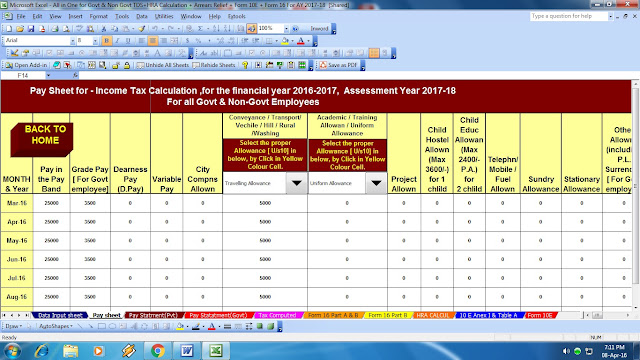

Download All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 & AssessmentYear 2017-18 [This Excel Utility can prepare at a time Tax Computed Sheet +

Individual Salary Structure + Automated H.R.A. Exemption Calculation U/s

10(13A) + Automated Arrears Relief Calculation U/s 89(1) with Form 10E + Automated

Form 16 Part A&B + Automated Form 16 Part B for F.Y.2016-17 with all

amended as per Budget 2016]

Many of us take a home loan to buy the dream

home. However, we hardly know the tax benefits associated with Home loan. In

this post, I will throw light on Home loan tax benefits. I will also cover 10

less known facts which are not known to a majority of people.

Home Loan Tax Benefits

Home

Loan EMI payment has two components (1) Principal (2) Interest (Section 24).

You can avail tax benefit on both these components.

·

Principal – You can claim tax deduction on the Home loan principal

paid by you. The limit for this deduction is 1.5 Lac (Section 80C). You can get

details about principal amount paid by you from your lender.

·

Interest – You can also avail tax benefit on the interest

component of the home loan. The total deduction allowed on interest component

is up to 2 Lac. The condition of availing this tax benefit is owner should live

in the house for which home loan is taken or house should be vacant.

Total

Tax Benefit = 1.5 Lac Principal (80 C) + 2 Lac Interest (Section 24) = 3.5 Lac

Now

let’s take a look at 10 less known facts about home loan tax benefit section

24.

10 Less Known facts about Home

Loan Tax Benefits

First time home buyers can

claim additional tax deduction of Rs 50,000 on Home Loan Interest

In

budget 2016 new section 80EE is introduced for the first time home buyers. As

per the new section 80EE, first time home buyers can claim an additional tax

deduction of Rs 50,000 on home loan interest. This deduction is over and above

tax deduction of 2 Lac under section 24 and 1.5 Lac under section 80C.

So, maximum tax benefit shall be

4 Lac per year. This new benefit is applicable under following conditions.

·

You are first time home owner.

·

No other house is owned by you.

·

The value of the loan is less than 35 lacs and property value is

less than 50 lacs.

·

The loan should be sanction between 1st April 2016 and 31st March

2017.

This

benefit shall be extended till the time repayment of home loan continues.

Deduction

is allowed to the borrower and co-borrower

Home loan deduction on principal

and interest is extended to the borrow

and co-borrower both. This means if you have taken a home loan on your and your

wife’s name you and your wife both can claim these tax deductions. So,

effectively you and your wife both can enjoy tax benefit applicable on a home

loan.

No

benefit on principal payment during construction on property

As

per income tax law, you can not avail any tax benefit on principal payment

during the construction of the property. You are eligible for this benefit only

after the project is completed and property possession is given to you.

Preconstruction period interest is also deductible in 5 equal

proportion in 5 years.

You

can claim home loan benefit only on the possession of the property. Any

preconstruction payment towards principal cannot be claimed. However, you can

claim preconstruction period interest payment once you received possession of

the property. The tax deduction benefit on such interest is available equally

over a period of 5 years starting from the year of possession.

Tax benefit on Home Protection Insurance

premium payment

Many

banks offer home protection insurance scheme. If you opt to take home

protection scheme, an insurance premium paid towards this scheme can be claimed

for tax deduction under section 80C. For home protection scheme sum assured and

premium changes with the time.

Principal and repayment tax benefit shall be reversed if you to

sell the property before 5 years.

You

cannot sell the property before 5 years. If you sell the property before 5

years, all principal paid by you in last five years shall be reversed and added

to your income. In addition to this, you may need to pay capital gain tax.

Loan from relative and friends

is also eligible for tax benefits

You

can take home loan from your friends and relatives and avail tax benefits.

However, you will not get any tax benefit on the principal amount.

Let

me explain, if you take home loan from your friend you can claim a tax

deduction on interest paid to your friend (Under section 24). The following

condition should be fulfilled in order to avail this tax benefits.

·

You need to submit proof that you have paid interest to your

friend. This may be in the form of a certificate.

·

Your friend needs to show this interest income and he/she need to

pay income tax on this income.

You

can not avail tax benefit on principal payment under such case.

Benefit

of section 80 C, section 24 and HRA

You

can not avail the benefit of HRA if you are living in your own house and

getting tax benefit towards section 80 c and section 24. However, if you are

living in rented house despite owning your own house you can avail the benefit

of section 80 C, section 24 and HRA also.

Buying multiple homes using

home loan

You

can purchase multiple home and avail tax benefits. The benefit under section 80

C for the principal payment shall be capped at 1.5 Lacs for all loans. The

benefit under section 24 for the interest payment for the self-occupied property

shall be 2 Lacs. For the house which is given on rent, there is no limit

on interest payment claim.

Stamp

Duty, Registration fee, Processing Fee and Tax Deduction

In

addition to principal and interest component other expenses can also be claimed

for the tax benefit. These expenses include stamp duty, registration fee

expenses etc. All these expenses can be claimed as tax benefit under section

80C. Any processing fees for getting home loan sanction can also be claimed for

tax benefit.