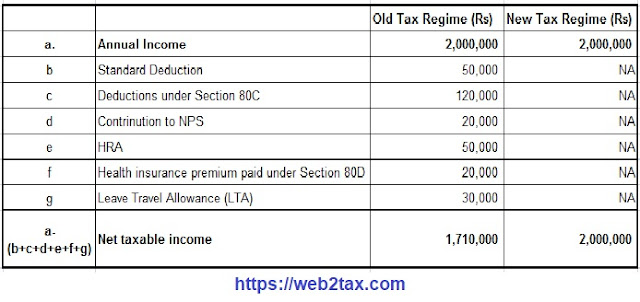

In the Budget 2020 introduced a new Section 115 BAC for the F.Y.2020-21. This Section 115BAC have an option that you can stay in the Old Tax System along with all the Income Tax Exemptions as per the F.Y.2019-20 and you can Opt in the New Tax Regime Excluding any Exemptions of Income Tax as the previous F.Y. 2019-20 as clearly mentioned in the Budge 2020 U/s 115BAC.

As per the Budget the New Tax Slab is given below U/s 115BAC which introduced in the Budget 2020.

Also it is clear that no relaxation to the Senior Citizen in the New Tax Slab as per U/s 115BAC ( New Tax Regime). We Prepared a Unique Income Tax Preparation Excel Based Software only for the Govt and Private Employees for the F.Y.2020-21 as per the new Budget 2020 with New and Old Tax Regime U/s 115BAC introduced in the Budget 2020.

As per the New Income Tax Section 115 BAC introduced in Budget 2020. As per the Section 115 BAC you should give your option as you opt-in as New Tax Regime or Old Tax Regime in the newly prescribed Form 10-IE. If you choose the New Tax Regime you can not avail this exemption U/s 80 TTA or if you choose the Old Tax Regime then you can avail this Exemption U/s 80 TTA.

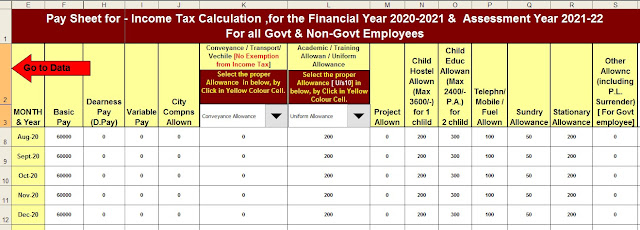

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet