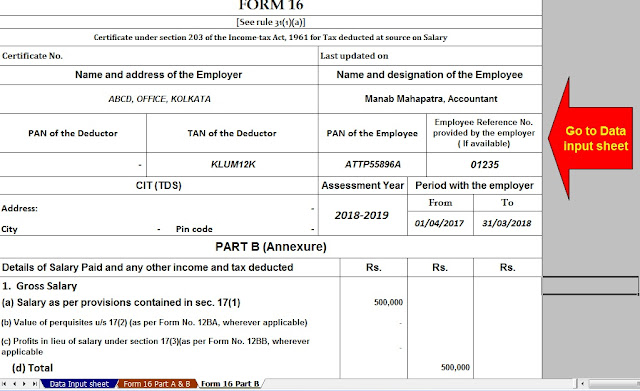

- Automated Income Tax Form 16 Part A&B for F.Y.2017-18

- Automated Income Tax Form 16 Part B for F.Y.2017-18

- Automatic Convert the Amount in to the In-Words

- Easy to Install in any computer

- Easy to Generate like as an Excel File.

Click here to Download the Automated All in One TDS on Salary for only Bihar State Employees for the Financial Year 2017-18.

Main Data Sheet for Deductor

|

Bihar State Employees Salary Structure

|

Tax Computed Sheet

|

Form 16 Part A&B

|

Form 16 Part B

|

No comments:

Post a Comment