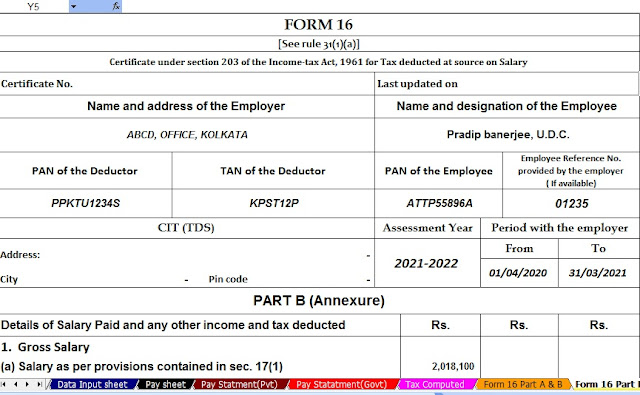

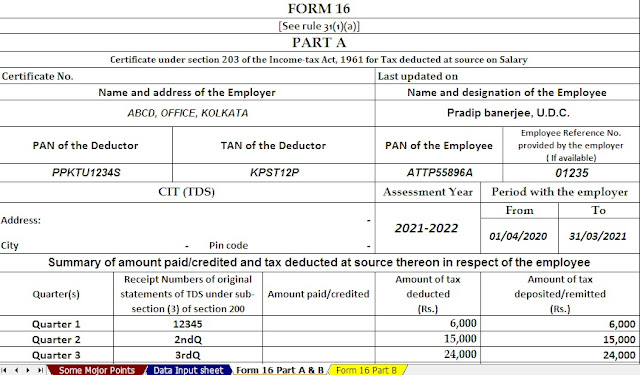

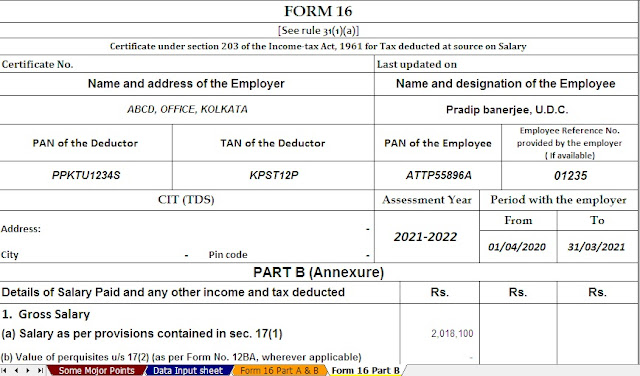

Income Tax Revised Form 16 for the F.Y.2020-21 with New and Old Tax Regime under the New Tax Section 115 BAC

This Excel Based Income Tax Revised Form 16 Prepare as per the new and old tax regime. The main highlight the new and old tax regime for taxpayers. It is a simplified tax duty where taxpayers cannot avail the number of concessions and exemptions that they can avail themselves of under the old system of governance.

It is currently available as an alchemical scheme for individual and Hindu undivided families; it was unveiled in the previous central budget.

With the introduction of this tariff structure, various questions have arisen in the minds of the taxpayers about the plan to change it. We solve these few questions here.

Which rule saves more taxes?

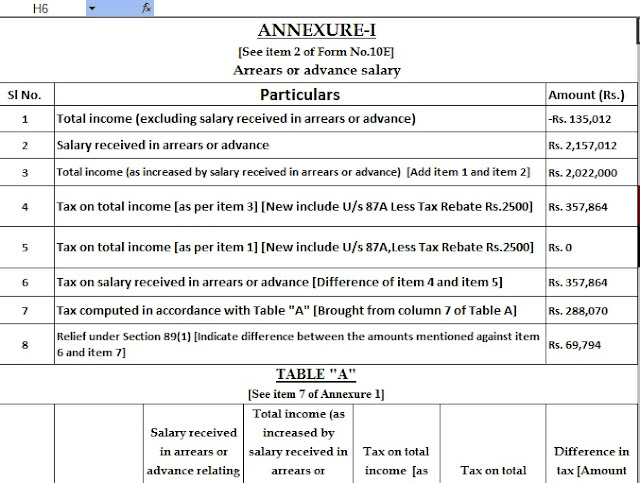

Tax savings will depend on tax income.

For example, you are eligible for an exemption and a deduction of Rs 1.5 lakh. With an estimated annual income of Rs 6,50,000, your tax liability under both governments will be the same (Rs 54,600). For income less than Rs 7.5 lakh, the old system of governance will save more taxes.

For income above Rs 8.5 lakh, for example, the new tax duty is beneficial. This is because the tax rate in the new regime increases at a lower rate than in the old regime

What is the difference between the Old and New Regimes?

The important difference between the two governments is the tax rate.

* Tax exemption U/s 87a available in both systems

Another difference in the new tax system is that taxpayers can afford to invest less in discounted investments, which will increase household income.

The new system of governance does not require the maintenance and submission of tax protection documents applicable to the old system.

Can I change my tax regime every year?

The tax system can be changed every financial year in case of income from salary, home property, capital gain or other sources. In business or professional earning, this regime can only be selected once for a specific type of business.

When should my employer be intimate about my tax regime selection?

The employer may be notified of the elected regime at the beginning of the financial year. Once established and informed, governance cannot be changed for years for the purpose of TDS.

However, you can switch to other systems when filing an income tax return. In such cases, TDS will be adjusted accordingly.

* All tax rates for residential taxpayers under 60 years of age.