What is the Maximum Income Tax I can save for this Year (FY 2018-19)? A question I am often asked. Tax laws keep changing year on year, especially in Budget. 2019

Showing posts with label Sec 80C. Show all posts

Showing posts with label Sec 80C. Show all posts

Tuesday, 7 May 2019

Wednesday, 10 April 2019

The assessment Year 2019-20 is here the "Best Tax Saving Investments". Sadly there is no straight response to this. The best speculation is diverse for various individuals and is lined up with their arrival desires, chance-taking capacity, individual conditions, and arrangement with their monetary objectives in addition to other things.

Thursday, 16 August 2018

Saturday, 4 November 2017

Monday, 4 July 2016

Changes in Income Tax Rules as per the Finance Budget 2016-17 & A.Y.2017-18:

1. There has been no change in the income tax slabs for the Financial Year 2016-17 & Assessment Year 2017-18.

2. For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

3. Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

4. Tax Exemption u/s 80GG (for rent expenses who do have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

5. For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

6. Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

7. 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in the case of EPF income tax would be applicable on 60% of the corpus in maturity.

8. Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

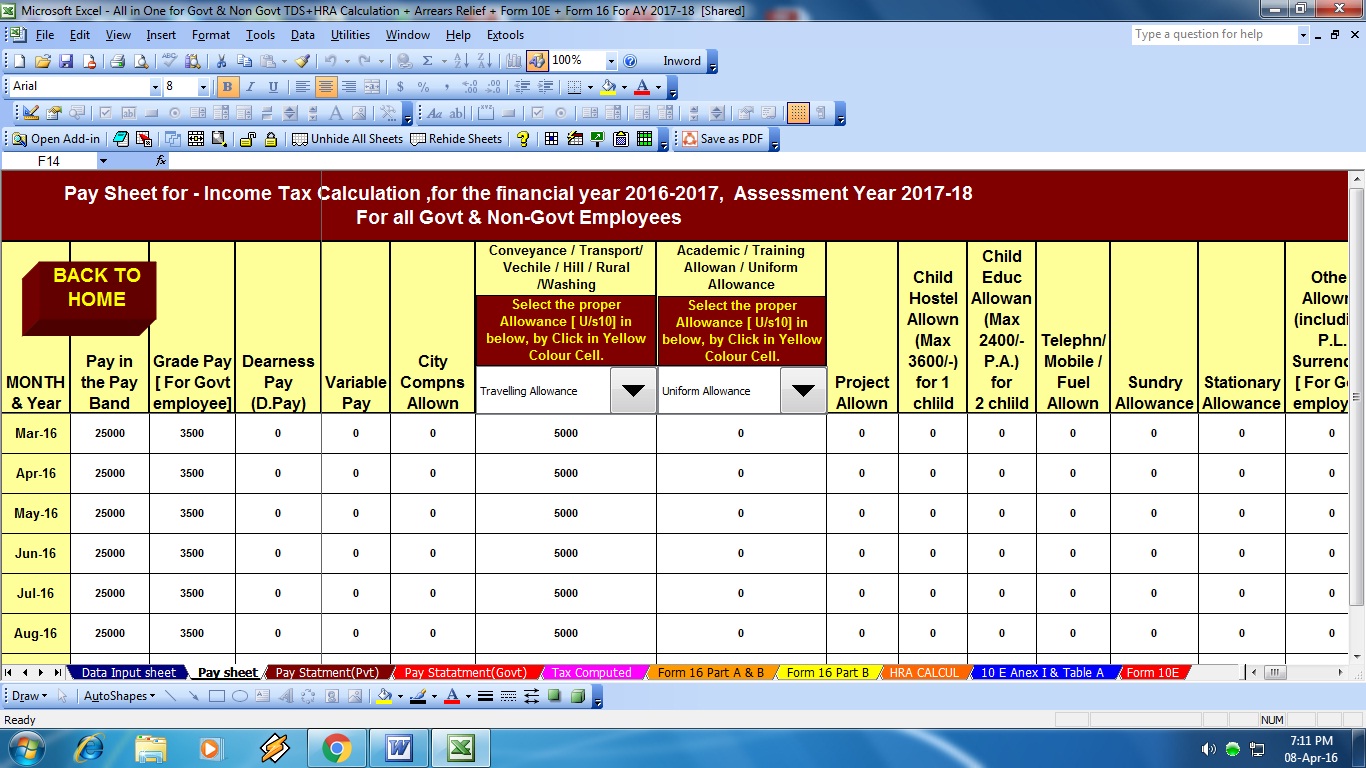

Download All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Download All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

These 3 are the most popular sections for tax saving and have a lot of options to save tax. The maximum exemption combining all the above sections is Rs 1.5 lakhs. 80CCC deals with the pension products while 80CCD includes Central Government Employee Pension Scheme.

You can choose from the following for tax saving investments:

1. Employee/ Voluntary Provident Fund (EPF/VPF)

2. PPF (Public Provident fund)

3. Sukanya Samriddhi Account

4. National Saving Certificate (NSC)

5. Senior Citizen’s Saving Scheme (SCSS)

6. 5 years Tax Saving Fixed Deposit in banks/post offices

7. Life Insurance Premium

8. Pension Plans from Life Insurance or Mutual Funds

9. NPS (New Pension Scheme)

10. Equity Linked Saving Scheme (ELSS – popularly known as Tax Saving Mutual Funds)

11. Central Government Employee Pension Scheme

12. Principal Payment on Home Loan

13. Stamp Duty and registration of the House

14. Tuition Fee for 2 children

2. Section 80CCD(1B) – Investment in NPS

Budget 2015 has allowed additional exemption of Rs 50,000 for investment in NPS. We have done a complete analysis and concluded that it would be beneficial for you to discard this benefit and invest after-tax money in a good equity mutual fund.

Download All in One TDS on Salary for Central Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Central Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

3. Payment of interest on Home Loan (Section 24/80EE)

3. Payment of interest on Home Loan (Section 24/80EE)

The interest paid up to Rs 2 lakhs on home loan for the self-occupied home is exempted u/s 24. There is no limit for home given on rent.

Budget 2016 has provided additional exemption up to Rs 50,000 for payment of home loan interest for first time home buyers. To avail this benefit the value of the home should not exceed Rs 50 lakhs and loan should not be more than Rs 35 lakhs.

4. Payment of Interest on Education Loan (Section 80E)

The total interest paid on education loan can be claimed as tax exemption. There is no upper limit for the same.

5. Investment in RGESS (Section 80CCG)

Deduction Up to Rs 25,000 (50% of the amount invested) is allowed if you make the investment in preapproved stocks and mutual funds in Rajiv Gandhi Equity Savings Scheme (RGESS). This is available to first-time equity investors subject to certain conditions.

6. Medical insurance for Self and Parents (Section 80D)

You can get the tax deduction up to Rs 60,000 by paying the medical insurance premium for self, your dependents, and your parents. There is also sub-limit of Rs 5,000 for the preventive medical checkup.

7. Treatment of Serious disease (Section 80DDB)

You can claim deduction up to Rs 80,000 for treatment of certain diseases like AIDS, renal failure, etc for self or dependents

8. Physically Disabled Tax-payer (Section 80U)

Physically Disabled Tax-payer can get tax exemption up to Rs 1.25 lakhs u/s 80U

9. Physically Disabled Dependent (Section 80DD)

You can claim deduction up to Rs 1.25 lakhs for maintenance and medical treatment of Physically Disabled dependent

10. Donations to Charitable Institutions (Section 80G)

Deduction up to Rs 40,000 is allowed for Donation to certain charitable funds, charitable institutions, etc.

11. Donations to Charitable Institutions (Section 80GGA)

Deduction up to Rs 1 lakh is allowed for donations for scientific research or rural development

12. Donations to Charitable Institutions (Section 80GGC)

Deduction up to Rs 60,000 is allowed for donations to political parties

Download All in One TDS on Salary for Only Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Non-Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 12 BA + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Along with the tax saving options, it also has details about all the common salary components and their tax treatment. This section can help you to plan your salary components in case your company offers such facility.

We hope that this eBook would help you in understanding, planning and saving taxes.

Wednesday, 29 June 2016

Changes in Income Tax Rules as per the Finance Budget 2016-17 & A.Y.2017-18:

1. There has been no change in the income tax slabs for the Financial Year 2016-17 & Assessment Year 2017-18.

2. For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

3. Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

4. Tax Exemption u/s 80GG (for rent expenses who do have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

5. For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

6. Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

7. 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in the case of EPF income tax would be applicable on 60% of the corpus in maturity.

8. Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

Download All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

These 3 are the most popular sections for tax saving and have a lot of options to save tax. The maximum exemption combining all the above sections is Rs 1.5 lakhs. 80CCC deals with the pension products while 80CCD includes Central Government Employee Pension Scheme.

You can choose from the following for tax saving investments:

1. Employee/ Voluntary Provident Fund (EPF/VPF)

2. PPF (Public Provident fund)

3. Sukanya Samriddhi Account

4. National Saving Certificate (NSC)

5. Senior Citizen’s Saving Scheme (SCSS)

6. 5 years Tax Saving Fixed Deposit in banks/post offices

7. Life Insurance Premium

8. Pension Plans from Life Insurance or Mutual Funds

9. NPS (New Pension Scheme)

10. Equity Linked Saving Scheme (ELSS – popularly known as Tax Saving Mutual Funds)

11. Central Government Employee Pension Scheme

12. Principal Payment on Home Loan

13. Stamp Duty and registration of the House

14. Tuition Fee for 2 children

2. Section 80CCD(1B) – Investment in NPS

Budget 2015 has allowed additional exemption of Rs 50,000 for investment in NPS. We have done a complete analysis and concluded that it would be beneficial for you to discard this benefit and invest after-tax money in a good equity mutual fund.

Download All in One TDS on Salary for Central Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Central Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Download All in One TDS on Salary for Central Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Central Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B + Automated Form 16 Part B ]

3. Payment of interest on Home Loan (Section 24/80EE)

The interest paid up to Rs 2 lakhs on home loan for the self-occupied home is exempted u/s 24. There is no limit for home given on rent.

Budget 2016 has provided additional exemption up to Rs 50,000 for payment of home loan interest for first time home buyers. To avail this benefit the value of the home should not exceed Rs 50 lakhs and loan should not be more than Rs 35 lakhs.

4. Payment of Interest on Education Loan (Section 80E)

The total interest paid on education loan can be claimed as tax exemption. There is no upper limit for the same.

5. Investment in RGESS (Section 80CCG)

Deduction Up to Rs 25,000 (50% of the amount invested) is allowed if you make the investment in preapproved stocks and mutual funds in Rajiv Gandhi Equity Savings Scheme (RGESS). This is available to first-time equity investors subject to certain conditions.

6. Medical insurance for Self and Parents (Section 80D)

You can get the tax deduction up to Rs 60,000 by paying the medical insurance premium for self, your dependents, and your parents. There is also sub-limit of Rs 5,000 for the preventive medical checkup.

7. Treatment of Serious disease (Section 80DDB)

You can claim deduction up to Rs 80,000 for treatment of certain diseases like AIDS, renal failure, etc for self or dependents

8. Physically Disabled Tax-payer (Section 80U)

Physically Disabled Tax-payer can get tax exemption up to Rs 1.25 lakhs u/s 80U

9. Physically Disabled Dependent (Section 80DD)

You can claim deduction up to Rs 1.25 lakhs for maintenance and medical treatment of Physically Disabled dependent

10. Donations to Charitable Institutions (Section 80G)

Deduction up to Rs 40,000 is allowed for Donation to certain charitable funds, charitable institutions, etc.

11. Donations to Charitable Institutions (Section 80GGA)

Deduction up to Rs 1 lakh is allowed for donations for scientific research or rural development

12. Donations to Charitable Institutions (Section 80GGC)

Deduction up to Rs 60,000 is allowed for donations to political parties

Download All in One TDS on Salary for Only Non-Govt employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Based Software can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure as per Non-Govt Salary Patterns + Automatic H.R.A. Exemption Calculation + Automated Form 12 BA + Automated Form 16 Part A&B + Automated Form 16 Part B ]

Along with the tax saving options, it also has details about all the common salary components and their tax treatment. This section can help you to plan your salary components in case your company offers such facility.

We hope that this eBook would help you in understanding, planning and saving taxes.

Sunday, 7 February 2016

Download All in One Income Tax preparation Excel Based Software which can prepare both of Govt and Non-Govt Concerned employees for the Financial Year 2015-16 [ This Excel Based utility can prepare at a time

Income Tax Compute Sheet + Individual Salary Structure + Automatic HRA

Exemption Calculation + Automatic Arrears Relief Calculator with Form 10e U/s

89(1), Automated Form 16 Part A&B and Form 16 Part B]

Tax Saving Sections Summary:

Below is the recap of all tax saving sections for

FY 2015-16:

Section 80C/80CCC/80CCD/ 80CCD(1B):

Investment in EPF, ELSS, PPF, FD, NPS, NSC, Pension Plans, Life Insurance,

SCSS, SSA and NPS. Also includes Home Loan Principal repayment, Tuition Fees,

Stamp Duty

Section 24: Interest paid on Home Loan for Self occupied homes. No Limit for Rented house

Section 80E: Interest paid on

Education Loan. No Limit – Rs 50,000 is just an assumed value

Section 80CCG: 50% of investment

in RGESS approved stocks & mutual funds. Max investment limit is Rs 50,000

Section 80D: Premium payment for

medical insurance for self and parents. Also includes Rs 5,000 limit for

preventive health checkup

Section 80DDB: Treatment of

Serious illness for self and dependents (Limit of Rs 80,000 for person above 80

years, Rs 60,000 for person above 60 years and Rs 40,000 for rest)

Section 80U: Physically Disabled

Tax payer (Rs 75,000 for 40% to 80% disability and Rs 1,25,000 for more than

80%)

Section 80DD: Physically

Disabled Dependent (Rs 75,000 for 40% to 80% disability and Rs 1,25,000 for

more than 80%)

Section 80G: Donation to approved

charitable funds like Prime Minister Relief fund, etc 100% or 50%

Section 80TTA: Interest received

in Savings Account Max Rs. 10,000/-

Section 87A: Income Tax Rebate

Rs.2,000/- who’s total taxable income less than 5 Lakh.

Sunday, 17 January 2016

It’s time of the year when everyone including your employer is worried about your taxes. Most people would have received mail from their Accounts department about “submission of proofs for investments done to claim income tax exemption”. In case you have not, it might be on its way.

This post helps you understand why It is the time for Submit the Income Tax deduction Proof to Employer – With Automatic Tax Preparation Excel Based All in One TDS on Salary with Form 16 for F.Y.2015-16

Salaried class needs to submit these proofs to their employers, how it should be done, what documents to be submitted and if there is a deadline?

Why Employers Ask for Tax Saving Investment Proofs?

Employers are responsible to deduct income tax (TDS – Tax deduction at source) from salary paid to its employees and deposit the same to income tax department. But income tax is complicated and the final tax depends on the tax saving investments a person makes or if the person lives on rent or if he has a house. So to compute your taxes correctly your employer asks for a declaration at the start of financial year (in April). The TDS is deducted based on this declaration.

As we approach the end of financial year, employer wants to make sure you did what you declared as it impacts the tax calculation. So it asks you to submit proofs for income tax saving investment that you made, rent receipts along with any other documents. Once the proof is submitted the employer computes tax based on the actual investments made and TDS is adjusted accordingly.

AlsoDownload Master of Form 16 Part B for F.Y.2015-16: [This Excel Utility Can prepare at a time 50 employees Form 16 Part B for FY 2015-16.]

When does Employer ask for Proofs?

There are no guidelines about when any employer should ask for investment proofs. Some companies start asking for the same in December but most of them would ask for it before end of January. This is asked so early on as the enhanced tax deduction can be done from 2-3 months’ salary. Also this awakes the lazy ones and they start their tax planning.

What if you do not Submit the Proofs?

In case you do not submit the proofs, employer would not be able to give you tax benefit on your tax saving investments. This would lead to higher deduction of taxes. You can claim refund of these taxes only during filing of tax returns.

Documents to be Submitted

Indian income tax laws are complicated and have multiple exemptions and investment options. Below is the list of documents that needs to be submitted to your employer to get relevant tax deductions.

Download All in One TDS on Salary for Private (Non-Govt) Employees for the Financial Year 2015-16 and Ass Year 2016-17 [ This Excel Based Software can prepare at a time Income Tax Compute Sheet + Automatic H.R.A. Exemption Calculation + Individual Salary Sheet + Individual Salary Structure for Central Govt Salary Pattern + Automatic Form 16 Part A&B + Automatic Form 16 Part B + Form 12 BA for F.Y.2015-16]

House Rent Allowance (HRA) u/s 10(13A):- Click here to download the Automatic HRA Exemption Calculator U/s 10(13A)

Following documents need to be submitted to claim tax benefit on HRA:

§ Rent receipt for starting and the end month and of intermediate month in case there has been change in rent or rented accommodation. So you need to submit rent receipt for April and Dec/Jan if there is no rent change.

§ The rent receipt must have One rupee revenue stamp on it (ideally a revenue stamp is required for receipts if the rent is paid by cash and is over Rs.5,000 but most employers still ask for it).

§ No rent receipt is required if the monthly rent paid is below Rs.3,000

§ Some employers may also ask for copy of rent agreement.

§ If the annual rent paid exceeds Rs 1 lakh you also need to give PAN number of the landlord. In case your landlord does not have PAN card, a declaration needs to be submitted stating so.

Also Read: What can you do if your landlord does not give his PAN number?

Home Loan Interest u/s 24

§ Copy of Provisional Interest certification from Bank/Financial Institution stating the amount of principle and interest separately.

§ The certificate should also have the loan sanction date

§ Copy of Possession Certificate

§ Copy of Sale Deed (In case possession letter in not available)

§ Copy of Lease deed, in case of let out property

§ In case of Joint Home Loan, self-declaration of the ownership proportion needs to be furnished

§ Form 12C

Medical Insurance Premium u/s 80D

§ Copy of Insurance Premium receipt paid

§ Copy of receipt for Preventive Health Checkup for self, spouse, dependent children or parents

Interest on Repayment of Education Loan u/s 80E

§ Copy of Provisional Interest certification from Bank/Financial Institution showing the interest and principle separately.

Rajiv Gandhi Equity Saving Scheme (RGESS) u/s 80CCG

§ Demat Account Statement

§ Self declaration stating RGESS enabled investments

Handicapped dependent u/s 80DD

§ Amount paid or deposited under any scheme framed in this behalf by the LIC or UTI or any other insurer and approved by the Board for the maintenance of the handicapped dependent

§ Physical disability certificate from a physician, a surgeon, or a psychiatrist, as the case may be, working in a Govt. hospital. The certificate should contain the employee’s name and percentage of Disability clearly.

§ Form 10-IA.

Medical Treatment Expenses u/s 80DDB

§ Medical Bills / expenditure incurred by way of medical treatment for a specified disease along with a certificate from a hospital in the prescribed form.

§ Form 10-I

National Pension Scheme u/s 80CCD(1B)

§ Photo copy of deposit receipt or account statement

Section 80C Deductions:

.No.

|

Investment Type

|

Documents as Investment Proof

|

1

|

Life Insurance Premium

|

Copy of Premium Receipt. Late payment fees will not be included as premium paid

For the premium falling due after submission deadline, attach previous year’s receipt with declaration (Download: Declaration for Insurance Premium Payment)

|

2

|

Public Provident Fund (PPF)

|

Copy of passbook/statement along with the cover page showing investor’s name OR

Copy of the deposit challan duly acknowledged by the Bank

|

3

|

Senior Citizens’ Savings Scheme

|

Copy of passbook/statement along with the cover page showing investor’s name OR

Copy of the deposit challan duly acknowledged by the Bank

|

4

|

NSC

|

Copy of the Certificates purchased during the financial year

For accrued Interest on NSC – Copy of Certificates to be enclosed with date of purchase and the amount

|

5

|

ELSS (Tax Saving Mutual Fund)

|

Copy of Account Statement

|

6

|

Children’s Tuition Fees

|

Copy of receipts for Tuition Fees and Exam Fees (excluding Donations & Development fees, Bus / Transportation charges, Text Books, Private Tuitions or Tutorial Fees) paid to any University/College/School or Other Educational Institution in India during the current year for a maximum of 2 children.

|

7

|

Sukanya Samriddhi Yojana

|

Copy of passbook/statement along with the cover page showing investor’s name OR

Copy of the deposit challan duly acknowledged by the Bank

|

8

|

Pension Plan from Insurance Companies

|

Copy of Premium receipt

For premium falling due after Jan ’16. Please attach previous year’s receipt with declaration (Download: Declaration for Insurance Premium Payment)

|

9

|

Post Office Tax Saving Term Deposit

|

Copy of deposit receipt

|

10

|

Tax Saving Bank Fixed Deposits

|

Copy of Deposit Receipt OR Account Statement

|

Previous Employment Details

In case you were employed with another employer in the financial year you need to give following documents:

§ Form 12B with copy of Form 16 for F.Y 2015-16/ Latest / Full and Final Tax computation statement submitted by you).

§ Copy of Form 16 for F.Y. 2015-16 / Latest / Full and Final Tax computation statement certifying Earnings and Deductions from your previous employer is mandatory.

Subscribe to:

Posts (Atom)