Income Tax Deduction under Chapter

VI-A Chapter V-A of the Income-tax Act contains different sub-sections of

section 80 which permit an appraiser to guarantee a deduction from the absolute

income because of different tax-saving speculations, supported uses, awards,

and so forth Lessen taxes payable.

Chapter VI-A of the Income Tax Act

has the accompanying sections:

Section 80C: Deduction in Life

coverage Premium, Contribution to PF, Youngsters' Educational expense, PPF and

so forth

This is the most well-known income

tax deduction. Battling under this section is private and HUF is allowed. The

greatest sum that can be guaranteed under 80C is Rs.1,50,000. Different

speculation and instalment choices that fit the bill for deduction under this

classification:

• Disaster protection premium

instalment

Yearly arrangement of LIC or some

other promoted backup plan (life advance, life misfortune and so forth)

Contribution of UTI Unit Connected

Protection Plan (ULIP) or ULIP 10 (23D) of LIC Common Asset

PPF (Public Opportune Fund)

contribution

Non-drove deferred yearly

arrangement instalments

Government A conceded annuity is

the sum deducted from the compensation of an administration representative to

get him

SRF/RPF contributions

Instalment of educational expenses

Lodging credit reimbursement

Management Asset contributions

Senior Resident Scheme Venture

PPF venture

long term FD venture

Sukanya Samriddhi Yojana venture

Shared Asset (Value Connected

Reserve funds Scheme) Venture

Membership to any Public Lodging

Bank (NHB) Store Scheme/Benefits Asset

Bond membership gave by Public Bank

for Farming and Rustic Turn of events (NABARD)

Public Area Lodging Money

Organization Advised Store Scheme Membership and Metropolitan, Town and Rustic

Lodging Improvement Authority

Membership of value offers or

debentures of a public organization or part of a certified issue of capital

endorsed by the Leading group of Public Monetary Establishments where profits

are made for a foundation organization.

Stamp duty registration, the enrollment

expense with the end goal of the move of such house property to the endorsed

person.

80CCC: Deduction in contribution to

the proper benefits store. With Section 80C and Section 80CCD (1), the

exception limit is Rs. 1.5 lakhs.

80CCD (1): Deduction in

contribution to Focal Government Annuity Scheme - In the case of a

representative, 10 % of pay (Fundamental + DA) and in some other cases, 20 % of

his complete income will be without tax in one FY. The general limit with 80C

and 80CCC is Rs 1.5 lakh.

80CCD (1B): Markdown up to Rs.

50,000 for contribution to Focal Government (NPS) Benefits Scheme.

80CCD (2): Deduction in the

contribution of the business to the benefits scheme of the Focal Government.

Tax benefits are given on 14% contribution by the business, where such

contribution is made by the focal government and where the contribution is made

by some other boss, 10% tax advantage is given.

80D: Deduction in case of health

care coverage charge. Expenses up to Rs 25,000 are paid for those other than

senior residents. For senior residents, the limit is Rs 50,000 and the general

limit under 80D is Rs 1 lakh.

80DD: Decrease in co-support

including treatment of a debilitated person The greatest exclusion limit under

this section is Rs.75,000.

80DDB: A nervous system specialist,

oncologist, urologist, haematologist, immunologist or another such expert can

surrender a markdown of Rs 40,000 for the treatment of a recommended illness.

80E: Exception with no maximum

limit in case of interest on advance taken for advanced education.

80EE: Deduction in case of interest

up to Rs. 50,000 on credit taken for private house property.

80EEA: Rebate on interest up to Rs

1.5 lakh on credit taken for fixed home property (reasonable lodging).

80EEB: Markdown on interest up to

Rs 1.5 lakh on credit taken for the acquisition of an electric vehicle.

80G: Gifts are made to explicit

assets, good cause, and so on, contingent upon the nature, the limit shifts

from 100 % of the all-out award, 50 % of the absolute award or 50 % of the

award to 10 % All out income.

80GG: Lessening in lease paid by

non-salaried persons who don't get HRA benefits. The deduction limit is Rs

5,000 every month or 25% of the all-out income each year, whichever is less.

80GGA: Complete rebate for explicit

awards for logical examination or rustic turn of events.

80GGC: Complete exclusion for

awards to ideological groups, if such awards are not in real money.

80TTA: Rebate up to Rs 10,000 in

case of revenue on investment funds financial balance in case of assessors

other than an occupant senior resident.

80TTB: Decrease in interest on

stores up to Rs 50,000 on account of inhabitant senior residents.

80U: Rebate in case of a crippled

person. Contingent upon the kind and degree of inability, the most extreme

remittance endorsed under this section is Rs. 1.25 lakhs.

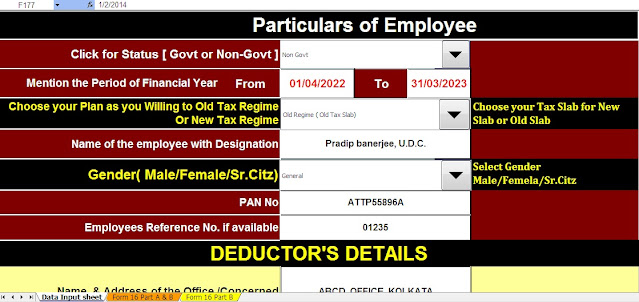

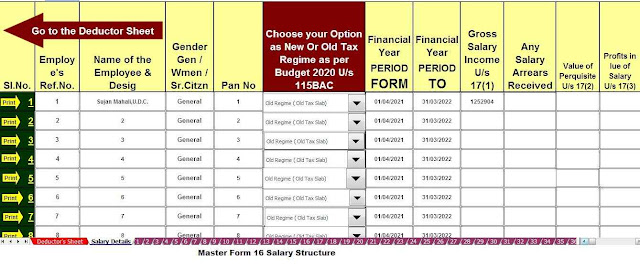

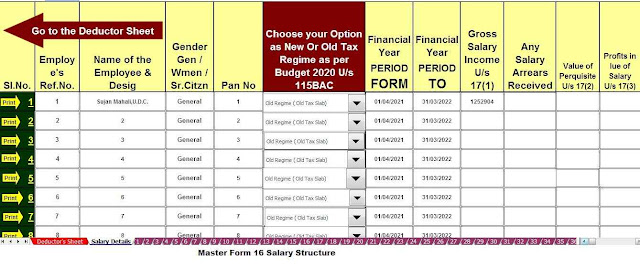

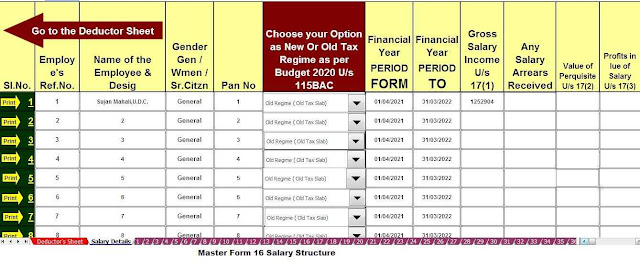

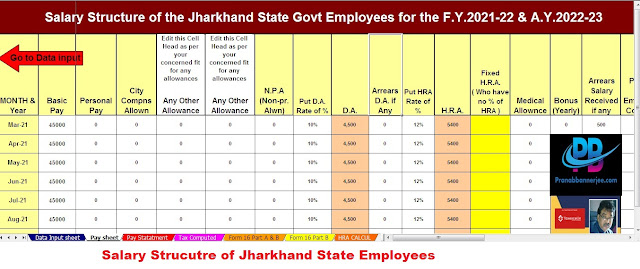

Download Automated Income Tax

Preparation Excel Based Software All in One for the Government &

Non-Government (Private) Employees for the F.Y.2021-22 and A.Y.2022-23

Feature of this Excel Utility:-

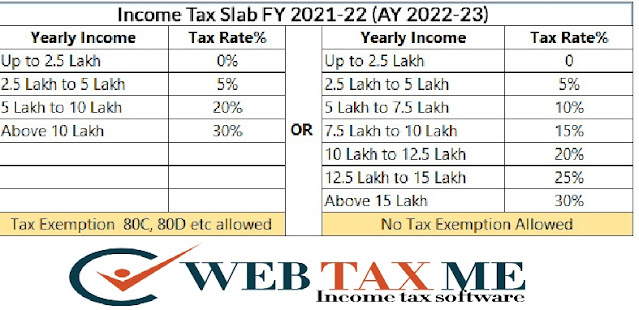

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

