Showing posts with label 80TTA. Show all posts

Showing posts with label 80TTA. Show all posts

Sunday, 3 February 2019

Thursday, 1 September 2016

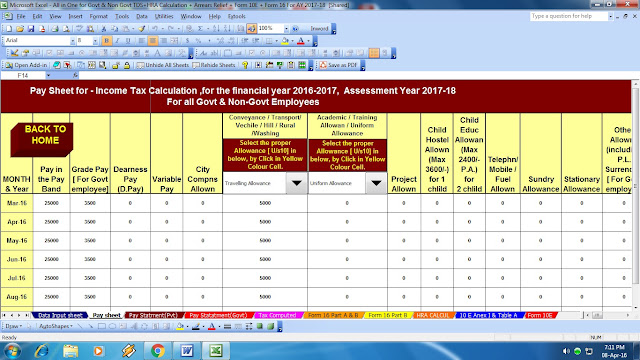

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure +Automated Arrears Relief Calculation with Form 10E +HRA Exemption Calculation + Form 16 Part A&B and Form 16 Part B for the Financial year 2016-17)

Income Tax F.Y.2016-17 – what are all the changes affecting Salaried Employees ? – Highlights of Changes announced in Budget 2016 and Finance Bill 2016 as far as Income Tax Provisions relating to Salaried Employees,

(1)Tax Rebate Rs. 5,000/-U/s 87A is available in the Financial Year 2016-17

(2)Up to Rs. 10 Thousand can get relief from Savings Bank Interest also U/s 80TTA.

(3) U/s 80CCD(1B) can get extra benefits up to Rs. 50,000/-

Income Tax 2016-17 (Assessment year 2017-18)

In case of individual (other than II and III below) and HUF

II. In case of an individual resident who is of the age of 60 years or more at any time during the previous year:-

Income-tax Act relating to deductions from income from house property (section 24B)

The existing provisions contained in section 24B provide that in a case of a self-occupied property where the acquisition or construction of the property is completed within three years from the end of financial year in which the capital is borrowed, the amount of deduction under that clause shall not exceed Two lakh thousand rupees.

Income Tax Exemption under Section 80 C in respect of Savings / Insurance Premium / Housing Loan Principal etc

Clause 27 of the Bill seeks to amend section 80C of the Income-tax Act relating to deduction in respect of life insurance premium, deferred annuity, contributions to provident fund, subscription to certain equity shares or debentures, etc.

The existing provisions of sub-section (1) of section 80C provide for deduction of Rs.Two lakh rupees.

Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government under Section 80 CCD(1) & CCD (2)

Clause 28 of the Bill seeks to amend section 80CCD of the Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government.

The existing provisions contained in sub-section (1) of section 80CCD, inter alia, provide that in the case of an individual, employed by the Central Government or any other employer on or after 1st January, 2004, who has in the previous year paid or deposited any amount in his account under a pension scheme notified or as may be notified by the Central Government, a deduction of such amount not exceeding ten per cent. of salary is allowed. This is subject to a limit of one lakh Fifty Thousand rupees provided under section 80CCE,excluding Rs. 50,000/- U/s 80CCD(1B).

It is proposed to amend sub-section (1) of the said section so as to provide that an individual employed by the Central Government on or after 1st January, 2004 or, being an individual employed by any other employer shall be allowed a deduction of the amount deposited by him in his account under a pension scheme notified or as may be notified by the Central Government to the extent it does not exceed ten per cent. of his salary.

It is further proposed to insert the new subsection (1A) so as to provide that a number of deductions shall not exceed One Lakh Fifty Thousand rupees.

Income-tax Act relating to limit on deductions under sections 80C, 80CCC and 80CCD under Section 80 CCE

Clause 29 of the Bill seeks to amend section 80CCE of the Income-tax Act relating to limit on deductions under sections 80C, 80CCC, and 80CCD.

80CCD(1B):- Additional deduction shall be allowed Max Rs.50,000/- as New National Pension Scheme 2016. This Amount out of 1.5 Lakh U/s 80C.

Click to Download the Automated H.R.A. Exemption Calculator U/s 10(13A)

Section 80 D of Income Tax Act:

There is no change in the income Tax Exemption available in respect of Health Insurance Premium which can be deducted at source.

