Interest on EPF Contributing surpassing Rs 2.5 Lack| The budget proposition influencing salaried employees adding to Employee Provident Funds|

The money serves has proposed to incompletely burden the interest accumulated on the provident fund record of employees| Allow us to examine the arrangement.

Present Provisions

Presently, any instalment got by an employee from his provident fund account is completely tax-exempt| The equivalent might be gotten either as fractional withdrawal as allowed under the scheme or one got after retirement| The instalment got from the provident fund includes the contribution made by the employer and the employee just as the interest accumulated on the contributions|

A year ago, the government corrected the expense laws to set a limit for the greatest measure of the contribution made by an employer towards provident fund, National Pension Scheme and superannuation scheme to Rs. 7.50 lack past which the equivalent is burdened as perquisite in the possession of the employee| Additionally, the alteration gave that any interest owing to the overabundance contribution past Rs. 7.50 lacks were likewise to be treated as perquisite in the possession of the employee|

You may also, like- Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 [This Excel Utility Prepare at a time 50 Employees Form 16 Part A&B as per new and old tax regime]

An employee is needed to contribute 12% of his essential compensation and dearness remittance towards employee provident fund account which is needed to be coordinated by the employer by equivalent contribution| There is no such limitation on the employee contributing past 12% as a willful contribution| Since the interest rates have descended radically and the pace of interest announced by the government is appealing and which likewise comes tax-exempt in the possession of employees, employees are picking a higher intentional contribution| Since this is rather than the taxation of development continues of NPS of which just 60% comes tax-exempt and the equilibrium is by implication burdened as an annuity as the endorser needs to purchase an annuity of at least 40% of the corpus| So there was an interest for getting equality of taxation between these two retirement items which the government attempted to do previously however with no achievement.

What is the proposition and what are its suggestions?

Since the interest on the contribution made by an employee appreciates charge exemption without there being a maximum cutoff, the government has suggested that interest gathered in regard of employee's contribution in the overabundance of Rs. 2.50 lacks consistently will get available in the possession of the employee| So the interest in regard to the yearly contribution of Rs. 2.50 lakhs just will come tax-exempt and any interest accumulated on overabundance contribution will get available in the possession of the employee without fail|

You may also, like- Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 [This Excel Utility Prepare at a time 50 Employees Form 16 Part B as per new and old tax regime]

It isn't that the estimation of interest on abundance contribution must be done once just yet it must be made each year for the overabundance contribution made for every one of the previous years| As I would see it, to anticipate that the employee should make such estimation consistently is excessive | On the off chance that the government doesn't need the employees to procure tax-exempt interest for contribution past Rs. 2.50 lakhs, it should set a limit for top-level augmentation consistently toward a provident fund like the one which is pertinent in the event of Public Provident Fund (PPF) account| This is in inconsistency to the recommendations contained in the new work code where the employer and employee should make a contribution toward provident fund on the higher sum as the meaning of the compensation is proposed to be changed in the new work code.

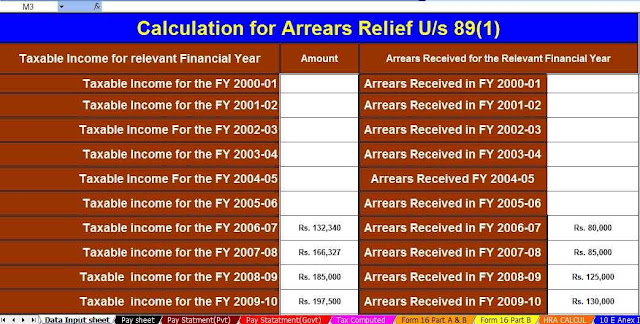

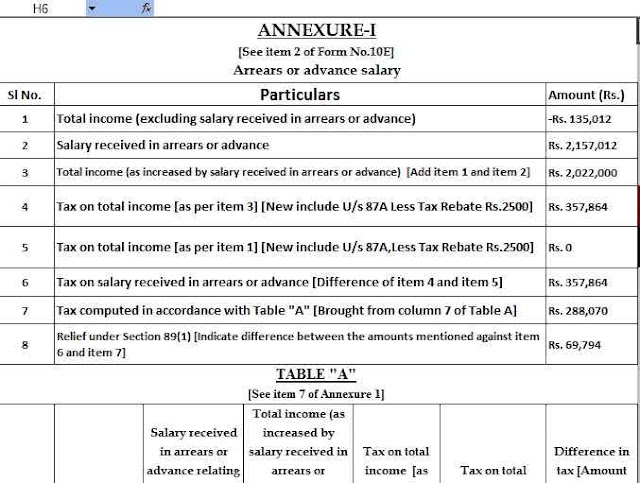

You may also, like- Automated Income Preparation Excel Based Software All in One for the Government and Non-Government Employees for the F.Y.2020-21[This Excel Utility can prepare at a time Tax Computed Sheet + Individual Salary Structure as per both of Govt & Non-Govt Concerned Salary Pattern + Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E for F.Y.2020-21 + Automated Income Tax Revised Form 16 Part A&B and Part B + Automated H.R.A. Exemption Calculation U/s 10(13A)]

As I would like to think, since we don't have a government-managed retirement framework in our country for what reason should the government deter anybody from offering higher sum towards his retirement fund. The government should reexamine on this proposition.

There is one more proposition which will straightforwardly influence the employees who have Employees provident fund account| Since the employee gets the interest from the date when the employer stores the cash with provident fund specialists, the employees used to languish over no issue of theirs| This budget gives that on the off chance that the employer neglects to store the provident fund cash by the due date, he won't be permitted the deduction for such contribution which thusly power the employers to pay the contribution by the due date and subsequently, assist the employee with procuring interest for the authentic period.