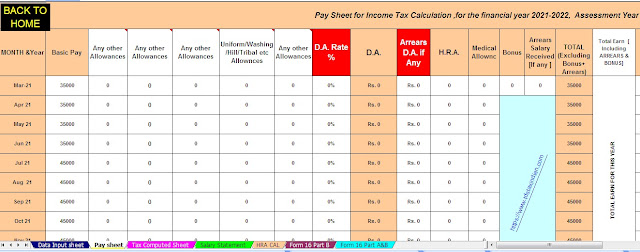

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

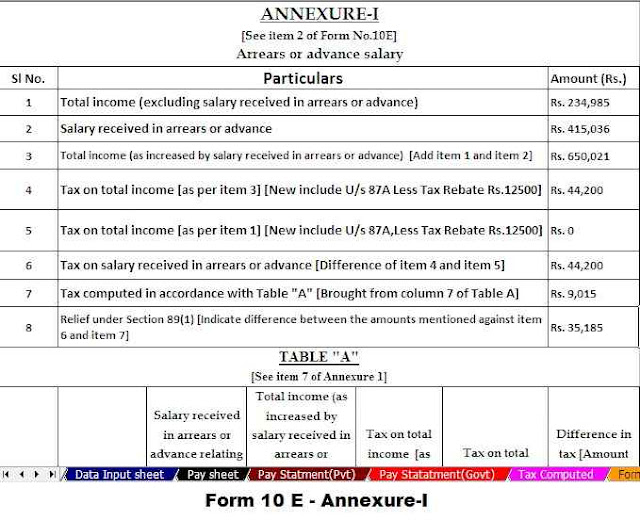

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

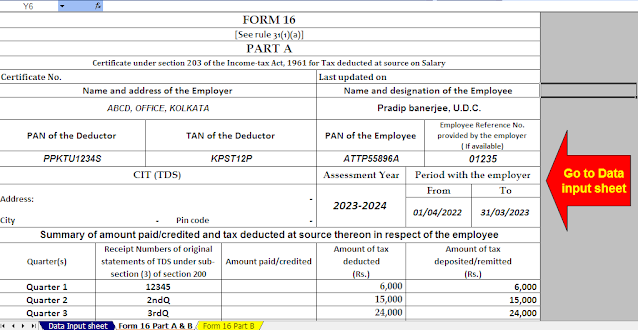

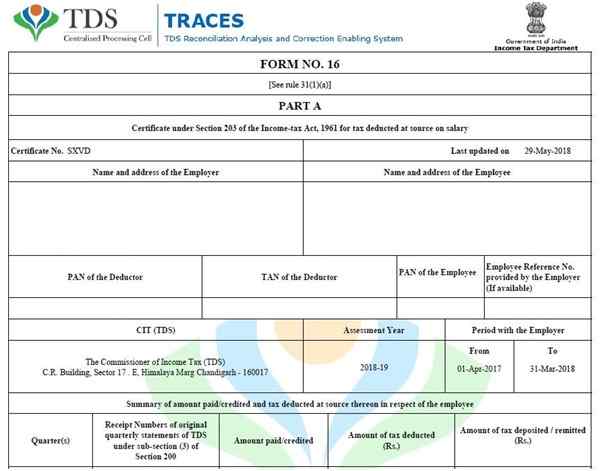

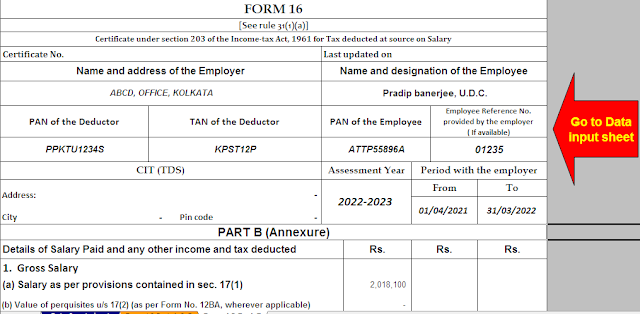

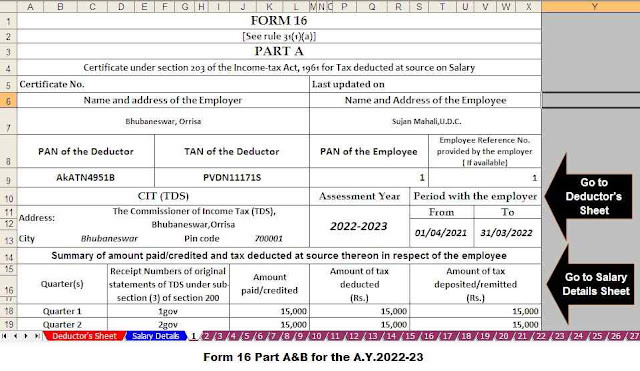

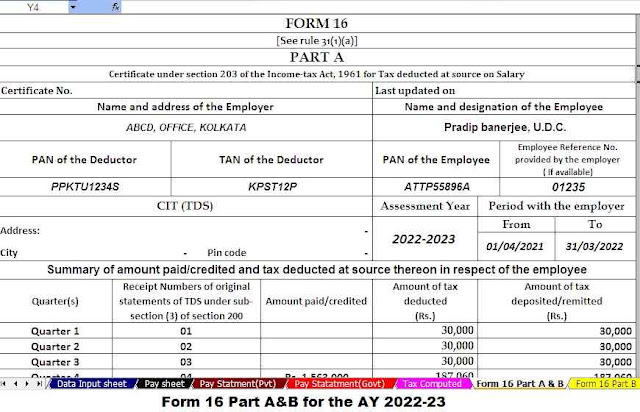

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22