As such, with a maximum limit of Rs.25,000, an individual can deduct at source the Health Insurance premium paid by him / her in a financial year (2015-16 and onwards)

Download Automatic Arrears Relief Calculator U/s 89(1) with Form 10E up to F.Y.2016-17 ( Updated Version)

In addition to Income tax exemption availed for Health Insurance relating to individual and his / her family, health Insurance Premium paid by the individual for covering health of his / her parents can also be deducted from the total income subject to a maximum of Rs. 25,000. In the case of Health Insurance cover in these cases pertains to Senior Citizen then the maximum limit of deduction under Section 80D would be Rs. 30,000

Deduction for preventive health check-up

Under Section 80D, a deduction of Rs 5,000 is allowed for expenditure incurred during the year by a taxpayer on account of preventive health check-up of self, spouse, dependent children or parents

The above deduction to be within the overall limits of Rs 15,000 / Rs 20,000 prescribed under the said Section of the Act.

Click hereto Download the Automated All in One TDS on Salary for Non-Govt Employees F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure + HRA Exemption + Form 16 Part A&B and Part B for the Financial year 2016-17)

Thursday, 7 January 2016

For the individuals or company in India, if the gross income is under taxable income, has to pay tax. However with the provisions available in the income tax sections exemptions are given on certain incomes. There are many tax saving options , on which an individual/company can avail tax exemption on total income.

Tax saving planning is one of the main objects for an individual who come under taxable income. Plan early to avoid confusions and analyze the various sections of tax deductions under the Income Tax Act .

We already discussed about the tax deductions under Section 80C (Click here to know about Section 80C deductions). Planning of tax doesn’t end with Section 80C. Apart from 80C several tax emption sections are available in Income tax act. So, its prudent to analyze other tax deductions provided by the Income Tax Act, 1961 and start looking beyond 80C. Here, we take an attempt to understand them briefly to benefit you.

Download Automated Master of Form 16 Part A&B for F.Y.2015-16 [This Excel Utility Can prepare at a time 100 employees Form 16 Part A&B as per new Finance Budget 2015]

Download Automated Master of Form 16 Part B for F.Y.2015-16 [This Excel Utility Can prepare at a time 100 employees Form 16 Part A&B as per new Finance Budget 2015]

The premium which is paid towards Mediclaim/Health insurance for self, Spouse, children and parents is considered tax deduction under U/s 80D. The sudden medical expenses incurred for self and family members comes under this section. The maximum amount for claiming deduction is Rs.25,000. The individuals above 60years of age can avail tax deduction Rs 30,000.

If you having dependent who is differently abled, the there is provision to get deduction for expenses on his maintenance and medical treatment. Paying premium for the medical treatment of a dependent physically disabled person, you can avail exemption under the section 80DD. You can get these claim up to Rs 50,000 or actual expenditure incurred, whichever is lesser. For severe conditions this limit exempted up to 1lakh. The exemption applies those, the dependents(parents, spouse, children or sibling) should not have claimed any deduction for self. The diseases like Blindness and Vision problems, leprosy cured, Hearing impairment, Locomotors disability , mental retardness or illness with 40% or more considerable under this section.

The expenditure incurred for the medical treatment of self or your dependents can claim a deduction of up to Rs. 80,000 or the actual amount paid, whichever is less, under the section 80DDB. Dependent can be parents, spouse, children or siblings with completely dependent on you. For a senior citizen this exemption is Rs. 80,000, or the amount actually paid for medical expenses. The individuals who want to claim a deduction under this section need to submit a medical certificate from a doctor working in a government hospital. Diseases like Neurological, Parkinson, Malignant Cancers, AODS, Chronic Renal Failure, Hemophia, Thalassemia covered under this section. The expenses claimed by the insurance companies not considered under this section and cannot be exempted.

The education loan interest for pursuing higher education for self and dependent is completely tax exemptible. The exemption is only for interest on education loan and no deduction on principal paid. The loan education loan for self , spouse or children only. For pursuing full time courses only this loan interest deductible is applicable. This deduction is applicable for a period of eight years or till the interest is paid, whichever is earlier.

The donations given to charitable organizations can get tax deduction u/s 80G. The donations made under philanthropic ground are exempted for 100% of the amount donated while for others its 50% of the donated amount. Receipts issued by the charitable institution with singed , stamped and registration number issued by Income Tax Deparment printed on it , is must and considered for tax deduction. The name on the receipt should match with that on PAN number. The donations made to approved organizations and institutions qualify for deduction. Only donations made in cash or cheque are eligible for deduction.

