The new income tax regime announced in Budget,

give an option to individuals and Hindu Unified Families (HUFs) to be taxed at

lower rates on the off chance that they don't profit determined exclusions and reasoning’s

Showing posts with label Form 16. Show all posts

Showing posts with label Form 16. Show all posts

Monday, 24 August 2020

Monday, 9 September 2019

· Surcharge hiked for those earning above Rs.2 crore; higher deduction on home loan interest for low-cost housing

· Extra deduction for interest paid on loans taken in current FY for buying a house priced up to Rs.45 lakh

Finance minister maiden budget speech lasted for over two hours but she spent about five minutes on direct taxes. Clearly, after February’s populist Interim Budget, there was little room to offer more benefits. But the budget was not entirely without implications for taxpayers.

Monday, 18 February 2019

Wednesday, 13 February 2019

Click here to Download the Automated Income Tax Form 16 Part B for the Financial Year2018-19 & Assessment Year 2019-20 [This Excel Utility can prepare at a time 50 Employees Form 16 Part B for F.Y. 2018-19]

The Main Feature of this Excel Utility is:-

1) Prepare At a time 50 Employees Form 16 Part B for F.Y. 2018-19

2)

After filling the Salary Details Form 16 will be prepared automatically

and perfectly as per the Rules by the Income Tax Department.

3) All latest Amended Income Tax Section have in this Excel Utility

4)

You are aware when you put any employees salary data double( Mistakly)

the Software can prevent the Double Entry of any Employee's

5) Automatic Convert the Amount into the In-Words without any Excel Formula.

6) Easy to install just like as an Excel File and Easy to Generate

Wednesday, 31 October 2018

Income Tax exemption is a monetary exemption that reduces the taxable income of an individual. This decreases total taxable income and reduces the amount of income tax you would have otherwise paid. Deduction under chapter VI-A is restricted to Gross total income & this deduction cannot be carried forward. Let us discuss the following deductions covered u/s VI-A

Monday, 17 September 2018

Monday, 2 July 2018

Now this month is March 2018 is the end of the F.Y.2017-18 and Income Tax Preparation and submit the Tax Statement to the employer by the employee with their Tax Savings deposit. Also, it is time to prepare the Form 16 Part B by each employer/ Deductor for distributing the Form 16 Part B for the Financial Year 2017-18 and Assessment Year 2018-19.

Wednesday, 13 June 2018

Click here to Download Automated Excel Based Income Tax Form 16 Part B for F.Y.2017-18[ This Excel Utility can prepare One by One Form 16 Part B for f.Y.2017-18]

Monday, 19 June 2017

Form 16 is a TDS Certificate issued by the employer deducting the TDS while making payment to an employee. As per the Income Tax Act, every employer at the time of payment of Salaries shall deduct TDS at the average rate of income tax computed on the basis of the Income Tax Slab Rates in force for that financial year in which the payment is made on the estimated income of the assessee.

The TDS so deducted by the employer is to be deposited with the Income Tax department and after depositing the same, the employer issues a TDS Certificate containing all particulars of the tax so deducted and deposited in Form 16. It is issued by the employer after the end of the year. As per the Income Tax (Sixth Amendment Rules), the last date for issuance of Form 16 by an employer to his employee is 31st May of the next year.

Only the TDS Deducted from Salary is reflected in this form and TDS Deductions from any other Income are reflected in Form 16A/ Form 16B.

Components of Form 16

Form 16 is a very simple and easy to understand form which states the Salary (and its related components) paid by an employer to his employee and the income tax deducted thereon.

On the basis of Form 16, a taxpayer can easily file his income tax return form without the help of a Chartered Accountant. There are various income tax return forms for different category of income earners. For taxpayers earning income from Salary and/or House Property and/or Capital Gains and/or Other Sources, they can file ITR 1/ ITR

Form 16 is divided into 2 parts: Part A & Part B.

PART A OF FORM 16

Part A of this type of TDS Certificate consists of details like:-

- Name, PAN Card No. & Address of the Employee

- Name, PAN No., Address & TAN No. of the Employer

- The Assessment Year for which the TDS has been deducted.

