- You must be a RESIDENT INDIVIDUAL; and

- Your Total Income, fewer Deductions, (under Section 80) is equal to or less than Rs 5,00,000.

- The rebate is limited to Rs 12,500. This means the total tax payable or Rs 12,500, whichever is lower, that amount will be the rebate under section 87A. [This rebate is applied to the total tax before adding the Education Cess (4%)]

Tuesday, 22 December 2020

Sunday, 22 November 2020

In the Budget 2020 introduced a new Section 115 BAC for the F.Y.2020-21. This Section 115BAC have an option that you can stay in the Old Tax System along with all the Income Tax Exemptions as per the F.Y.2019-20 and you can Opt in the New Tax Regime Excluding any Exemptions of Income Tax as the previous F.Y. 2019-20 as clearly mentioned in the Budge 2020 U/s 115BAC.

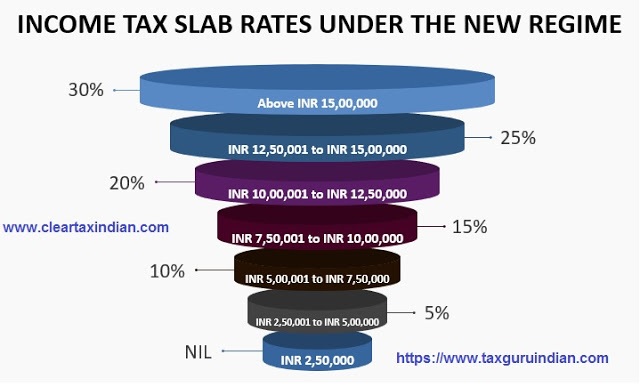

As per the Budget the New Tax Slab is given below U/s 115BAC which introduced in the Budget 2020.

Also it is clear that no relaxation to the Senior Citizen in the New Tax Slab as per U/s 115BAC ( New Tax Regime). We Prepared a Unique Income Tax Preparation Excel Based Software only for the Govt and Private Employees for the F.Y.2020-21 as per the new Budget 2020 with New and Old Tax Regime U/s 115BAC introduced in the Budget 2020.

As per the New Income Tax Section 115 BAC

introduced in Budget 2020. As per the Section 115 BAC you should give your

option as you opt-in as New Tax Regime or Old Tax Regime in the newly

prescribed Form 10-IE. If you choose

the New Tax Regime you can not avail this exemption U/s 80 TTA or if you choose

the Old Tax Regime then you can avail this Exemption U/s 80 TTA.

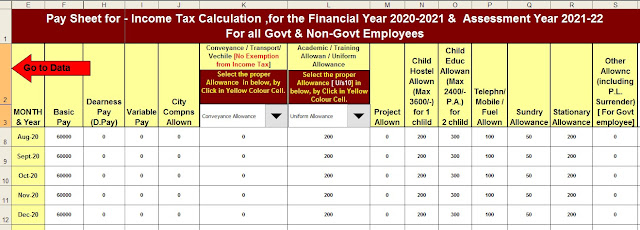

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet