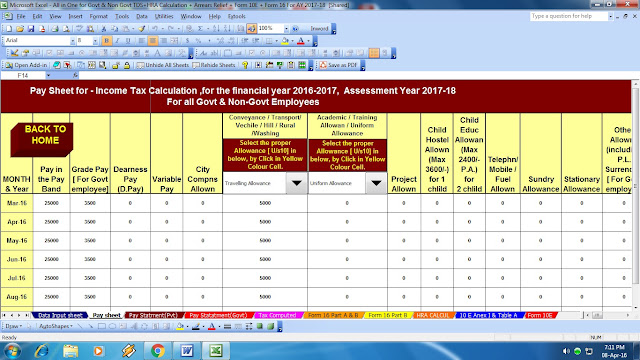

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 ( Prepare at a time Tax Calculation + Individual Salary Sheet + Salary Structure +Automated Arrears Relief Calculation with Form 10E +HRA Exemption Calculation + Form 16 Part A&B and Form 16 Part B for the Financial year 2016-17)

Income Tax F.Y.2016-17 – what are all the changes affecting Salaried Employees ? – Highlights of Changes announced in Budget 2016 and Finance Bill 2016 as far as Income Tax Provisions relating to Salaried Employees,

(1)Tax Rebate Rs. 5,000/-U/s 87A is available in the Financial Year 2016-17

(2)Up to Rs. 10 Thousand can get relief from Savings Bank Interest also U/s 80TTA.

(3) U/s 80CCD(1B) can get extra benefits up to Rs. 50,000/-

Income Tax 2016-17 (Assessment year 2017-18)

In case of individual (other than II and III below) and HUF

II. In case of an individual resident who is of the age of 60 years or more at any time during the previous year:-

Income-tax Act relating to deductions from income from house property (section 24B)

The existing provisions contained in section 24B provide that in a case of a self-occupied property where the acquisition or construction of the property is completed within three years from the end of financial year in which the capital is borrowed, the amount of deduction under that clause shall not exceed Two lakh thousand rupees.

Income Tax Exemption under Section 80 C in respect of Savings / Insurance Premium / Housing Loan Principal etc

Clause 27 of the Bill seeks to amend section 80C of the Income-tax Act relating to deduction in respect of life insurance premium, deferred annuity, contributions to provident fund, subscription to certain equity shares or debentures, etc.

The existing provisions of sub-section (1) of section 80C provide for deduction of Rs.Two lakh rupees.

Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government under Section 80 CCD(1) & CCD (2)

Clause 28 of the Bill seeks to amend section 80CCD of the Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government.

The existing provisions contained in sub-section (1) of section 80CCD, inter alia, provide that in the case of an individual, employed by the Central Government or any other employer on or after 1st January, 2004, who has in the previous year paid or deposited any amount in his account under a pension scheme notified or as may be notified by the Central Government, a deduction of such amount not exceeding ten per cent. of salary is allowed. This is subject to a limit of one lakh Fifty Thousand rupees provided under section 80CCE,excluding Rs. 50,000/- U/s 80CCD(1B).

It is proposed to amend sub-section (1) of the said section so as to provide that an individual employed by the Central Government on or after 1st January, 2004 or, being an individual employed by any other employer shall be allowed a deduction of the amount deposited by him in his account under a pension scheme notified or as may be notified by the Central Government to the extent it does not exceed ten per cent. of his salary.

It is further proposed to insert the new subsection (1A) so as to provide that a number of deductions shall not exceed One Lakh Fifty Thousand rupees.

Income-tax Act relating to limit on deductions under sections 80C, 80CCC and 80CCD under Section 80 CCE

Clause 29 of the Bill seeks to amend section 80CCE of the Income-tax Act relating to limit on deductions under sections 80C, 80CCC, and 80CCD.

80CCD(1B):- Additional deduction shall be allowed Max Rs.50,000/- as New National Pension Scheme 2016. This Amount out of 1.5 Lakh U/s 80C.

Click to Download the Automated H.R.A. Exemption Calculator U/s 10(13A)

Section 80 D of Income Tax Act:

There is no change in the income Tax Exemption available in respect of Health Insurance Premium which can be deducted at source.

As such, with a maximum limit of Rs.25,000, an individual can deduct at source the Health Insurance premium paid by him / her in a financial year (2015-16 and onwards)

Download Automatic Arrears Relief Calculator U/s 89(1) with Form 10E up to F.Y.2016-17 ( Updated Version)

In addition to Income tax exemption availed for Health Insurance relating to individual and his / her family, health Insurance Premium paid by the individual for covering health of his / her parents can also be deducted from the total income subject to a maximum of Rs. 25,000. In the case of Health Insurance cover in these cases pertains to Senior Citizen then the maximum limit of deduction under Section 80D would be Rs. 30,000

Deduction for preventive health check-up

Under Section 80D, a deduction of Rs 5,000 is allowed for expenditure incurred during the year by a taxpayer on account of preventive health check-up of self, spouse, dependent children or parents

The above deduction to be within the overall limits of Rs 15,000 / Rs 20,000 prescribed under the said Section of the Act.