- Summary of Salary paid and the TDS deducted and deposited with the govt.

- Acknowledgement No. of the TDS Payment deposited with Govt.

PART B OF FORM 16

Part B of this type of TDS Certificate consists of details like:-

§ Detailed Salary particulars like House Rent Allowance, Leave Travel Allowance, Leave Encashment, Gratuity, Pension, Deductions claimed like PPF, Tax Saving FD, National Saving Certificate etc:-

- The Total Income and the Total Tax on Salaries thereon

- Education Cess and Surcharge if any

- Tax Deducted under section 192(1A)

- Balance Tax Payable/tax refundable

This TDS Certificate also contains a declaration at the end that the person deducting the tax has deposited the same with the Central Govt. This statement may either be manually signed or digitally signed. An extract of a specimen copy of Form 16 is shown below:-

Form 16 in case of Job Change

In case you have changed your job during the year, you are required to collect this form from both the previous employer as well as the new employer as you would be filing your Income Tax Returns on the basis of your Form 16.

When you join any new organisation, you should furnish your TDS details from the previous employer to the new employer. You would also be required to furnish Form 12B to the new employer

Furnishing the TDS Details issued by the previous employer would help the current employer in deducting the tax accordingly. Although furnishing these details is not mandatory, if you do not mention these details to your current employer, then you are liable to yourself compute the total income from both the employers and calculate your tax liability accordingly. (Only applicable in the year of job change)

BENEFITS OF FORM 16

1. This TDS Certificate contains all particulars and details of the TDS deducted and deposited. Although a copy of this TDS Certificate is not required to be furnished at the time of filing of Income Tax Return, the details mentioned in Form 16 are required to be furnished in the Income Tax Return.

2. This TDS Certificate is the most powerful proof of the Income of an Individual and the fact that the tax has been paid thereon. Banks heavily rely on this TDS Certificate to assess the Income of an Individual at the time of Home Loan application and require any Home Loan applicant to furnish his Form 16

Download Below given Automated Form 16 for the Financial Year 2016-17

One by One Preparation Form 16 Part A&B and Part B for FY 2016-17

| |

Master of Form 16 Part B ( Prepare at a time 50 employees Form 16 Part B for FY 2016-17)

| |

Master of Form 16 Part B ( Prepare at a time 100 employees Form 16 Part B for FY 2016-17)

| |

Master of Form 16 Part B with 12 BA ( Prepare at a time 50 employees Form 16 Part B + 12 BA for FY 2016-17)

| |

Master of Form 16 Part A&B for 50 employees ( Prepare at a time 50 employees Form 16 Part B for F.Y.2016-17)

| |

Master of Form 16 Part A&B ( Prepare at a time 100 employees Form 16 Part A&B for FY 2014-15

|

Saturday, 17 December 2016

Download Automated Master of Form 16 Part A&B for the Financial Year 2016-17 [ This Excel Utility can prepare at a time 100 employees Form 16 Part A&B with all up dated Tax Section and Tax Section as per Finance Bill 2016]

Deductions on Section 80C, 80CCC, 80CCD & 80CCD(1B)

Section 80C

The deduction under section 80C is allowed from your Gross Total Income. These are available to an Individual or an HUF.

Broadly speaking, this section provides deduction from total income in respect of various investments / expenditures / payments. Total Deduction under section 80C, 80CCC and 80CCD(1) together cannot exceed Rs 1,50,000 for the financial year 2016-17, excluding U/s 80CCD(2) And 80CCD(1B).

Section 80CCC: Deduction in respect of Premium Paid for Annuity Plan of LIC or Other Insurer

This section provides the deduction to an Individual for any amount paid or deposited in any annuity plan of LIC any other insurer for receiving the pension from a fund referred to in Section 10(23AAB).

In case the annuity is surrendered before the date of its maturity, the surrender value is taxable in the year of receipt.