For salaried individuals as a salary component or self-employed person staying in a rented house does not receive any kind of HRA, they can claim a deduction under 80GG. If you or your spouse or your children having own home can’t get tax deduction under this section. You can claim tax deduction Rs 2000 or 25% of annual income or rent paid 10% of annual income whichever is less.

The individual resident of India, who is suffering from specified disability can get tax deduction u/s 80U In order to avail this deduction one should from disabilities like Blindness and Vision problems, Leprosy cured, Hearing impairment, Locomotor disability, Mental retardation, Autism, Cerebral Palsy . For normal disabilities with 40% or more disabilities the tax deduction is Rs 75,000. For more than 80% disability can avail tax deduction Rs 1,25,000/- .

According to the 80TTA, which is newly introduced in Budget 2012, allows deduction of Rs 10,000 on interest earned on saving bank account.

In the Budget 2013 has introduced a new section 80EE, which gives additional exemption up to Rs 1 lakh on payment of interest on Home loan. The loan which is taken from banks or housing finance companies in the financial year 2012-13 is applicable to this and also the house, which Is not cost more than Rs.40 lakh. The borrower should not own any other property at the time of loan sanction. The additional deduction on interest payment of home loans can be claimed in financial year 2013-14. In case, if you are not able to exhaust the limit in financial year 2013-14, the balance can be claimed in FY 2014-15.

Thursday, 23 April 2015

In the Finance

Budget 2015 have some changes as previous Financial Year 2014-15, but

the Tax Slab is Same as previous Financial Year. The Major Changes is

Raised the some Tax Section which is given below :-

1 U/s 80 U :- Max Limit Rs. 75,000/- for General from 40% to 80% for Phy.Disable Person and Rs. 1,25000/- for more than 80%.

2. U/s 10 Transport/Traveling Allowance :- Max Limit Rs. 1600 P.M. for general and Rs. 3200/- P.M. for Phy.Disable persons.

3. U/s 80D Medical Health Insurance :- Max Limit Rs. 25,000/- for below 60 years age and Rs. 30,000/- for above 60 years age.

4. U/s 80CCC Pension Scheme :- Max Limit Rs. 1,50,000/-

5. U/s 80 DDB Sever Medical Treatment :- Max Limit Rs. 80,000/- instead of 40,000/-

6. U/s 80C :- One New deduction has incorporate as Sukanya Samriddhi Account for minor girl child who's age below 10 Years, and Max Limit Rs. 1.5000/-

7. U/s 80TTA relief from Savings Bank Interest is also entitled in this financial year up to Rs. 10,000/- who's taxable Income below Rs. 5 Lakh.

8. U/s 87A :- Tax Rebate Rs. 2,000/- is also entitled in this financial year as before.

Download the Automatic Tax Calculator for W.B.Govt employees for FY 2015-16

Monday, 20 April 2015

In the Finance Budget 2015 have some changes as previous Financial Year 2014-15, but the Tax Slab is Same as previous Financial Year. The Major Changes is Raised the some Tax Section which is given below :-

1 U/s 80 U :- Max Limit Rs. 75,000/- for General from 40% to 80% for Phy.Disable Person and Rs. 1,25000/- for more than 80%.

2. U/s 10 Transport/Traveling Allowance :- Max Limit Rs. 1600 P.M. for general and Rs. 3200/- P.M. for Phy.Disable persons.

3. U/s 80D Medical Health Insurance :- Max Limit Rs. 25,000/- for below 60 years age and Rs. 30,000/- for above 60 years age.

4. U/s 80CCC Pension Scheme :- Max Limit Rs. 1,50,000/-

5. U/s 80 DDB Sever Medical Treatment :- Max Limit Rs. 80,000/- instead of 40,000/-

6. U/s 80C :- One New deduction has incorporate as Sukanya Samriddhi Account for minor girl child who's age below 10 Years, and Max Limit Rs. 1.5000/-

7. U/s 80TTA relief from Savings Bank Interest is also entitled in this financial year up to Rs. 10,000/- who's taxable Income below Rs. 5 Lakh.

