Section 87A provides an income tax rebate to a resident individual having prescribed income. This rebate is also available to senior citizens. However, for a Super Senior Citizens, this deduction becomes irrelevant.

Showing posts with label U/s 87A. Show all posts

Showing posts with label U/s 87A. Show all posts

Thursday, 27 February 2020

Tuesday, 22 October 2019

Section 87A provides an income tax rebate to a resident individual having prescribed income. This rebate is also available to senior citizens. However, for a Super Senior Citizens, this deduction becomes irrelevant.

Tuesday, 3 September 2019

Thursday, 15 August 2019

Saturday, 1 September 2018

Download Automatic House Rent Exemption Calculator

Under Section 80GG, an Individual can claim the deduction for the rent paid even if he does not get House Rent Allowances. Not many people are aware of this deduction.

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence.

Such deduction is permissible subject to the following conditions:-

Such deduction is permissible subject to the following conditions:-

- The Individual has not been in receipt of any House Rent Allowance from his employer specifically granted to him which qualifies for exemption under section 10(13A) of the Act;

- The Individual files the declaration in Form No. 10BA. Download Excel Based Form 10 BA

- The employee does not own:

- A) any residential accommodation himself or by his spouse or minor child or where such Individual is a member of a Hindu Undivided Family, by such family, at the place where he ordinarily resides or performs duties of his office or carries on his business or profession; or

B ) at any other place, any residential accommodation being accommodation in the occupation of the Individual, the value of which is to be determined under Section 23(2)(a) or Section 23(4)(a) as the case may be.

- He will be entitled to a deduction in respect of house rent paid by him in excess of 10% of his total income, subject to a ceiling of 25% thereof or Rs. 2,000/- per month, whichever is less. The total income for working out these percentages will be computed before making any deduction under section 80GG. In other words, eligibility will be the least amount of the following:-

2)

- Rent paid minus 10 percent the adjusted total income.

- Rs 2,000 per month.

- 25 percent of the adjusted total income.

- The deduction will also not be available to an assessee if any residential accommodation is owned by the assessee at any other place, which he is occupying, and the concessions in respect of self-occupied house are claimed by him for that property. In such a case, no deduction will be allowed in respect of the rent paid, even if the person does not own any residential accommodation at the place where he ordinarily resides.

Sunday, 16 July 2017

Thursday, 1 September 2016

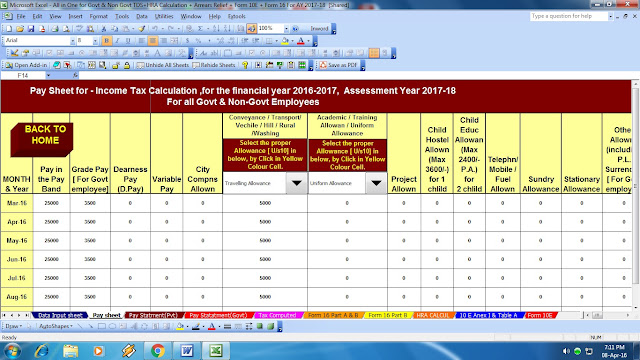

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure +Automated Arrears Relief Calculation with Form 10E +HRA Exemption Calculation + Form 16 Part A&B and Form 16 Part B for the Financial year 2016-17)

Income Tax F.Y.2016-17 – what are all the changes affecting Salaried Employees ? – Highlights of Changes announced in Budget 2016 and Finance Bill 2016 as far as Income Tax Provisions relating to Salaried Employees,

(1)Tax Rebate Rs. 5,000/-U/s 87A is available in the Financial Year 2016-17

(2)Up to Rs. 10 Thousand can get relief from Savings Bank Interest also U/s 80TTA.

(3) U/s 80CCD(1B) can get extra benefits up to Rs. 50,000/-

Income Tax 2016-17 (Assessment year 2017-18)

In case of individual (other than II and III below) and HUF

II. In case of an individual resident who is of the age of 60 years or more at any time during the previous year:-

Income-tax Act relating to deductions from income from house property (section 24B)

The existing provisions contained in section 24B provide that in a case of a self-occupied property where the acquisition or construction of the property is completed within three years from the end of financial year in which the capital is borrowed, the amount of deduction under that clause shall not exceed Two lakh thousand rupees.