Section 80CCD: Deduction in respect of Contribution to Pension Account

Total Deduction under Section 80C, 80CCC and 80CCD(1) cannot exceed Rs 1,50,000. Employer’s contribution under section 80CCD(2) towards NPS is outside the monetary ceiling mentioned above & Rs. 50 thousand can get additional tax relief from U/s 80CCD(1B)

Deductions on Savings Bank Account

Section 80 TTA: Deduction from gross total income in respect of any Income by way of Interest on Savings account

Deduction from gross total income of an individual or HUF, up to a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account ( not time deposits ) with a bank, co-operative society or post office, is allowable

Deductions on House Rent

Section 80GG: Deduction in respect of House Rent Paid

Deduction available is the least of

- Rent paid minus 10% of total income

- Rs.5000/- per month

- 25% of total income, provided

- Assessee or his spouse or minor child should not own residential accommodation at the place of employment.

- He should not be in receipt of house rent allowance.

- He should not have self-occupied residential premises in any other place.

Deductions on Loan for Higher Studies

Section 80E: Deduction in respect of Interest on Loan for Higher Studies

Deduction in respect of interest on loan is taken for pursuing higher education. The deduction is also available for the purpose of higher education of a relative w.e.f. A.Y. 2008-09.

Deductions on Rajiv Gandhi Equity Saving Scheme (RGESS)

Section 80CCG: Rajiv Gandhi Equity Saving Scheme (RGESS)

The Rajiv Gandhi Equity Saving Scheme (RGESS) was launched after the 2012 Budget. Investors whose annual income is less than Rs. 10 lakhs can invest in this scheme (up to Rs. 50,000) and get a deduction of 50% of the investment.

So, if you invest Rs. 50,000 (maximum amount eligible for income tax rebate is Rs. 50,000), you can claim a tax deduction of Rs. 25,000 (50% of Rs. 50,000).

Deductions on Medical Insurance

Section 80D: Deduction in respect of Medical Insurance

The deduction is available up to Rs. 20,000/- for senior citizens and up to Rs. 25,000/ in other cases for insurance of self, spouse, and dependent children. Additionally, a deduction for insurance of parents (father or mother or both) is available to the extent of Rs. 30,000/- if parents are senior Citizen and Rs. 15,000/- in other cases. Therefore, the maximum deduction available under this section is to the extent of Rs. 55,000/-. From A.Y 2016-17, within the existing limit a deduction of up to Rs. 5,000 for preventive health check-up is available.

Deductions on Medical Expenditure on Self or Dependent Relative

Section 80DDB: Deduction in respect of Medical Expenditure on Self or Dependent Relative

A deduction to the extent of Rs. 80,000/- or the amount actually paid, whichever is less is available for expenditure actually incurred by resident assessee on himself or dependent relative for medical treatment of specified disease or ailment. The diseases have been specified in Rule 11DD. A certificate in form 10 I is to be furnished by the assessee from any Registered Doctor.

Deductions on Medical Expenditure for a Handicapped Relative

Section 80DD: Deduction in respect of Rehabilitation of Handicapped Dependent Relative

Deduction of Rs. 50,000/- is available on:

- expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative.

- Payment or deposit to specified scheme for maintenance of dependent handicapped relative.

Further, if the dependant is a person with severe disability, a deduction of Rs. 100,000/- is also available under this section. The handicapped dependent should be a dependent relative suffering from a permanent disability (including blindness) or mentally retarded, as certified by a specified physician or psychiatrist.

Note: A person with 'severe disability' means a person with 80% or more of one or more disabilities as outlined in section 56(4) of the 'Persons with disabilities (Equal opportunities, protection of rights and full participation)' Act.

Deductions on Person suffering from Physical Disability

Section 80U: Deduction in respect of Person suffering from Physical Disability

Deduction of Rs. 75,000/- to an individual who suffers from a physical disability (including blindness) or mental retardation. Further, if the individual is a person with severe disability, deduction of Rs. 125,000/- shall be available u/s 80U. The certificate should be obtained from a Govt. Doctor. The relevant rule is Rule 11D.

Deduction for donations towards Social Causes

Section 80G: Deduction for donations towards Social Causes

The various donations specified in Sec. 80G are eligible for deduction up to either 100% or 50% with or without restriction as provided in Sec. 80G. 80G deduction not applicable in case donation is done in form of cash for an amount over Rs 10,000.

Donations with 100% deduction without any qualifying limit:

- National Defence Fund set up by the Central Government

- Prime Minister’s National Relief Fund

- National Foundation for Communal Harmony

- An approved university/educational institution of National eminence

- Zila Saksharta Samiti constituted in any district under the chairmanship of the Collector of that district

- Fund set up by a State Government for the medical relief of the poor

- National Illness Assistance Fund

- National Blood Transfusion Council or to any State Blood Transfusion Council

- National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

- National Sports Fund

- National Cultural Fund

- Fund for Technology Development and Application

- Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund in respect of any State or Union Territory

- the Army Central Welfare Fund or the Indian Naval Benevolent Fund or the Air Force Central Welfare Fund, Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- The Maharashtra Chief Minister’s Relief Fund during October 1, 1993, and October 6, 1993

- Chief Minister’s Earthquake Relief Fund, Maharashtra

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of earthquake in Gujarat

- Any trust, institution or fund to which Section 80G(5C) applies for providing relief to the victims of earthquake in Gujarat (contribution made during January 26, 2001, and September 30, 2001) or

- Prime Minister’s Armenia Earthquake Relief Fund

- Africa (Public Contributions — India) Fund

Donations with 50% deduction without any qualifying limit.

- Jawaharlal Nehru Memorial Fund

- Prime Minister’s Drought Relief Fund

- National Children’s Fund

- Indira Gandhi Memorial Trust

- The Rajiv Gandhi Foundation

Donations to the following are eligible for 100% deduction subject to 10% of adjusted gross total income

- Government or any approved local authority, institution or association to be utilized for the purpose of promoting family planning

- Donation by a Company to the Indian Olympic Association or to any other notified association or institution established in India for the development of infrastructure for sports and games in India or the sponsorship of sports and games in India.

Donations to the following are eligible for 50% deduction subject to 10% of adjusted gross total income

- Any other fund or any institution which satisfies conditions mentioned in Section 80G(5)

- Government or any local authority to be utilized for any charitable purpose other than the purpose of promoting family planning

- Any authority constituted in India for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns, villages or both

- Any corporation referred in Section 10(26BB) for promoting interest of minority community

- For repairs or renovation of any notified temple, mosque, gurudwara, church or another place.

Download Automated Master of Form 16 Part B for the Financial Year 2016-17[ This Excel Utility can prepare at a time 100 employees Form 16 Part B with all updated Tax Section and Tax Slab]

Thursday, 1 September 2016

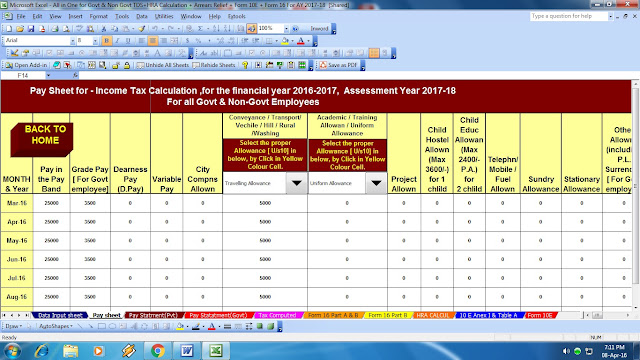

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure +Automated Arrears Relief Calculation with Form 10E +HRA Exemption Calculation + Form 16 Part A&B and Form 16 Part B for the Financial year 2016-17)

Income Tax F.Y.2016-17 – what are all the changes affecting Salaried Employees ? – Highlights of Changes announced in Budget 2016 and Finance Bill 2016 as far as Income Tax Provisions relating to Salaried Employees,

(1)Tax Rebate Rs. 5,000/-U/s 87A is available in the Financial Year 2016-17

(2)Up to Rs. 10 Thousand can get relief from Savings Bank Interest also U/s 80TTA.

