NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B),With Automated All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2018-19

Tax Benefit on NPS Tier 1 and/or 2?

NPS has two Tiers – 1 and 2.

NPS

Tier 1 is the long-term investment, which has restricted withdrawals

and meant primarily for retirement planning. On maturity, you can

withdraw a maximum of 60% of the corpus as lump sum and rest has to be

used for annuity purchase.

NPS

Tier 2 is for managing short to medium term investment. You can invest

and withdraw anytime as per your wish. This is an optional feature and

you are asked if you need Tier 2 account while opening NPS.

All the tax benefit related to NPS is available to invest in NPS Tier 1 account only.

NPS Tax Benefits:

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). We discuss each below:

1. Section 80CCD(1)

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction. [This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction].

Self-employed can also claim this tax benefit. However, the limit is

10% of their annual income up to a maximum of Rs 1.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction. This was introduced in Budget 2015.

3. Section 80CCD(2)

Employer’s

contribution up to 10% of basic plus DA is eligible for deduction under

this section above the Rs 1.5 lakh limit in Sec 80CCD(1). This is also

beneficial for the employer as it can claim tax benefit for its

contribution by showing it as a business expense in the profit and loss

account. Self-employed cannot claim this tax benefit.

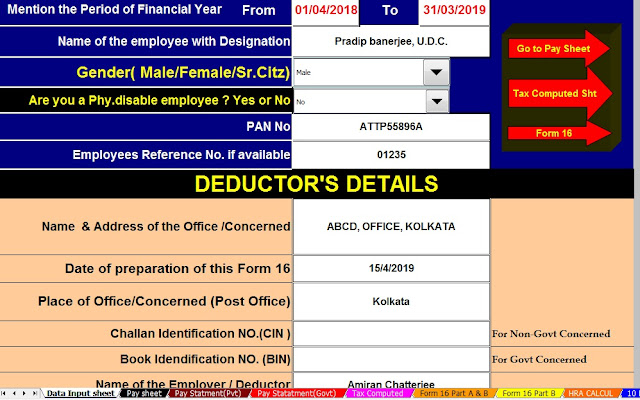

Click to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for the Financial Year 2018-19 & Ass Year 2019-20 [ This Excel Utility can prepare at a time your Tax Computed sheet + Individual Salary Statement + Individual Salary Structure as per Salary Pattern of Govt and Non-Govt Concerned + Automated Arrears Relief Calculation U/s 89(1) with Form 10E from F.Y.2000-2001 to F.Y.2018-19 +Automated Income Tax Form 16 Part A&B and Form 16 Part B for as per the Finance Budget 2018-19]

Tax Benefit for Compulsory NPS deduction:

The

earlier pension structure was replaced by NPS in most central and state

government jobs since 2004. So anyone who joined after that has a

compulsory deduction for NPS. The deduction is 10% of basic salary and

dearness allowance (DA) and the employer to contributes the matching

amount. The confusion for most employees is how they take tax benefit on

their compulsory NPS deduction?

The

employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he

wants to show his contribution. Ideally he should show Rs 50,000

investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can

be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C

has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he

should make an additional investment of Rs 1,38,000 in Section 80C to

save maximum tax. In all, he can save Rs 2 lakhs tax u/s 80C and

80CCD(1B).

No comments:

Post a Comment