Auto-Fill Income Tax Preparation Software in Excel for the Govt and Non- Govt Employees.Section

10 for salaried employees under the Income-tax Act includes various allowances ranging from house

rent and travel allowance to research / academic allowance and uniform allowance.

Salary employees receive a certain amount of money or other allowances in addition to their salary for the specific needs of the employees. Most allowances are a fraction of the total income unless they are subject to certain exemptions under the Income Tax Act. Employees are paid allowances for their services or for working in unusual circumstances.

As per Income Tax Act U/s 10 many allowances include.

Under the Special Allowance Act of Section 10 (14), an exemption is given on the basis of the amount used by the employee for a specific purpose. Exemption depends on the following factors:

Amount of allowance.

The actual amount used for the purpose for which the allowance was granted.

Section 10 (14) (i)

Under section 10 (14) (i), a waiver is given in the amount received as allowance or in the amount spent on certain duties, which may be the figure below.

Allowances under this category are:

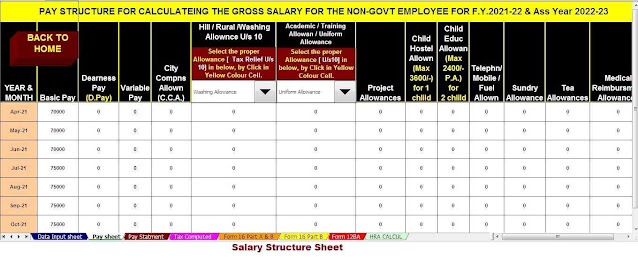

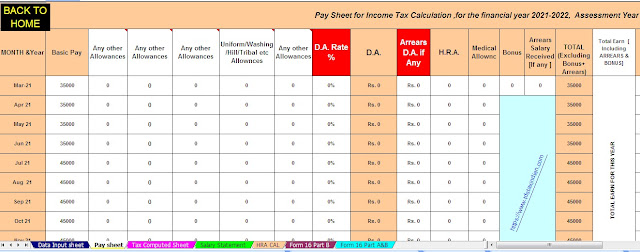

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Government Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax computed Sheet + Salary Structure as per the Non-Govt Employees Salary Pattern + Automatic Calculation House Rent Exemption U/s 10(13A) + Automatic Income Tax Form 16 Part A&B and Part B + Automatic Form 12 B.A. as per new and old tax regime]

• Daily Allowance: Employees are paid daily allowance during travel or transfer time. Such allowances are paid when the employee is not in a place of normal responsibility.

Travel Allowance: Travel Allowance bears the costs related to travel or transfer while on duty. This allowance includes travel expenses when moving to another location, including packaging or transportation of a private building.

Transport Allowance: Allowance for transportation is paid to the employees in case of spending time travelling for office duties. However, the employer does not pay for travel from home to work because it is not considered an official responsibility. This allowance comes under a different category called ‘Transportation Allowance’ and it is not tax-free.

• Uniform Allowance: When the allowance is paid for the purchase or maintenance of a uniform, it must be worn while on duty. This allowance can be chosen only when the office responsibilities determine a certain uniform.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Assam State Government Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax computed Sheet + Salary Structure as per the Assam State Govt Employees Salary Pattern + Automatic Calculation House Rent Exemption U/s 10(13A) + Automatic Income Tax Form 16 Part A&B and Part B]

Generally, it is not necessary to submit a statement of expenditure under this category of allowance unless the expenditure is inappropriate or unreasonable in respect of the responsibilities performed by the employee. Most of the time, you don't need to keep documentary evidence and a general declaration meets the purpose.

Section 10 (14) (ii):

Under this section, allowances are paid to employees for working under a certain condition during their tenure. The amount of discount is the amount received as allowance or the mentioned limit, whichever is less.

The types of allowances and discounts given in this section are listed below:

1. Compensation allowance for working in high altitude or hilly areas Rs.800/- p.m.

Siachen area of J&K - 7000 rupees per month

Ordinary place 1000 mtr or above - 300 rupees

2. Scheduled or Tribal or Agency Area Allowance: Rs.200 p.m.

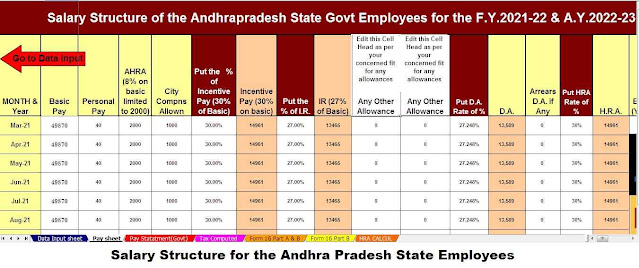

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Government Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax computed Sheet + Salary Structure as per the Andhra Pradesh State Govt Employees Salary Pattern + Automatic Calculation House Rent Exemption U/s 10(13A) + Automatic Income Tax Form 16 Part A&B and Part B + Automatic Form 12 B.A. as per new and old tax regime]

For duty in the border area or remotest area or any difficult/turbulent area:

Allowance from Rs.200 to Rs.1300 is exempted under Rule 2BB.

4. Allowance for children's education:

100 for each child and a maximum of two children.

5. Allowance for working in a transport system for personal expenses while performing duties:

70% of allowance up to Rs.10,000/-

6. Area allowance:

Area of Nagaland, J&K, HP, UP, UP,

7. Allowance for hostel expenses of employee's children:

Rs.100/- in the education for each child up to two children.

8. Allowance paid to the Armed Forces for anti-militant cases:

3900 per month.

9. Travel allowance for physically disabled employees:

1600 per month.

10. Transportation allowance for travel between work and accommodation:

1600 in the afternoon.

11. Specific areas of

3250 per month.

13. Allowance for working in underground mines:

800 per month.

14. Special Compensatory Highly Active Area Allowance:

200200 in the afternoon.

15. Allowance for Armed Forces at High Altitude:

9000 - 15,000ft - Rs.1060 pm

15,000 feet above - 1600 pm

Feature of this Excel Utility:-

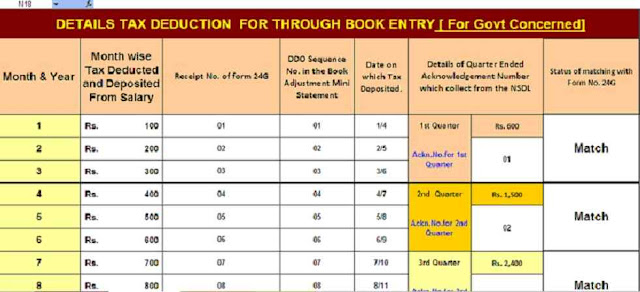

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

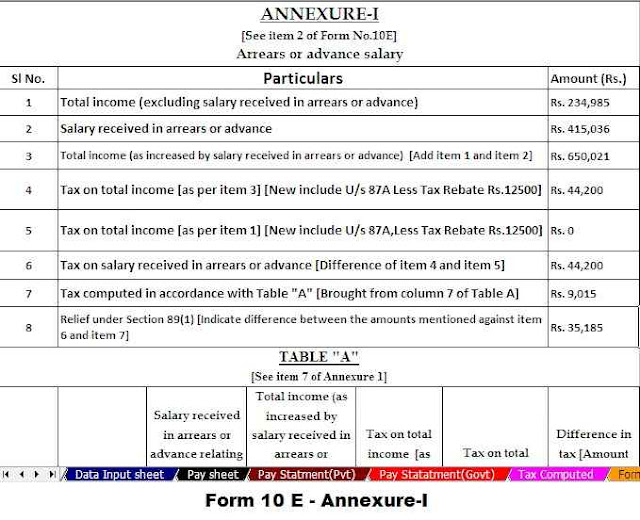

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

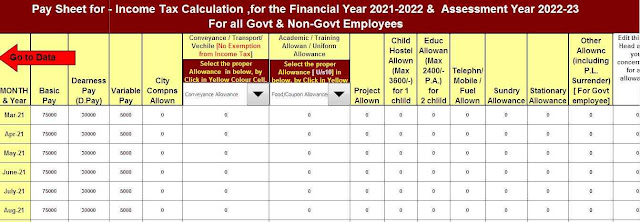

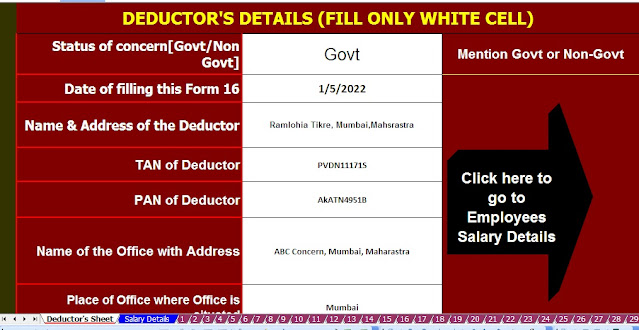

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula