Section 89 comes in picture when

salary/annuity or different parts are paid financially overdue or advance. As

indicated by Section 89, on the off

chance that you simply get salary financially overdue or advance during a

budgetary year thanks to which your all-out income for the year expands, which

thusly builds your taxable income, you'll guarantee for relief under Section

89. you need to refill Structure 10E with these subtleties and afterwards

submit it to your current manager to make sure the relief. Structure 10E must be

submitted on the web and no duplicate is required to be connected alongside

your tax return.

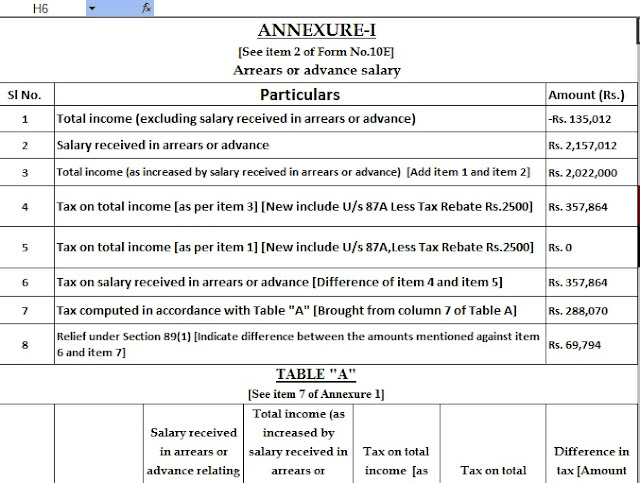

Here's the way relief u/s 89 is set

Step 1: Ascertain tax for this year (counting cess and instruction

cess) on income remembering salary for arrears/advance/pay.

Step 2: Find out tax for this year (counting cess and instruction

cess) on income barring salary falling behind financial remunerations.

Step 3: Step 1 short Step 2

Step 4: Ascertain tax for the year during which salary should are

gotten (counting cees and instruction cess) on income remembering salary for

arrears remunerations.

Step 5: Compute tax for the

year during which salary/remuneration should are gotten (counting cess and

instruction cess) on income barring salary financially overdue

Step 6: Step 4 short Step 5

Step 7 : Arrears Relief u/s 89 = Step 3 short Step 6 (if positive,

in any case nil)

Step 8: Tax purchased Current Appraisal year = Step1 short step7