(3) U/s 80CCD(1B) can get extra benefits up to Rs. 50,000/-

Income Tax 2016-17 (Assessment year 2017-18)

In case of individual (other than II and III below) and HUF

II. In case of an individual resident who is of the age of 60 years or more at any time during the previous year:-

Income-tax Act relating to deductions from income from house property (section 24B)

The existing provisions contained in section 24B provide that in a case of a self-occupied property where the acquisition or construction of the property is completed within three years from the end of financial year in which the capital is borrowed, the amount of deduction under that clause shall not exceed Two lakh thousand rupees.

Income Tax Exemption under Section 80 C in respect of Savings / Insurance Premium / Housing Loan Principal etc

Clause 27 of the Bill seeks to amend section 80C of the Income-tax Act relating to deduction in respect of life insurance premium, deferred annuity, contributions to provident fund, subscription to certain equity shares or debentures, etc.

The existing provisions of sub-section (1) of section 80C provide for deduction of Rs.Two lakh rupees.

Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government under Section 80 CCD(1) & CCD (2)

Clause 28 of the Bill seeks to amend section 80CCD of the Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government.

The existing provisions contained in sub-section (1) of section 80CCD, inter alia, provide that in the case of an individual, employed by the Central Government or any other employer on or after 1st January, 2004, who has in the previous year paid or deposited any amount in his account under a pension scheme notified or as may be notified by the Central Government, a deduction of such amount not exceeding ten per cent. of salary is allowed. This is subject to a limit of one lakh Fifty Thousand rupees provided under section 80CCE,excluding Rs. 50,000/- U/s 80CCD(1B).

It is proposed to amend sub-section (1) of the said section so as to provide that an individual employed by the Central Government on or after 1st January, 2004 or, being an individual employed by any other employer shall be allowed a deduction of the amount deposited by him in his account under a pension scheme notified or as may be notified by the Central Government to the extent it does not exceed ten per cent. of his salary.

It is further proposed to insert the new subsection (1A) so as to provide that a number of deductions shall not exceed One Lakh Fifty Thousand rupees.

Income-tax Act relating to limit on deductions under sections 80C, 80CCC and 80CCD under Section 80 CCE

Clause 29 of the Bill seeks to amend section 80CCE of the Income-tax Act relating to limit on deductions under sections 80C, 80CCC, and 80CCD.

80CCD(1B):- Additional deduction shall be allowed Max Rs.50,000/- as New National Pension Scheme 2016. This Amount out of 1.5 Lakh U/s 80C.

Click to Download the Automated H.R.A. Exemption Calculator U/s 10(13A)

Section 80 D of Income Tax Act:

There is no change in the income Tax Exemption available in respect of Health Insurance Premium which can be deducted at source.

As such, with a maximum limit of Rs.25,000, an individual can deduct at source the Health Insurance premium paid by him / her in a financial year (2015-16 and onwards)

Download Automatic Arrears Relief Calculator U/s 89(1) with Form 10E up to F.Y.2016-17 ( Updated Version)

In addition to Income tax exemption availed for Health Insurance relating to individual and his / her family, health Insurance Premium paid by the individual for covering health of his / her parents can also be deducted from the total income subject to a maximum of Rs. 25,000. In the case of Health Insurance cover in these cases pertains to Senior Citizen then the maximum limit of deduction under Section 80D would be Rs. 30,000

Deduction for preventive health check-up

Under Section 80D, a deduction of Rs 5,000 is allowed for expenditure incurred during the year by a taxpayer on account of preventive health check-up of self, spouse, dependent children or parents

The above deduction to be within the overall limits of Rs 15,000 / Rs 20,000 prescribed under the said Section of the Act.

Click hereto Download the Automated All in One TDS on Salary for Non-Govt Employees F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure + HRA Exemption + Form 16 Part A&B and Part B for the Financial year 2016-17)

Subscribe to:

Posts (Atom)