Tax benefits on home loans for Co-owners. All joint owners can get tax benefits on a joint home loan

if certain conditions are met. Let's take a look.

It is pertinent to note that ‘ownership of property is a prerequisite for receiving any tax benefit as opposed to property. You may have taken it jointly, but if you do not own the property - you cannot get tax benefits.

There are situations where the property is owned by one parent, and the parent and child together take out a loan that is only repaid by the child. In such cases, the child who is not a co-owner is deprived of the tax benefit on the home loan.

Terms of claiming property tax benefits

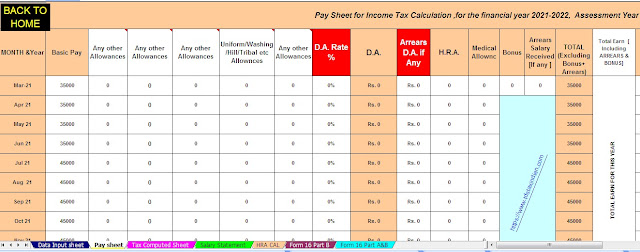

You may also, Like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Govt Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax Computed Sheet with New and Old Tax Regime U/s 115 BAC + Individual Salary Statures as per the Bihar State Employees Salary Pattern + Automated H.R.A. Exemption Calculator U/s 10)13A) + Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B]

You must be a co-owner of the property to be able to claim tax benefits for a home loan, you must be a property owner. In many cases, the loan is taken jointly, but the borrower does not own the property according to the documents. In such cases, you cannot claim tax benefits.

You must be a co-recipient for the loan. In addition to being an owner, you must be an applicant according to the loan documents. Owners who are not borrowers and do not contribute to EMI will be deprived of tax benefits.

The construction of the property must be completed - tax benefits on the property of a home can only be claimed, from the financial year that the construction of the property is completed. Tax benefits are not available for a property under construction. However, any costs prior to completion are claimed in five equal instalments from the year the construction is completed.

You may also, Like- Automated Income Tax Preparation Excel Based Software All in One for the Assam State Govt Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax Computed Sheet with New and Old Tax Regime U/s 115 BAC + Individual Salary Statures as per the Assam State Employees Salary Pattern + Automated H.R.A. Exemption Calculator U/s 10)13A) + Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B]

What are the tax benefits?

Each co-owner, who is a co-applicant for the loan, may claim a tax benefit of Rs 2,00,000 U/s 24 B for home loan interest on their income tax return. The total interest paid on the loan is allocated to the owners in proportion to their ownership. Needless to say, the total interest claimed by the owner / or recipient cannot exceed the total interest paid for the loan.

For example, let's say Tatul and his wife bought a home on loan and paid Rs 4,50,000 in interest. They have a 50:50 equal share of the property. Ratul can claim Rs 2,00,000 in his tax return, his wife can also claim Rs 2,00,000.

For a rented property - In the budget of the year 201, the interest that can be claimed in the case of rented property is limited to the amount that the loss of property of such house is not more than Rs. 2 lakhs.

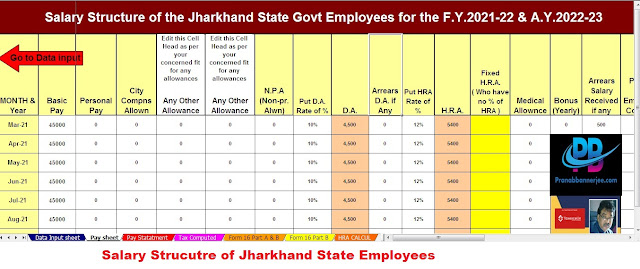

You may also, Like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand StateGovt Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax Computed Sheet with New and Old Tax Regime U/s 115 BAC + Individual Salary Statures as per the Jharkhand State Employees Salary Pattern + Automated H.R.A. Exemption Calculator U/s 10)13A) + Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B]

Each co-owner can claim a maximum rebate of Rs 1,50,000 for capital payment under section 80C. This is within the overall limit of Rs 1,50,000 under Section 80C.

Therefore, as a family, you will be able to take a larger tax benefit as opposed to the interest paid on a home loan when the property is jointly owned and your interest is more than Rs 2,00,000 per annum.

There may be a situation where you are paying the entire loan instalment and the co-borrower is not paying any money. In this case, you can claim full interest as a deduction on your income tax return.

Joint owners can also claim stamp duty and registration charges for a property. We have a detailed guide to help you maximize your tax benefits when you own a home.

You may also, Like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Govt (Private) Employees for the F.Y.2021-22

Main Feature of this Excel Utility-

@ This Excel Utility can prepare at a time your Tax Computed Sheet with New and Old Tax Regime U/s 115 BAC

@ Individual Salary Statures as per the Non-Govt (Private) Employees Salary Pattern

@ Automated H.R.A. Exemption Calculator U/s 10)13A)

@ Automated Income Tax 12 BA

@ Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B]