All the

taxpayers are known that the new system introduced in Budget 2020 U/s 115 BAC For the

F.Y.2020-21. In this method you'll choose your option as Old Tax Slab or New

Tax Slab U/s 115 BAC.

In this regard, you want to know your

Tax that you simply shall be paid to the government for the fiscal

year 2020-21 and Assessment Year 2021-22. As per the Section 115 BAC you'll

choose your option within the PRESCRIBED FORM 10-IE as New or Old tax Regime.

When you submit your tax Details to your Employer or Dedicator, you want to

mention your Option as New or Old Tax Regime.

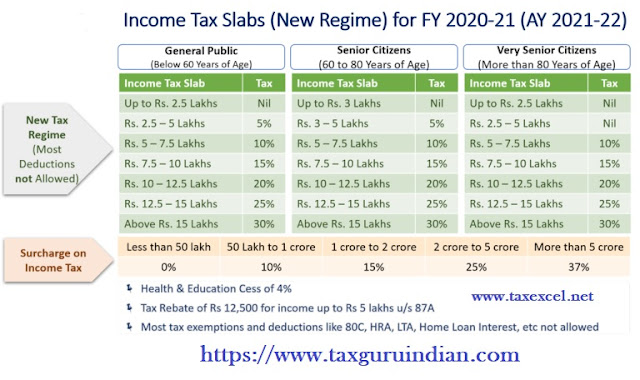

Look about the new section 115 BAC:-

1) If you select A New Tax Regime then

you'll not entitle any tax Benefits as per tax Act 1961

and also, you'll not get the Old Tax Slab as before the F.Y.2019-20.

But you will get only one Tax Benefits for NPS (Pension Scheme) U/s 80CCD. Follow

the below the New tax Slab Rate Chart for the F.Y.2020-21 as New Tax Regime.

2) If you select A Old Tax Regime then

you'll get the all tax Benefits as per the tax Act

1961,and you'll avail the Old Income Tax Slab Rate as per the

F.Y.2019-20. You can get all the tax Sections benefits if you select the Old

Tax Regime. Follow the below the New tax Slab Rate Chart for the F.Y.2020-21 as

New Tax Regime.

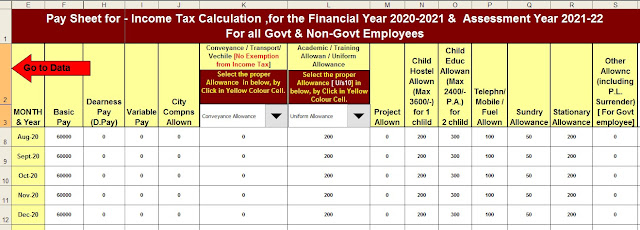

You may check your Income To

Tax Liability by the Unique & Most popular Excel Based Income Tax

Software All in One where from you know your Total Tax Burden as New and Old

Tax Regime (As per your Option) This Excel Based tax Preparation Software

for the Andhra Pradesh State Employee.

This Unique Software All

in One prepare at a time your

1) Income

Tax Computed Sheet as per your Option New or Old Tax Regime

2) Individual

Salary Structure as per the

3) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

4) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

5) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

6) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

7) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

8) Individual Salary Sheet

9) Auto Calculate your House Rent Exemption

Calculation U/s 10(13A)