Exemptions U/s 80 E –Vs- EEA on Home Loan interest which is benefited

In this post, we will dive deeper into exemptions under the 80EEA of the Income Tax Department.

What is Section 80EEA?

Section 80EEA Additional Discount for Individuals for Paying Interest on Home Loans However, HUF, AOP, BOI, partnership firm or any other taxpayer is not eligible for exemption under section 80EEA.

Section 80EEA has been introduced to increase the benefits approved under Section 80EE for low-cost housing. Exemption / 80EEA can be claimed till the home loan is not repaid.

The maximum discount under Section 80EEA is up to Rs.1,50,000. This discount is more than the 24 discounts of the department (maximum Rs. 2 lakhs). Therefore, taxpayers can simultaneously claim both Section 80EEA and Section 24 (discount of 3.5% of the total). If you claim 80EEA, you cannot claim a waiver under section 80EE.

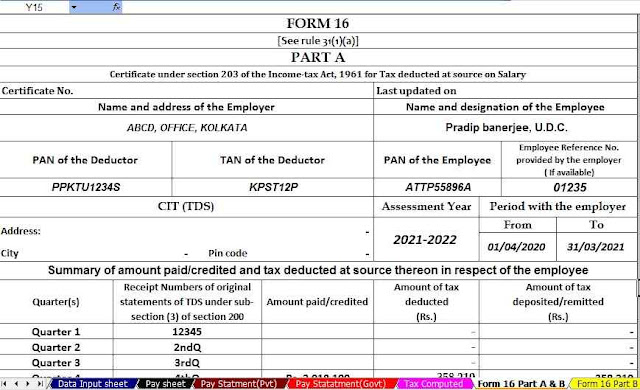

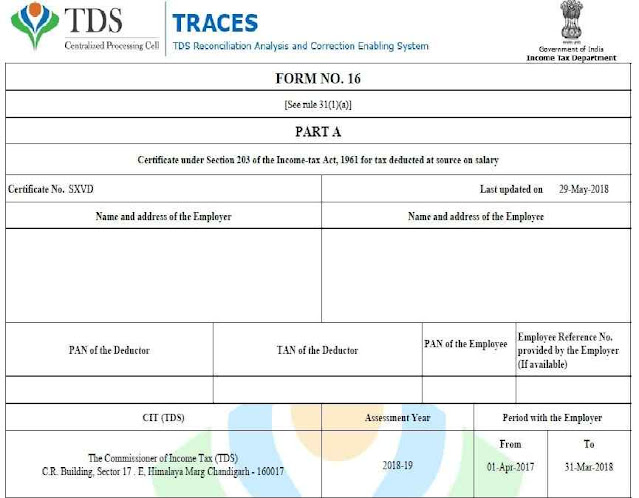

You may also, like- Automated Income Tax Revised Form 16 Part B which can prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21

How to claim U / S 80EEA discount?

There are several conditions for a

A housing loan should only be taken to buy a residential home property.

Financial should also be taken from a "financial institution".

She should be a first-time domestic worker. He should not have any home property on the date of sanction.

The stamp duty value of Rs. 45 lakhs or less.

The approval should be between 01-04-2019 to 31-03-2020.

The appraiser is not claiming any exemption under section 80EE.

You may also, like- Automated Income Tax Revised Form 16 Part B which can prepare at a time 100 Employees Form 16 Part B for the F.Y.2020-21

The "carpet area" has one additional condition:

The carpet area of the Met property should not exceed 60 square meters (645 sq ft) in the metropolitan city including

Met In cities or towns except for metropolitan cities it should not be above 90 square meters (968 square feet).

This applies to affordable housing projects approved on or after September 1, 2019.

Section 80EEA does not specify if you must be a resident to claim this benefit. Thus, both resident and non-resident Indians can claim it.

You may also, like- Automated Income Tax Revised Form 16 Part A&B which can prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2020-21

Section 80EEA also does not specify whether residential homes should be self-occupied to claim this benefit so, people living in rented homes can also claim it.

Individuals who have bought a home jointly or individually can claim this discount. If a person jointly owns the house with his / her spouse and both of them have paid the loan, then both of them can claim this discount.

Conclusion:

What is a “financial institution” in 80EEA?

Reg is a banking company that enforces the Banking Regulation Act

Any banking institution mentioned in Section 51 of the Act or

Housing is a real estate finance company

What is the “stamp duty value” at 80EEA?

Price accepted/evaluated/ evaluated by:

Government No authority of the Central Government or

The state is a state government

For the purpose of paying stamp duty on immovable property

You may also, like- Automated Income Tax Revised Form 16 Part A&B which can prepare at a time 100 Employees Form 16 Part B for the F.Y.2020-21

What is the "carpet zone" of the 80EEA?

Price accepted/evaluated/ evaluated by:

Government No authority of the Central Government or

The state is a state government

For the purpose of paying stamp duty on immovable property

The disparity among the Section 80EEA and Section 80EE

Now let’s look at some of the differences between the 80EEA category and the 80EE category.

Category 80EEA-

1) The stamp duty value of the house should be Rs 45 lakh or less.

2) Approved term from 01-April-2018 to 31-March-2020,

3) The maximum discount amount is Rs. 1,50,000

4) Limitless value of the land.

Section 80EE

1) The value of a house should be 50 lakhs or less.

2) Sanan Approved Term 01-April-2016 to 31-March-2017.

3) The maximum discount amount is Rs. 50,000

4) The value of land should not be more than 35 lakhs.

The difference between section 80EEA and paragraph 24

The table below shows the differences between 80EEA and Section 24.

Section 80EEA

1) You can claim a deduction as soon as you start paying your interest. It does not impose any occupation requirement.

At the same time, we have come to the end of this post on exemptions under section 80EEA.

2) Only loans from banks and financial institutions are allowed.

3) The maximum discount amount is Rs. 1,50,000

4) There are certain conditions for claiming a discount.

Section 24

1) You must be at home to claim a discount.

2) Allows loan taken from any institution

3) The maximum discount amount is Rs. 200,000

4) There is no condition to claim a discount.

At the same time, we have come to the end of this post on exemptions under section 80EEA.