Income Tax Exemption under Section 80 C in respect of Savings / Insurance Premium / Housing Loan Principal etc

Clause 27 of the Bill seeks to amend section 80C of the Income-tax Act relating to deduction in respect of life insurance premium, deferred annuity, contributions to provident fund, subscription to certain equity shares or debentures, etc.

The existing provisions of sub-section (1) of section 80C provide for deduction of Rs.Two lakh rupees.

Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government under Section 80 CCD(1) & CCD (2)

Clause 28 of the Bill seeks to amend section 80CCD of the Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government.

The existing provisions contained in sub-section (1) of section 80CCD, inter alia, provide that in the case of an individual, employed by the Central Government or any other employer on or after 1st January, 2004, who has in the previous year paid or deposited any amount in his account under a pension scheme notified or as may be notified by the Central Government, a deduction of such amount not exceeding ten per cent. of salary is allowed. This is subject to a limit of one lakh Fifty Thousand rupees provided under section 80CCE,excluding Rs. 50,000/- U/s 80CCD(1B).

It is proposed to amend sub-section (1) of the said section so as to provide that an individual employed by the Central Government on or after 1st January, 2004 or, being an individual employed by any other employer shall be allowed a deduction of the amount deposited by him in his account under a pension scheme notified or as may be notified by the Central Government to the extent it does not exceed ten per cent. of his salary.

It is further proposed to insert the new subsection (1A) so as to provide that a number of deductions shall not exceed One Lakh Fifty Thousand rupees.

Income-tax Act relating to limit on deductions under sections 80C, 80CCC and 80CCD under Section 80 CCE

Clause 29 of the Bill seeks to amend section 80CCE of the Income-tax Act relating to limit on deductions under sections 80C, 80CCC, and 80CCD.

80CCD(1B):- Additional deduction shall be allowed Max Rs.50,000/- as New National Pension Scheme 2016. This Amount out of 1.5 Lakh U/s 80C.

Click to Download the Automated H.R.A. Exemption Calculator U/s 10(13A)

Section 80 D of Income Tax Act:

There is no change in the income Tax Exemption available in respect of Health Insurance Premium which can be deducted at source.

As such, with a maximum limit of Rs.25,000, an individual can deduct at source the Health Insurance premium paid by him / her in a financial year (2015-16 and onwards)

Download Automatic Arrears Relief Calculator U/s 89(1) with Form 10E up to F.Y.2016-17 ( Updated Version)

In addition to Income tax exemption availed for Health Insurance relating to individual and his / her family, health Insurance Premium paid by the individual for covering health of his / her parents can also be deducted from the total income subject to a maximum of Rs. 25,000. In the case of Health Insurance cover in these cases pertains to Senior Citizen then the maximum limit of deduction under Section 80D would be Rs. 30,000

Deduction for preventive health check-up

Under Section 80D, a deduction of Rs 5,000 is allowed for expenditure incurred during the year by a taxpayer on account of preventive health check-up of self, spouse, dependent children or parents

The above deduction to be within the overall limits of Rs 15,000 / Rs 20,000 prescribed under the said Section of the Act.

Click hereto Download the Automated All in One TDS on Salary for Non-Govt Employees F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure + HRA Exemption + Form 16 Part A&B and Part B for the Financial year 2016-17)

Sunday, 5 June 2016

DownloadAll in One TDS on Salary for Non-Govt Employees for F.Y.2016-17 & Ass Yr 2017-18 [This Excel based software can prepare at a time Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automated H.R.A Exemption Calculation + Automated Form 12 BA + Automated Form 16 Part A&B and Form 16 Part B as per the Budget 2016]

Changes in Income Tax Rules:

1. There has been no change in the income tax slabs.

2. For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

3. Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

4. Tax Exemption u/s 80GG (for rent expenses who do have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

5. For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

6. Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

7. 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in case of EPF income tax would be applicable on 60% of the corpus on maturity.

8. Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

Download Automated ArrearsRelief Calculator U/s 89(1) with Form 10E from F.Y. 2001-02 to F.Y. 2016-17 [ Up to date Version]

1. Section 80C/80CCC/80CCD

These 3 are the most popular sections for tax saving and have lot of options to save tax. The maximum exemption combining all the above sections is Rs 1.5 lakhs. 80CCC deals with the pension products while 80CCD includes Central Government Employee Pension Scheme.

