People

often change their jobs for various reasons. If you have switched your job in the middle of the financial year, you will have to provide details of your previous salary earned along with tax deductions to the new employer through Form 12B. When you submit your Form 12B, your the current employer can deduct the correct amount of TDS or Tax Deducted at

Source from your salary. Every new employee has to submit Form 12B to

their new employer along with proofs of all the investments made before

31st March.

Showing posts with label Automated Arrears Relief Calculator U/s 89(1). Show all posts

Showing posts with label Automated Arrears Relief Calculator U/s 89(1). Show all posts

Tuesday, 24 September 2019

Friday, 11 January 2019

In 2017, Mr.A had taken a home loan for buying a home in Delhi. The home loan amount was 15 Lakh tenure was 20 years and EMI was Rs.14976. He got transferred to Mumbai before two years.

He could have sold the old house and purchased a new house at Mumbai. But, he decided to purchase another house instead of renting. He has taken a second home loan of Rs 15 lakh for 20 years, for which EMI is about Rs.16, 550.

Sunday, 16 September 2018

Budget 2018 though did not change the broad tax slabs but made some changes in the tax exemptions. One of them was the reintroduction of Standard Deduction for salaried and pensioners. From FY 2018-19 (AY 2019-20) all salaried and pensioners would be eligible for the standard deduction of Rs 40,000. However, as they say, the devil lies in details. With the introduction of the standard deduction, the finance minister has removed two popular tax deductions which were available for salaried: Transport Allowance of Rs 19,200 and Medical Reimbursement of Rs 15,000. So, the net impact of the standard deduction for salaried would only be Rs 5,800 (40,000 – 19,200 – 15,000). However, as pensioners did not have these allowances standard deduction for them is really good news.

Monday, 4 July 2016

Changes in Income Tax Rules as per the Finance Budget 2016-17 & A.Y.2017-18:

1. There has been no change in the income tax slabs for the Financial Year 2016-17 & Assessment Year 2017-18.

2. For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

3. Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

4. Tax Exemption u/s 80GG (for rent expenses who do have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

5. For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

6. Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

7. 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in the case of EPF income tax would be applicable on 60% of the corpus in maturity.

8. Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

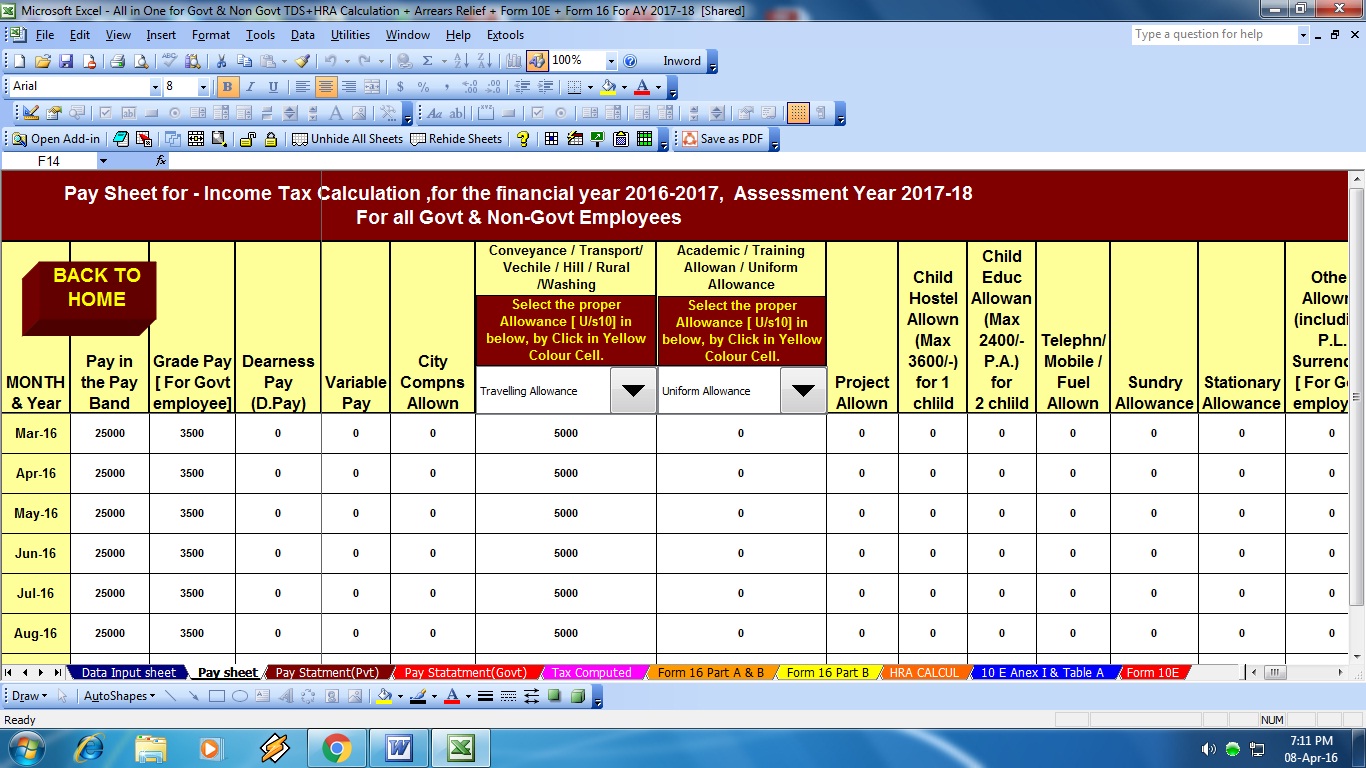

Download All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Download All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

These 3 are the most popular sections for tax saving and have a lot of options to save tax. The maximum exemption combining all the above sections is Rs 1.5 lakhs. 80CCC deals with the pension products while 80CCD includes Central Government Employee Pension Scheme.

You can choose from the following for tax saving investments:

1. Employee/ Voluntary Provident Fund (EPF/VPF)

2. PPF (Public Provident fund)

3. Sukanya Samriddhi Account

4. National Saving Certificate (NSC)

5. Senior Citizen’s Saving Scheme (SCSS)

6. 5 years Tax Saving Fixed Deposit in banks/post offices

7. Life Insurance Premium

8. Pension Plans from Life Insurance or Mutual Funds

9. NPS (New Pension Scheme)

10. Equity Linked Saving Scheme (ELSS – popularly known as Tax Saving Mutual Funds)

11. Central Government Employee Pension Scheme

12. Principal Payment on Home Loan

13. Stamp Duty and registration of the House

14. Tuition Fee for 2 children

2. Section 80CCD(1B) – Investment in NPS

Budget 2015 has allowed additional exemption of Rs 50,000 for investment in NPS. We have done a complete analysis and concluded that it would be beneficial for you to discard this benefit and invest after-tax money in a good equity mutual fund.

Download All in One TDS on Salary for Central Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Central Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

3. Payment of interest on Home Loan (Section 24/80EE)

3. Payment of interest on Home Loan (Section 24/80EE)

The interest paid up to Rs 2 lakhs on home loan for the self-occupied home is exempted u/s 24. There is no limit for home given on rent.

Budget 2016 has provided additional exemption up to Rs 50,000 for payment of home loan interest for first time home buyers. To avail this benefit the value of the home should not exceed Rs 50 lakhs and loan should not be more than Rs 35 lakhs.

4. Payment of Interest on Education Loan (Section 80E)

The total interest paid on education loan can be claimed as tax exemption. There is no upper limit for the same.

5. Investment in RGESS (Section 80CCG)

Deduction Up to Rs 25,000 (50% of the amount invested) is allowed if you make the investment in preapproved stocks and mutual funds in Rajiv Gandhi Equity Savings Scheme (RGESS). This is available to first-time equity investors subject to certain conditions.

6. Medical insurance for Self and Parents (Section 80D)

You can get the tax deduction up to Rs 60,000 by paying the medical insurance premium for self, your dependents, and your parents. There is also sub-limit of Rs 5,000 for the preventive medical checkup.

7. Treatment of Serious disease (Section 80DDB)

You can claim deduction up to Rs 80,000 for treatment of certain diseases like AIDS, renal failure, etc for self or dependents

8. Physically Disabled Tax-payer (Section 80U)

Physically Disabled Tax-payer can get tax exemption up to Rs 1.25 lakhs u/s 80U

9. Physically Disabled Dependent (Section 80DD)

You can claim deduction up to Rs 1.25 lakhs for maintenance and medical treatment of Physically Disabled dependent

10. Donations to Charitable Institutions (Section 80G)

Deduction up to Rs 40,000 is allowed for Donation to certain charitable funds, charitable institutions, etc.

11. Donations to Charitable Institutions (Section 80GGA)

Deduction up to Rs 1 lakh is allowed for donations for scientific research or rural development

12. Donations to Charitable Institutions (Section 80GGC)

Deduction up to Rs 60,000 is allowed for donations to political parties

Download All in One TDS on Salary for Only Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Non-Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 12 BA + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Along with the tax saving options, it also has details about all the common salary components and their tax treatment. This section can help you to plan your salary components in case your company offers such facility.

We hope that this eBook would help you in understanding, planning and saving taxes.

Wednesday, 29 June 2016

Changes in Income Tax Rules as per the Finance Budget 2016-17 & A.Y.2017-18:

1. There has been no change in the income tax slabs for the Financial Year 2016-17 & Assessment Year 2017-18.

2. For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

3. Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

4. Tax Exemption u/s 80GG (for rent expenses who do have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

5. For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

6. Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

7. 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in the case of EPF income tax would be applicable on 60% of the corpus in maturity.

8. Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

Download All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

These 3 are the most popular sections for tax saving and have a lot of options to save tax. The maximum exemption combining all the above sections is Rs 1.5 lakhs. 80CCC deals with the pension products while 80CCD includes Central Government Employee Pension Scheme.

You can choose from the following for tax saving investments:

1. Employee/ Voluntary Provident Fund (EPF/VPF)

2. PPF (Public Provident fund)

3. Sukanya Samriddhi Account

4. National Saving Certificate (NSC)

5. Senior Citizen’s Saving Scheme (SCSS)

6. 5 years Tax Saving Fixed Deposit in banks/post offices

7. Life Insurance Premium

8. Pension Plans from Life Insurance or Mutual Funds

9. NPS (New Pension Scheme)

10. Equity Linked Saving Scheme (ELSS – popularly known as Tax Saving Mutual Funds)

11. Central Government Employee Pension Scheme

12. Principal Payment on Home Loan

13. Stamp Duty and registration of the House

14. Tuition Fee for 2 children

2. Section 80CCD(1B) – Investment in NPS

Budget 2015 has allowed additional exemption of Rs 50,000 for investment in NPS. We have done a complete analysis and concluded that it would be beneficial for you to discard this benefit and invest after-tax money in a good equity mutual fund.

Download All in One TDS on Salary for Central Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Central Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Download All in One TDS on Salary for Central Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Central Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

3. Payment of interest on Home Loan (Section 24/80EE)

The interest paid up to Rs 2 lakhs on home loan for the self-occupied home is exempted u/s 24. There is no limit for home given on rent.

Budget 2016 has provided additional exemption up to Rs 50,000 for payment of home loan interest for first time home buyers. To avail this benefit the value of the home should not exceed Rs 50 lakhs and loan should not be more than Rs 35 lakhs.

4. Payment of Interest on Education Loan (Section 80E)

The total interest paid on education loan can be claimed as tax exemption. There is no upper limit for the same.

5. Investment in RGESS (Section 80CCG)

Deduction Up to Rs 25,000 (50% of the amount invested) is allowed if you make the investment in preapproved stocks and mutual funds in Rajiv Gandhi Equity Savings Scheme (RGESS). This is available to first-time equity investors subject to certain conditions.

6. Medical insurance for Self and Parents (Section 80D)

You can get the tax deduction up to Rs 60,000 by paying the medical insurance premium for self, your dependents, and your parents. There is also sub-limit of Rs 5,000 for the preventive medical checkup.

7. Treatment of Serious disease (Section 80DDB)

You can claim deduction up to Rs 80,000 for treatment of certain diseases like AIDS, renal failure, etc for self or dependents

8. Physically Disabled Tax-payer (Section 80U)

Physically Disabled Tax-payer can get tax exemption up to Rs 1.25 lakhs u/s 80U

9. Physically Disabled Dependent (Section 80DD)

You can claim deduction up to Rs 1.25 lakhs for maintenance and medical treatment of Physically Disabled dependent

10. Donations to Charitable Institutions (Section 80G)

Deduction up to Rs 40,000 is allowed for Donation to certain charitable funds, charitable institutions, etc.

11. Donations to Charitable Institutions (Section 80GGA)

Deduction up to Rs 1 lakh is allowed for donations for scientific research or rural development

12. Donations to Charitable Institutions (Section 80GGC)

Deduction up to Rs 60,000 is allowed for donations to political parties

Download All in One TDS on Salary for Only Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Non-Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 12 BA + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Along with the tax saving options, it also has details about all the common salary components and their tax treatment. This section can help you to plan your salary components in case your company offers such facility.

We hope that this eBook would help you in understanding, planning and saving taxes.

Friday, 29 April 2016

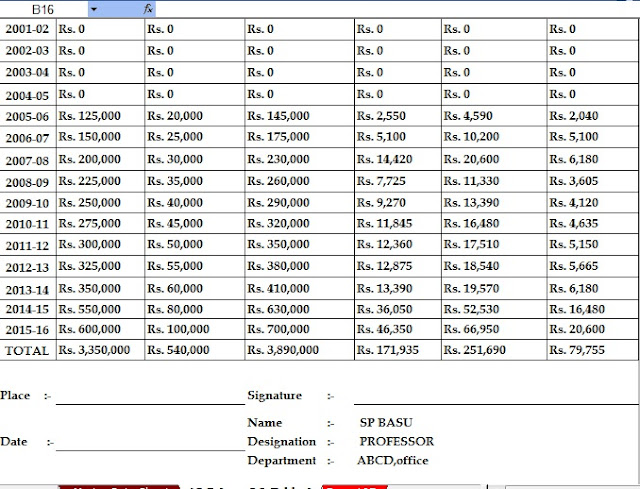

RELIEF UNDER SECTION 89(1) with Form 10E From F.Y.2001-2002 to F.Y.2017-18

Where

by reason of any portion of an assessee’s salary being paid in arrears

or in advance or by reason of his having received in any one financial

year, salary for more than twelve months or a payment of profit in lieu

of salary under section 17(3), his income is assessed at a rate higher

than that at which it would otherwise have been assessed, the Assessing

Officer shall, on an application made to him in this behalf, grant such

relief as prescribed. The procedure for computing the relief is given in

rule 21A. This relief is called relief u/s 89(1).

Sunday, 13 March 2016

Here is a key to tax benefit on home loans as per 2016-2017 budget presented on Feb 29th 2016 applicable for financial year 2016-17 and assessment year 2017-18 as compared to previous year and practical tips to avail these to maximize your tax savings on home loans.

Download Income Tax Calculator forNon-Govt employees For the Financial Year 2016-17 & Assessment Year 2017-18as per the Finance Budget 2016-17 [All Tax Amended have in this Tax Calculator & inbuilt the Salary Structure of Non-Govt employees Salary Pattern ]

Key highlight of the budget is that first time home buyers will get additional exemption of up to Rs. 50,000/- on interest paid for loans up to Rs. 35 lakhs with cost of home upto Rs. 50 lakhs.U/s 80EE

Key highlight of the budget is that first time home buyers will get additional exemption of up to Rs. 50,000/- on interest paid for loans up to Rs. 35 lakhs with cost of home upto Rs. 50 lakhs.U/s 80EE

Download Automated Income TaxArrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2001-02 to F.Y.2016-17 ( Up dated Version )

Tax benefits on home loan in summary

Tax Benefits

|

On Principal Repaid

|

On Interest Paid

|

First Home – Self Occupied

|

No change – Upto Rs. One Lakh Fifty Thousand (Rs. Two Lakh for senior citizens)

|

Up to Rs. Two Lakh if completed within 3 years from the end of the fin. year in which loan is taken, else Rs. 30,000. Additional exemption of upto Rs. 50,000/- U/s 80EE on interest paid for loans upto Rs. 35 lakhs with cost of home up to Rs. 50 lakhs

|

First Home – Rented/ Vacant

|

No change – Upto Rs. One Lakh Fifty Thousand if staying in a different city for work

|

No change – On entire interest paid without any limit

|

Second Home

|

None

|

No change – On entire interest paid without any limit

|

Under Constrn.

|

None

|

No change – The interest paid can be claimed in equal parts in five fin. years post completion or handing over.

|

Income tax exemption on repayment of home loan principal amount up to Rs. 150,000 P.A. under Section 80 C of the Income Tax Act:

Key Highlights/ Terms to avail this exemption

· Principal repayment component of up to Rs. one lakh fifty thousand can be clubbed under the overall limit for tax saving instruments eligible under Section 80C

· Available only for purchase or construction of residential property

· Deduction available only for self occupied property

· Any amount paid towards partial or full prepayment of home loan is also eligible to be included for benefit under this section

Deduction of home loan interest paid for self occupied home up to Rs. 2,00,000 P.A. under Section 24 of the Income Tax Act

Key Highlights/Terms to avail this exemption

· Annual interest component of up to Rs. two lakh can be claimed as deduction against income and reduce the your tax liability by upto Rs. 67,980 depending upon your tax slab

· Additional exemption of up to Rs. 50,000 can be claimed as deduction against income from FY 2016-17 and AY 2017-18 on first home provided the sanctioned loan amount is upto Rs. 35 lakhs and cost of house is upto Rs. 50 lakhs U/s 80EE

· Available for purchase/ construction/ repair/ renewal/ reconstruction of a residential house property

· Benefit available only for self occupied property

· Deduction is available on an accrual basis and not on a payment basis. Hence, deduction under Section 24 can be claimed on yearly basis even if no payment has been made during the year but interest has accrued

Subscribe to:

Posts (Atom)