Managing your finances efficiently is crucial. Therefore, One essential aspect of financial planning is optimizing your tax liabilities. This guide will delve into the intricacies of Income Tax Section 115BAC to help you navigate the complex world of income tax.

Understanding Income Tax Section 115BAC

What is Section 115BAC?

Income Tax Section 115BAC, also known as the New Tax Regime, simplifies the tax structure. It offers taxpayers a choice between the old tax regime (with deductions and exemptions) and the new tax regime (with reduced tax rates but no deductions).

In other words, the Benefits of Choosing Section 115BAC

However, Opting for Section 115BAC comes with several advantages:

- Lower Tax Rates: The new tax regime provides reduced tax rates, resulting in significant savings for taxpayers.

- No Deduction Hassles: With Section 115BAC, you won't need to calculate various deductions and exemptions, simplifying the tax filing process.

- Flexibility: Taxpayers can switch between the old and new tax regimes, allowing for greater flexibility based on their financial situation.

Above all, Optimizing Tax Planning with Section 115BAC

Now that you grasp the basics of Section 115BAC, let's explore strategies to maximize this tax provision.

1. Assess Your Eligibility

Before choosing Section 115BAC, evaluate whether you meet the eligibility criteria, including the correct income bracket and other specified requirements.

2. Compare Tax Benefits

Thoroughly analyze the tax benefits offered by both the old and new tax regimes. In addition, Calculate potential tax savings to make an informed decision.

3. Consult a Tax Professional

Seek advice from a qualified tax professional who can guide you on the most tax-efficient approach based on your financial goals and circumstances.

4. Regularly Review Your Tax Strategy

Tax laws and regulations can change, so stay updated. Regularly review your tax strategy to ensure you continue to benefit from Section 115BAC.

In Conclusion

Income Tax Section 115BAC offers taxpayers a simplified and flexible approach to managing their tax liabilities. By understanding the benefits and optimizing your tax planning, you can maximize tax savings and achieve better financial stability.

Remember, tax planning is a crucial part of your overall financial strategy. Always consult a tax professional to make informed decisions and stay on top of your tax obligations.

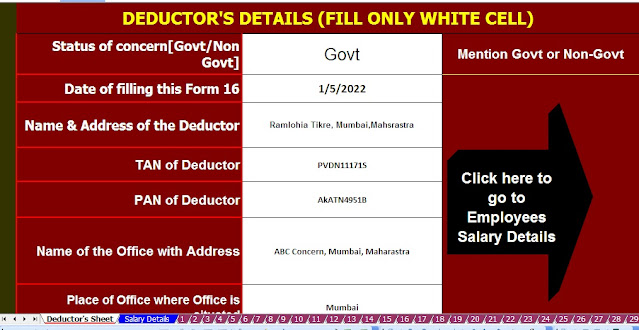

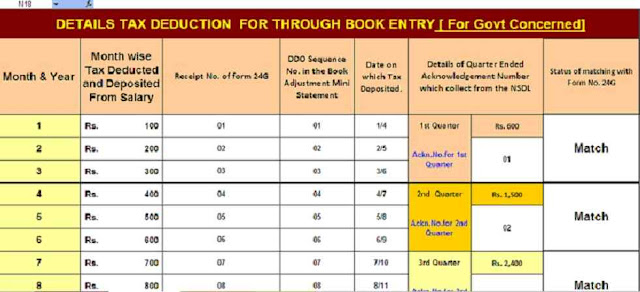

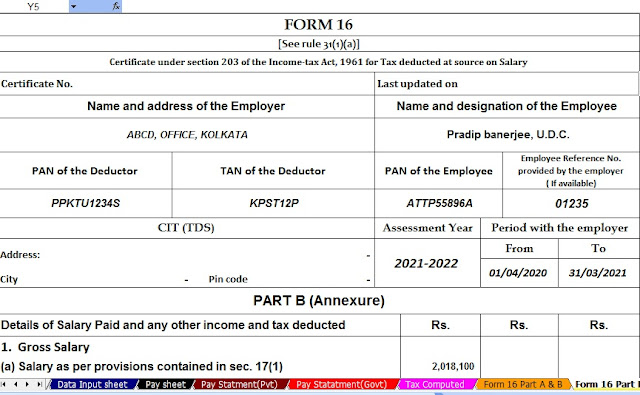

Download Auto Calculate and Auto Preparation Income Tax Software All in One in Excel for the Non-Government Employees as per Budget 2023 for the F.Y.2023-24

Features of this Excel Utility

- The Tax Calculation will be as per the Budget 2023 with New and Old Tax Regime U/s 115 BAC

- This Excel Utility has its own Salary Structure as per the Non-Government (Private) Employees' Salary Structure

- This Excel Utility can automatically prepare automatically your Income tax Computed Sheet Just fill in the Data

- For instance, This Excel Utility can Calculate your House Rent Exemption U/s 10(13A)

- For instance, This Excel Utility have a separate Salary Sheet

- For instance, This Excel Utility automatically your Arrears Relief Calculation U/s 89(1) with Form 10E

- For instance, This Excel Utility can prepare at a time your Form 16 Part B automatically

- For instance, This Excel Utility can prepare at a time Form 16 Part A and B