In today’s complex tax landscape, individuals often find themselves entangled in various tax-related issues, one of which is income tax arrears. The Income Tax Act, of 1961, provides provisions for relieving taxpayers from the burden of tax arrears through Section 89(1). Understanding and calculating tax relief under this section can be daunting, especially when dealing with multiple financial years.

Introduction to Income Tax Arrears Relief Calculator

An Income Tax Arrears Relief Calculator is a tool designed to simplify the process of computing tax relief under Section 89(1) of the Income Tax Act. It provides taxpayers with a convenient way to calculate the relief amount owed to them due to the delay in receiving income or arrears from previous years.

Understanding Section 89(1)

Explanation of Section 89(1)

Section 89(1) of the Income Tax Act allows taxpayers to claim relief when they receive arrears of salary or pension in a financial year other than the one in which it was due. This provision prevents taxpayers from being unfairly taxed at higher rates due to the accumulation of income from previous years.

Eligibility Criteria

Taxpayers eligible for relief under Section 89(1) include salaried individuals, pensioners, and those receiving family pensions. The relief is applicable when the taxpayer receives arrears or additional salary in a particular financial year.

Importance of Income Tax Arrears Relief Calculator

The complexity of tax calculations and the intricacies of Section 89(1) make it essential for taxpayers to use reliable tools like the Income Tax Arrears Relief Calculator. By accurately computing tax relief, taxpayers can ensure compliance with tax laws while minimizing their tax liability.

How to Use Form 10E

Purpose of Form 10E

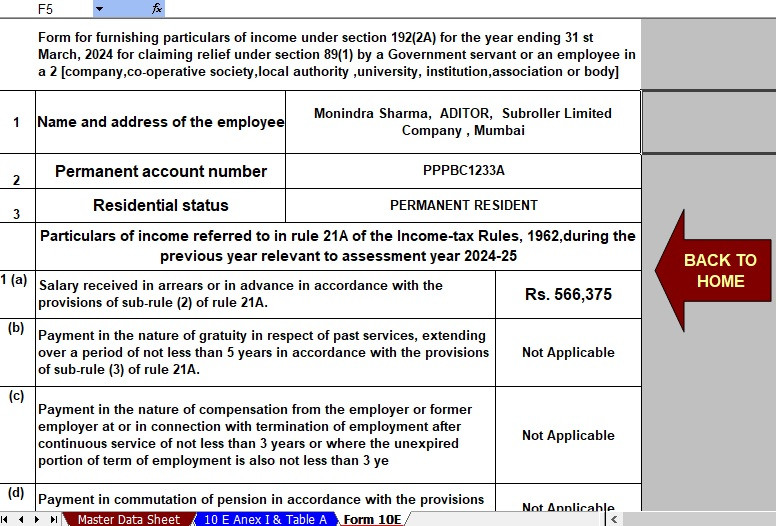

Form 10E is a declaration required to claim relief under Section 89(1). It serves as evidence of the taxpayer’s entitlement to relief and must be submitted to the relevant tax authorities along with the income tax return.

Step-by-Step Guide to Filling Form 10E

- Fill in personal details such as name, PAN, and address.

- Provide details of the previous employer(s) and the current employer.

- Specify the financial year for which relief is claimed and the amount of arrears received.

- Calculate the relief amount as per the provisions of Section 89(1).

- Sign and submit the form to the designated tax authority.

Benefits of Using Excel for Tax Calculations

Excel offers several advantages for tax calculations, including flexibility, customization, and ease of use. Taxpayers can create personalized templates and formulas to streamline the calculation process and ensure accuracy.

Features of Automatic Income Tax Arrears Relief Calculator

Accuracy

The Automatic Income Tax Arrears Relief Calculator ensures accurate computation of tax relief, eliminating the risk of manual errors.

Time-saving

By automating the calculation process, the calculator saves taxpayers valuable time that would otherwise be spent on manual calculations.

Convenience

The user-friendly interface and intuitive design of the calculator make it easy for taxpayers to input data and generate results quickly.

Downloading and Installing the Calculator

Sources to Download

The Automatic Income Tax Arrears Relief Calculator can be downloaded from reputable sources such as government websites, tax portals, or trusted financial platforms.

Installation Process

Once downloaded, the calculator can be installed on any device compatible with Excel, including desktops, laptops, and mobile devices.

Step-by-Step Guide to Using the Calculator

Inputting Data

- Open the calculator and navigate to the input section.

- Enter personal details, including PAN, name, and address.

- Provide details of income, deductions, and arrears received.

- Click on the calculate button to generate results.

Generating Results

The calculator will automatically compute the tax relief amount as per the provisions of Section 89(1) and display the results on the screen.

Understanding the Results

Breakdown of Results

The results section provides a detailed breakdown of the relief amount, including the computation method and applicable tax rates.

Interpretation

Taxpayers can interpret the results to understand their entitlement to relief and ensure compliance with tax laws.

Frequently Asked Questions about Income Tax Arrears Relief Calculator

- What is an Income Tax Arrears Relief Calculator?

- Who is eligible for relief under Section 89(1)?

- How does Form 10E facilitate the claim of relief?

- Are there any limitations to claiming relief under Section 89(1)?

- Can the calculator be used for multiple financial years?

Conclusion

In conclusion, the Automatic Income Tax Arrears Relief Calculator is a valuable tool for taxpayers seeking relief under Section 89(1) of the Income Tax Act. The calculator helps taxpayers fulfil their tax obligations while minimizing their tax liability by simplifying the calculation process and ensuring accuracy.

Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 in Excel