8. U/s 87A :- Tax Rebate Rs. 2,000/- is also entitled in this financial year as before.

Download Automatic Master of Form 16 Part A&B for the Financial Year 2015-16 and Ass year 2016-17 [ Prepare at a time 50 employees Form 16 Part A&B]

Feature of this Excel Utility[ Master of Form 16]

1. This Excel Utility can prepare at a time 50 employees Form 16 for FY 15-16 & AY 16-17.

2. This can prepare more than 2000 Form 16 automatically. First prepare 50 employees Form 16 & Save as it in another location in another name. After that You can again prepare the 50 employees Form 16.

3. This Excel Utility can provide and use the Both of Govt Concerned and Private Concerned.

4. This Excel Utility attach the Annexture A and Annexture B as you like can change by option

5. This Utility have also provide the Automatic Number to Word Convert, like as magic, no need to install any Add-ins or any Excel Formula

Download the Master of Form 16 Part A&B for FY 2015-16 [ Prepare at a time 50 employees Form 16 Part A&B for Assessment Year 2016-17]

Monday, 13 April 2015

Download Income Tax Calculator for Non-Govt employees For the Assessment Year 2016-2017 for Individual tax calculation.

Mr Arun Jaitley,The Finance Minister of India Presented his first full fledged budget today (28 Feb 2015). There were huge expectations from tax payers from the budget like increase in tax exemption slabs, Higher deductions on interest for housing loans etc., But the Finance Minister has chosen not to alter tax slabs during the budget. Although he hinted about the possibility of revision of tax slabs, it may not be before next budget.

So this Income Tax Calculator which is for Financial Year 2015-16 (FY 15-16) is made with little modification from the previous years Income Tax Calculator . The major changes proposed in the budget are also incorporate in the calculator for Financial Year 2015-16 and Assessment Year 2016-17 as per the Central Finance Budget 2015-16.

Major proposals in the union budget for Individual tax payers which are also included in the above income tax calculator for the assessment year 2016-17. The exemptions and deductions will be applicable if the investments / deductions are from 01 Apr 2015 to 31 Mar 2016.

There are no changes in the tax slabs. Previous tax slabs will remain same.

In spite of huge expectations from individual tax payers for increase in the limit of 80C from existing 1.5 Lakhs to atleast 2 lakhs, No increase is made. It must be appreciated that this limit is already increased in his last interim budget. But there is more thought out deduction announced in the budget which is deduction of Rs 50,000 if invested in New Pension Scheme or NPS. It almost works similar to exemption of 80C but can not be clubbed with other investments like PPF, Insurance Premium, ELSS Mutual Funds or even bank FD. This is a sort of making people having disciplined investment for their pension scheme which is in fact a good move. It augurs well for both Investors by rewarding them well in their golden years with pension and making investments available for the Nation.

Similarly, Health Insurance premium is increased from earlier 15000 rupees to 25000 and the same is increased from 20,000 to 30,000 in case of senior citizens. This will augur well for the people who wish to take complete health plan and paying premiums more than 15000 per annum.

For senior citizen who are above 80 years thus not eligible for health insurance, Rs 30,000 deduction is allowed for medical expenditure. Deduction limit of Rs 60,000 on expenditure of specified diseases is enhanced to Rs 80,000 in the case of senior citizens.

Similarly Investments in Sukanya Samriddhi Scheme are eligible for deduction under section 80C of the income-tax and any both principal and interest will be exempted from tax.

The other concession provided during the union budget, which can also be entered in the income tax calculator is transport allowance. For salaried people, the exemption limit in case of transport allowance is increased from earlier 800 rupees to 1600 rupees per month.

The Tax Rebate Rs.2000/- U/s 87A will be continue in the FY 2015-16 and Rs.10,000/- can be get relief from tax U/s 80TTA from Savings Bank Interest.

Monday, 30 March 2015

Download Automated Master of Form 16 Part B for FY 2014-15 [ This Excel Utility can prepare at a time 100 employees Form 16 Part B]. No need to prepare manual Form 16 Part B, if you use this handy Excel Utility which is most ease to generate and easy to install in any computer]

Main Feature of this Utility :-- Prevent double entry of Pan Number and Name of Employee

- Automatic Calculate Tax of each employee after filling the Salary Structure

- This Excel Utility can use both of Govt and Non-Govt Concerned

- This Utility can reduce your time to prepare Form 16 Part B

- All of Tax Feature as per the Budget 2014

- Automatic Convert the Amount in to the In Words.

Income-tax

department has issued Circular No 04/2013 dated April 17, 2013 in respect of

Form 16.

New Form 16

Revised

Form 16 has been notified vide Notification 11/2013 dated 19.02.2013

Form 16

has two distinct parts :-

Part A

: contains details of tax deduction and deposit

Part B

: contains details of salary and total income

Form 16 has to be issued on or before May 31, 2014 in respect of

Financial Year 2014-15

Procedure for Issuance

Now

vide Circular 04/2013, a deductor is required to issue

1) Part

A of Form 16 by downloading the same from TRACES web site

2) Part

B of Form 16 is to be prepare & issue by deductor manually

Form 16

Part A generated from TRACES PORTAL will contain unique TDS Certificate Number

Form 16 Part A by Govt. deductors, who make TDS payment by book

entry , is also to be issued by generating and downloading from TRACES

Authentication of Form

16

Form 16 must

be signed manually or using digital signature

Analysis

Issuing Form 16 will be a challenge for deductors for FY 2014-15, as

this involves two distinct parts being issued from two different sources.

Part A will have to be generated and downloaded from TRACES &

Part B will have to be prepared manually or using a third party software.

Download Automated Form 16 Part B for FY 2014-15 ( This Excel Utility can prepare One by One Form 16 Part B)

Thursday, 19 March 2015

Now this month is March 2015 and Income Tax Preparation and submit the Tax Statement to the employer by the employee with their Tax Savings deposit.Also it is time to prepare the Form 16 Part B by the each employer/Deductor for distribute the Form 16 Part B for the Financial Year 2014-15 and Assessment Year 2015-16.

Some of concerned have less than 10 employees and also give the Form 16 Part B to the employees in this Financial Year.

Below given Excel Based Software for prepare automated Form 16 Part B for FY 2014-15 with the all latest Tax Slab and Tax Section as per the Finance Budget 2014-15.

Feature of this Excel Utility :-

- Automatic Prepare Form 16 Part B after filling the employees salary details

- All the amended Income Tax Section have in this Utility

- This Excel Utility can prepare One by One Form 16 Part B

- The Format of Form 16 is amended version as per the notified by the CBDT in the Year 2013

- This Excel Utility can easily generate and easy to install in any Computer

- This Excel Utility can reduce your time for prepare the Form 16 Part B

Click here to download Automated Form 16 Part B for the Financial Year 2014-15 [ Prepare Automatic One by One Form 16 Part B for FY 2014-15]

|

| Main Input sheet |

|

Form 16 Part BClick here to download Automated Form 16 Part B for the Financial Year 2014-15 [ Prepare One by One Form 16 Part B for FY 2014-15 |

Wednesday, 18 March 2015

Download Automated Master of Form 16 for the Financial Year 2014-15 [ This Excel Utility can prepare at a time 100 employees Form 16 for the FY 2014-15]

How to Save Tax on Salary Income? This

question is popping up in the mind of every salaried employee. Since March is

fast approaching, HR department has started buzzing employees about the tax

savings investment he has made.

Tax

Savings investments have to be made before 31st March to claim the tax benefit and

maximize savings. But before rushing to invest, one needs to and plan out his

investment keeping in mind the changes made in the Budget 2014 to maximize his

tax savings.

Tax Savings does not necessarily means

acknowledging various sections of Income Tax Act, few sections along with your

salary slip can very well accomplish the peculiar task of tax planning for you.

In this article we will discuss the additional tax benefit and marginal reliefs

offered by budget 2014.

The Tax Slab has already Raised up to Rs. 2.5 Lakh by the Budget 2014 and the deduction limit of U/s 80C has also raised up to Rs.1.5 Lakh.

Enhanced limit of Section 80C

Budget 2014 has augmented the limit of

section 80C from Rs.1 lakh to Rs.1.5 lakhs. This enhanced limit gives

additional tax relief of Rs.15,450 for the person falling in the tax slab of

30%, similarly Rs.10,300 to person falling in the tax bracket of 20% and

Rs.5,150 to the person falling in the lowest tax bracket of 10%.

Maximize tax savings from increased limit of

section 80C:

Home Loan Benefit

Budget 2014 has also enhanced the limit

of deduction for Home Loan Principal u/s 80C and Home Loan Interest u/s 24.

Tax Benefits on Home

Loan – Principal Repayment

Principal Repayment of the Home Loan

taken from Financial Institutions is eligible for deductions u/s 80C but

restricted to the maximum of Rs.1.5 lakhs per annum. Remember this limit of

Rs.1.5 lakhs includes all deduction u/s 80C i.e. PPF, Tax Savings Bank FD, NSC,

EPF, LIC etc.

Reintroduce Kissan Vikas Patra (

K.V.P.) :-

Amount invested in Kissan Vikas Patra (KVP)

doubles in 100 months at the present rates. The certificates can be purchased

by an adult for himself or on behalf of a minor or to a minor. It can also be

purchased jointly by two adults.

A certificate may be transferred from one person to another with consent in writing to an officer of the Post Office or Bank. Under the scheme the transferee has to be eligible to purchase the certificate. The certificate may be prematurely encashed any time after two years and a half from the date of purchase, in the event of death of holder or any holder in case of joint holder, on order of court of Law and forfeiture by a pledge.

The Government has no proposal to separately tax benefit on KVP. However, income on KVP would be taxable as per existing provisions. Investor will have to undergo Know Your Customer (KYC) modalities at the time of application. In the case of transfer of KVP from one customer to another, a request has to be made in writing to an officer of the Post Office or Bank and the transferee has to be eligible to purchase KVP certification in the first instance.

Kissan Vikas Patra (KYP) has been reintroduced and is available in Post Offices. In future, KVP will be available in banks which are/will be authorized for handling small savings schemes.

A certificate may be transferred from one person to another with consent in writing to an officer of the Post Office or Bank. Under the scheme the transferee has to be eligible to purchase the certificate. The certificate may be prematurely encashed any time after two years and a half from the date of purchase, in the event of death of holder or any holder in case of joint holder, on order of court of Law and forfeiture by a pledge.

The Government has no proposal to separately tax benefit on KVP. However, income on KVP would be taxable as per existing provisions. Investor will have to undergo Know Your Customer (KYC) modalities at the time of application. In the case of transfer of KVP from one customer to another, a request has to be made in writing to an officer of the Post Office or Bank and the transferee has to be eligible to purchase KVP certification in the first instance.

Kissan Vikas Patra (KYP) has been reintroduced and is available in Post Offices. In future, KVP will be available in banks which are/will be authorized for handling small savings schemes.

Download Automated Form 16 Part B for the Financial Year 2014-15 [ This Excel Utility can prepare at a time 100 employees Form 16 Part B]

Tax Benefits on Home

Loan – Interest Component

Threshold limit of deduction of

Interest on the home loan u/s 24 is also increased in budget 2014 by Rs.50,000.

Now you can get maximum of Rs.2 lakhs deduction on the accrued interest on Home

Loan per annum.

Remember section 24 is applicable for

self-occupied house only i.e. capping limit of Rs.2 lakh applies when you hold

a self-occupied house. In case the house is not self-occupied than you can

claim the actual amount of interest paid which can even exceed Rs.2 lakhs.

Contribution towards Provident Funds

Section 80C comprises for various

instruments but contributions towards Provident Fund i.e. Employees Provident

Fund or Public Provident Fund are best amongst them. Being EEE scheme (Exempt,

Exempt, Exempt) these provide best solution for accumulating corpus for

retirement. Point to note is that provident fund is a long term investment

scheme, so opt this scheme considering it for post-retirement life.

National Savings Certificate (NSC) and Tax

Savings Bank FD

Both National Savings Certificate (NSC)

and Tax Savings Bank FD offers same rate of interest and same tax treatment.

The only things that makes NSC more lucrative than tax savings bank FD is the

method of interest calculation. The interest is compounded annually in case of

tax savings bank FD while the interest is compounded half-yearly in case of

NSC.

Equity Linked Savings Scheme

ELSS is also enjoys EEE tax treatment

as EPF and PPF but it comes with a high degree of risk. Since ELSS is exposed

to market the risk involved is similar to any other mutual fund but the quantum

is increased due to lock-in period of 3 years.

You can choose any of the four for

maximize your tax savings. No need to see any other investment scheme u/s 80C.

Continuation of Section 87A

Last year budget has introduced tax

credit system under which person having gross salary up to Rs.5,00,000 can get

additional tax rebate of Rs.2,000 from the income tax payable. This year budget

did not drop this section and thus letting taxpayer to get benefitted this year

also.

Click to download All in One TDS on Salary for Govt and Non-Govt employees for the Financial Year 2014-15

Subscribe to:

Posts (Atom)