You can choose from the following for tax saving investments:

1. Employee/ Voluntary Provident Fund (EPF/VPF)

2. PPF (Public Provident fund)

3. Sukanya Samriddhi Account

4. National Saving Certificate (NSC)

5. Senior Citizen’s Saving Scheme (SCSS)

6. 5 years Tax Saving Fixed Deposit in banks/post offices

7. Life Insurance Premium

8. Pension Plans from Life Insurance or Mutual Funds

9. NPS (New Pension Scheme)

10. Equity Linked Saving Scheme (ELSS – popularly known as Tax Saving Mutual Funds)

11. Central Government Employee Pension Scheme

12. Principal Payment on Home Loan

13. Stamp Duty and registration of the House

14. Tuition Fee for 2 children

2. Section 80CCD(1B) – Investment in NPS

Budget 2016 has allowed additional exemption of Rs 50,000 for investment in NPS. We have done a complete analysis and concluded that it would be beneficial for you to discard this benefit and invest after tax money in a good equity mutual fund.

Download Automated House Rent Exemption Calculator U/s 10(13A) [ Excel Based Software]

3. Payment of interest on Home Loan (Section 24/80EE)

The interest paid up to Rs 2 lakhs on home loan for self-occupied home is exempted u/s 24. There is no limit for home given on rent.

Budget 2016 has provided additional exemption up to Rs 50,000 for payment of home loan interest for first time home buyers. To avail this benefit the value of home should not exceed Rs 50 lakhs and loan should not be more than Rs 35 lakhs.

4. Payment of Interest on Education Loan (Section 80E)

The total interest paid on education loan can be claimed as tax exemption. There is no upper limit for the same.

5. Investment in RGESS-(Section 80CCG)

Deduction Up to Rs 25,000 (50% of amount invested) is allowed if you make investment in pre approved stocks and mutual funds in Rajiv Gandhi Equity Savings Scheme (RGESS). This is available to first time equity investors subject to certain conditions.

6. Medical insurance for Self and Parents (Section 80D)

You can get tax deduction up to Rs 60,000 by paying medical insurance premium for self, your dependents and your parents. There is also sub limit of Rs 5,000 for preventive medical checkup.

7. Treatment of Serious disease (Section 80DDB)

You can claim deduction up to Rs 80,000 for treatment of certain diseases like AIDS, renal failure, etc for self or dependents

8. Physically Disabled Tax payer (Section 80U)

Physically Disabled Tax payer can get tax exemption up to Rs 1.25 lakhs u/s 80U for above 801% and Rs.75,000/- for below 80% of physically Disabled Tax payer

9. Physically Disabled Dependent (Section 80DD)

You can claim deduction up to Rs 1.25 lakhs for maintenance and medical treatment of Physically Disabled dependent

10. Rebate Rs.5,000/- U/s 87A

Please give us your feedback and help us improve!

Sunday, 8 February 2015

Click here to Download the Haryana State Employees All in One TDS on Salary for the Financial Year 2014-15.[ This Excel Utility only for HARYANA State Employees for FY 2014-15]

As per the Finance Budget 2014 the Tax Slab has already Raised up to Rs. 2.5 Lakh and the Section 80C has already hike up to Rs. 1.5 Lakh. The House Building Loan Interest also raised up to Rs. 2 Lakh. One New Tax Relief also inserted in 80C that the K.V.P. Re-Lunched.

As per the New Finance Budget One Excel Based Software for HARYANA State Employees for the Financial Year 2014-15. You can prepare at a time your Tax Compute Sheet + Salary Structure as per the Haryana State employees Salary Pattern + Automated House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B for Only HARYANA State Govt employees.

Feature of this Excel Utility:-

1) Prepare at a time Tax Compute Sheet + HRA Calculation + Form 16

2) Automated Form 16 Part A&B and Part B

3) Automated Tax Calculation as per Latest Finance Budget 2014-15

4) Salary Structure is prepare as per the Haryana State Employees Salary Pattern

5) Easy to Install and easy to Generate this Excel Utility.

6) You can prepare more than 100 employees Tax by this one Software.

Click here to Download the Haryana State Employees All in One TDS on Salary for the Financial Year 2014-15.

Subscribe to:

Posts (Atom)